Make Agricultural Trade Great Again

photo credit: Getty

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

Following the multiple years of large harvests in the U.S., projections for record livestock, dairy and meat production in the current year and farm income at concerningly low levels, U.S. farmers and ranchers are actively seeking to enhance access in existing foreign markets like Canada, China, Japan, Mexico and South Korea, and gain access in new markets, e.g. re-entering the Trans-Pacific Partnership.

Opportunities for U.S. Agriculture

Efforts to improve U.S. agricultural trade include a North American Free Trade Agreement modernization, re-negotiation of the U.S.-Korea Free Trade Agreement, agricultural concessions as a result of U.S.-China Comprehensive Economic Dialogue, and renewed interest by the White House in the countries that comprise Comprehensive and Progressive Agreement for Trans-Pacific Partnership, formerly known as the Trans-Pacific Partnership. CPTPP includes Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam. Additionally, in the U.S. there is interest in engaging with Japan – our fourth-largest agricultural trading partner – on a bilateral level.

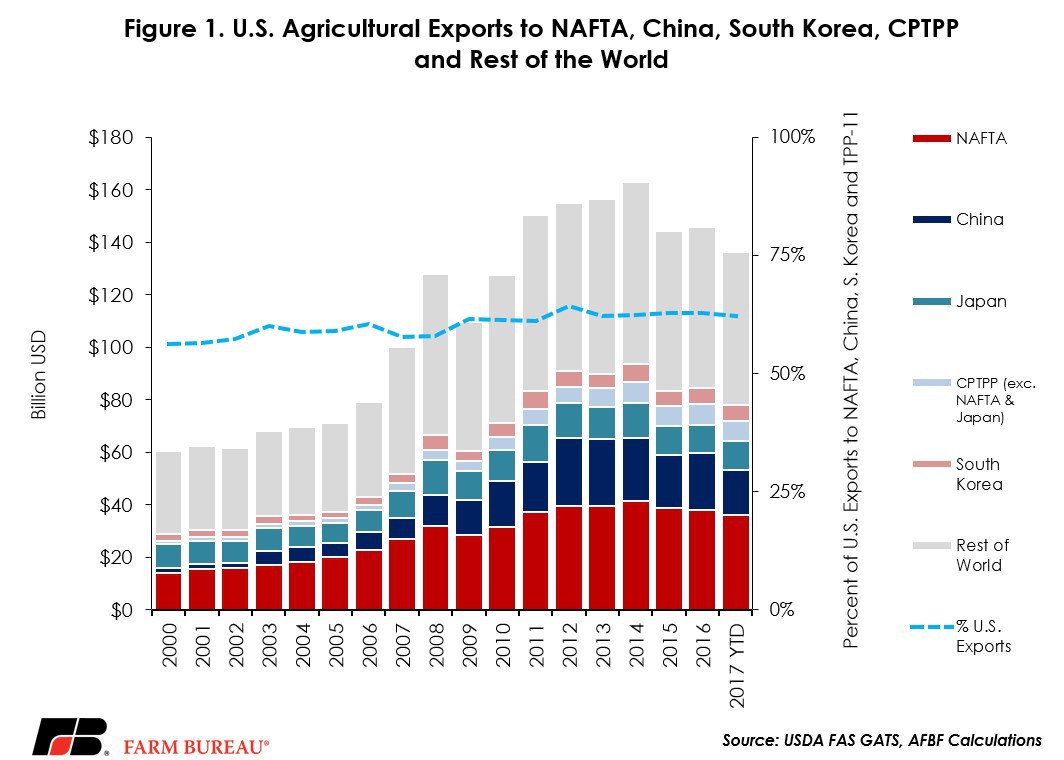

During 2016, $85 billion in U.S. agricultural exports were delivered to China, South Korea, Canada, Mexico and the CPTPP areas. Through November 2017, $78 billion in agricultural products had been exported to these areas. Since 2000, trade to China, South Korea, Canada, Mexico and the CPTPP areas has represented between 56 and 63 percent of all U.S. agricultural trade – reaching a high of $94 billion in 2014, Figure 1.

Gains have already been made in efforts to reduce long standing trade barriers. China is now allowing U.S. beef meeting certain specifications to enter the country, and a World Trade Organization ruling against China will result in lower tariffs on U.S. poultry exports. A revised NAFTA, which, among other improvements, could address Canada’s dairy pricing provisions, would go a long way to making U.S. farmers and ranchers more competitive. Finally, Farm Bureau estimated that the Trans-Pacific Partnership would have increased net farm income by $4.4 billion.

Challenges for U.S. Agriculture

While opportunities are presenting themselves to improve trade, challenges also exist. First, trade negotiators from Canada, Mexico and the U.S. have had six rounds of NAFTA negotiations, and rhetoric around a NAFTA termination remains. Through November 2017, the U.S. exported approximately $36 billion in agricultural products to Canada and Mexico, representing 29 percent of the U.S. agricultural export value. In the event of a NAFTA withdrawal, which requires a 6-month advance notice, and barring Congressional action denying the request, U.S. agricultural products would see substantially steeper barriers to trade.

Second, the Trump administration recently unveiled new tariffs on imports of Vietnamese-diverted Chinese steel as well as solar panels and washing machines. These products are primarily made in China and South Korea, which represent our second- and fifth-largest agricultural trading partners through November 2017, respectively. These recently imposed tariffs could potentially complicate recent gains for beef and poultry in China or efforts to improve the U.S.-Korea FTA. Additionally, South Korea and China could retaliate against our tariffs on steel, washing machines and solar panels by imposing tariffs or non-tariff barriers on our agricultural products such as soybeans or dairy products.

Third, the remaining 11 countries party to the Trans-Pacific Partnership recently resurrected and signed a new multilateral trade agreement, CPTPP. This new trade agreement includes 11 nations representing 14 percent of global GDP and a population of 500 million people. U.S. trade in agricultural products to these 11 countries – sans Mexico and Canada – was $18 billion through November 2017, representing 15 percent of our agricultural exports. Without being party to CPTPP, the U.S. will not have favored access to the agricultural markets in these countries and could lose market share in this high-growth and geopolitically-important part of the world.

A first-hand example of losing favored access came in August 2017, when Japan placed a safeguard tariff on frozen beef. FTA partners, like Australia, are exempt from this action while the U.S. was not. The end result is higher prices for U.S.-produced beef in Japan, while our competitors’ prices are declining due to a combination of reduced tariffs resulting from their FTA and the non-application of safeguard tariffs.

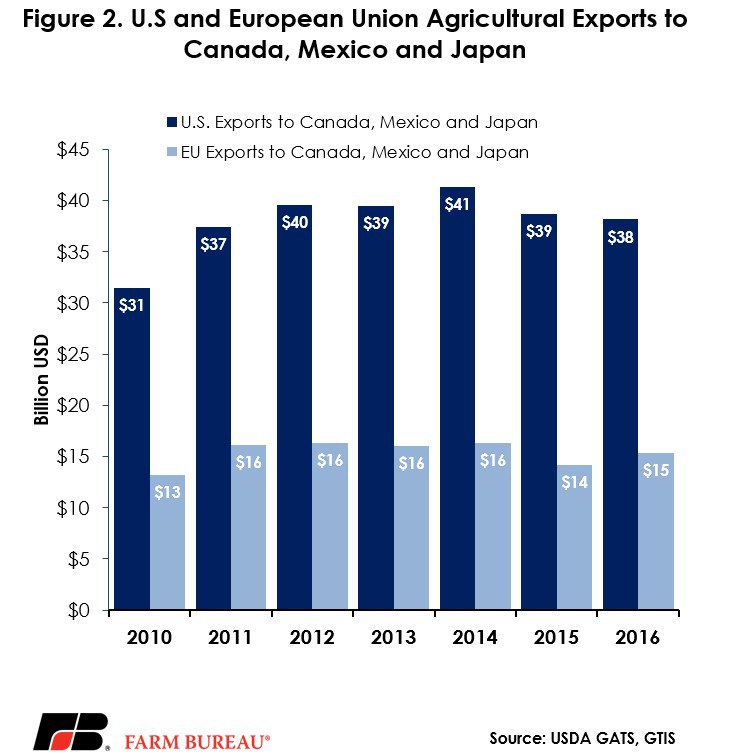

Finally, the European Union recently completed the Comprehensive Economic and Trade Agreement with Canada, the EU-Japan Economic Partnership Agreement, and EU and Mexico are currently negotiating to modernize their trade agreement. In 2016, U.S. exported nearly $50 billion to Canada, Mexico and Japan. EU FTAs will increase competition for U.S. agricultural exports in these critical markets, Figure 2.

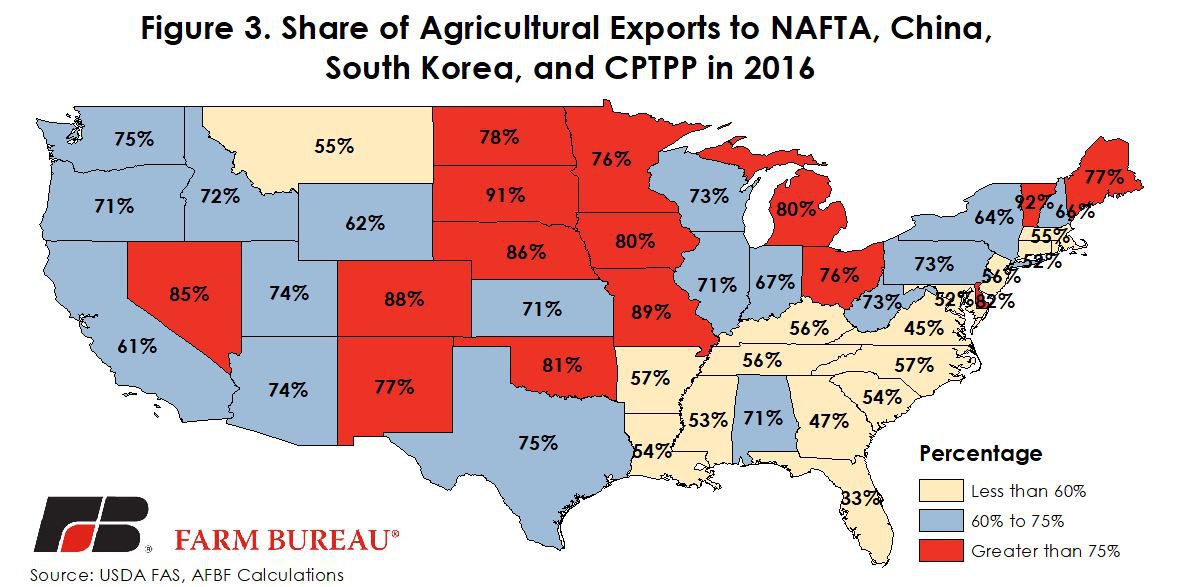

USDA’s Global Agricultural Trade System database provides state-level agricultural export data compiled from U.S. Census’ Foreign Trade Division agricultural trade data. This data reflects where shipments are consolidated, and not necessarily where a commodity is produced. However, this data can illustrate the importance of China, NAFTA, CPTPP, and South Korea on U.S. agricultural trade by estimating the share of agricultural exports to these regions by state

On average, 62 percent of U.S. agricultural exports are delivered to China, NAFTA, CPTPP and South Korea. During 2016, two-thirds of states had a higher export percentage to these areas than the U.S. average. An additional 17 states had more than 75 percent of their agricultural exports go to China, South Korea, Canada, Mexico and the CPTPP areas, Figure 3.

Implications

While most of the attention in U.S. agriculture has focused on a NAFTA modernization, there are several other opportunities available to simultaneously improve U.S. agricultural trade and boost farm income.

A modernized NAFTA with key Canadian concessions, more access into China, entering CPTPP, improving the U.S.-South Korea FTA or negotiating a bilateral trade agreement with Japan would improve the top markets the U.S. trades in – but challenges also exist. With more than 62 percent of U.S. agricultural exports represented by these areas, including NAFTA, the stakes are high. For obvious reasons, complications in other sectors such as autos, pharmaceuticals or manufacturing make agriculture anxious.

However, if the administration is successful, improved access in these areas will further enhance the importance of trade to the agricultural economy and to rural America. Consider a recent analysis from USDA indicating that:

Each dollar of agricultural exports stimulated another $1.28 in business activity. The $134.7 billion of agricultural exports in [2016] produced an additional $172.1 billion in economic activity for a total economic output of $306.8 billion. […] Agricultural exports in 2016 required 1,097,000 full-time civilian jobs.

USDA - Jan. 2018

With record harvests and livestock production coming online, free, fair and open trade is key to U.S. agriculture’s success in the future. Now is the time to make agricultural trade great again by enhancing NAFTA, negotiating a U.S. position in CPTPP, engaging with Japan, improving KORUS, and getting more access to the important Chinese market.

Top Issues

VIEW ALL