June Cattle on Feed Report Shows Inventory Up From a Year Ago

TOPICS

USDAMichael Nepveux

Former AFBF Economist

photo credit: Colorado Farm Bureau, Used with Permission

Michael Nepveux

Former AFBF Economist

The Cattle on Feed report provides monthly estimates of the number of cattle being fed for slaughter. For the report, USDA surveys feedlots of 1,000 head or more as this category of feedlots represents 85% of all fed cattle. Cattle feeders provide data on inventory, placements marketings and other disappearance.

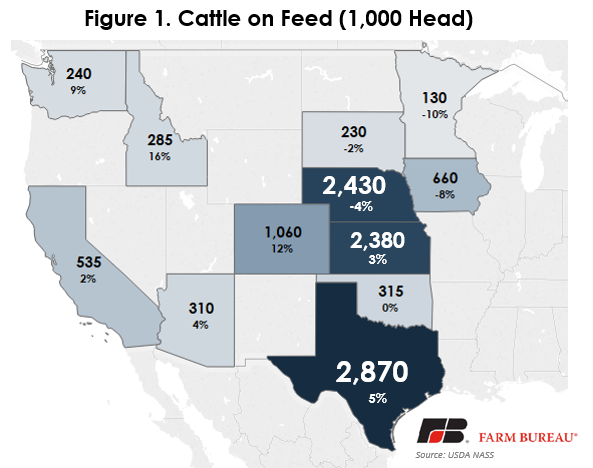

The report showed a total inventory of 11.7 million head for the United States on June 1. This increase of 1.6% is slightly above average analyst expectations, as most industry analysts were predicting a year-over-year increase in feedlot inventories of 1.3%.

As usual, Texas, Nebraska and Kansas lead the way in total fed cattle numbers, accounting for just under 7.7 million head, or approximately 65% of the total on-feed inventory in the country.

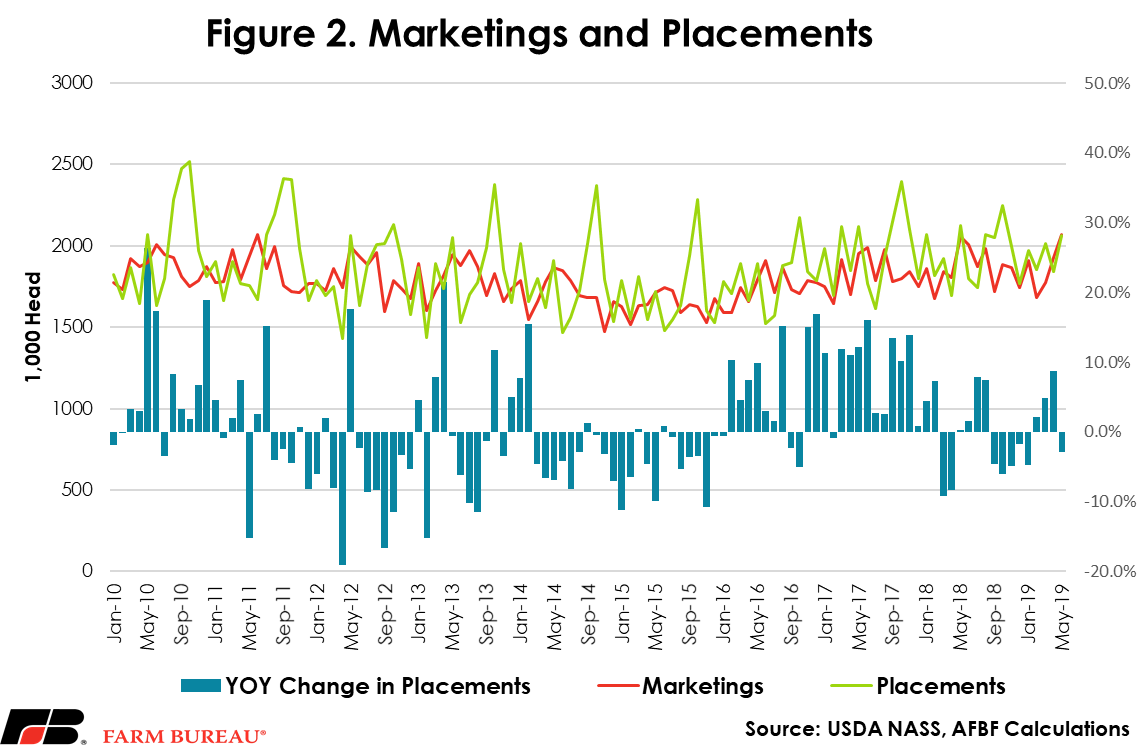

While total inventories are an important component of the report, other key factors include placements (new animals being placed on feed) and marketings (animals being taken off feed and sold for slaughter). Typically, May tends to be a larger month for placements, in part due to animals moving off wheat pasture in the southern Plains, and other backgrounding operations elsewhere into feedyards. However, this May most analysts were predicting a rather significant drawback with a 4.1% decrease on average, and some analysts predicting as much as a 7% decline from a year ago. Placements in May totaled 2.06 million head, which is 3% below 2018 levels. Marketings in May were 2.07 million head, up 1% from a year ago and in line with the average analyst expectation of an increase in 0.8%. Moving forward, uncertainty in other commodity markets will spill into the cattle markets. A result of historic delays in plantings, corn prices are likely to pressure feeder cattle lower as higher feed costs tend to depress what feedlots are willing to pay for feeder cattle. Excellent pasture and range conditions reported in USDA’s Crop Progress report combined with these higher feed costs may incentivize keeping animals on pasture longer, which could result in higher placement weights later on down the road.

Top Issues

VIEW ALL