March 15 Deadline Approaching for 2021 ARC and PLC Enrollment

TOPICS

Wheat

photo credit: Right Eye Digital, Used with Permission

Shelby Myers

Former AFBF Economist

March 15 is the deadline to enroll in the Price Loss Coverage (PLC) or Agriculture Risk Coverage (ARC) programs for 2021. Program enrollment, which farmers can do on a commodity-by-commodity basis, is required to participate in the programs this year. ARC and PLC are Title I commodity safety net programs established in the 2018 farm bill (What’s in Title I of the 2018 Farm Bill for Field Crops? ). For the 2021/22 crop year, farmers can change their coverage options from what they selected in 2019 for each of the commodities and base acres enrolled.

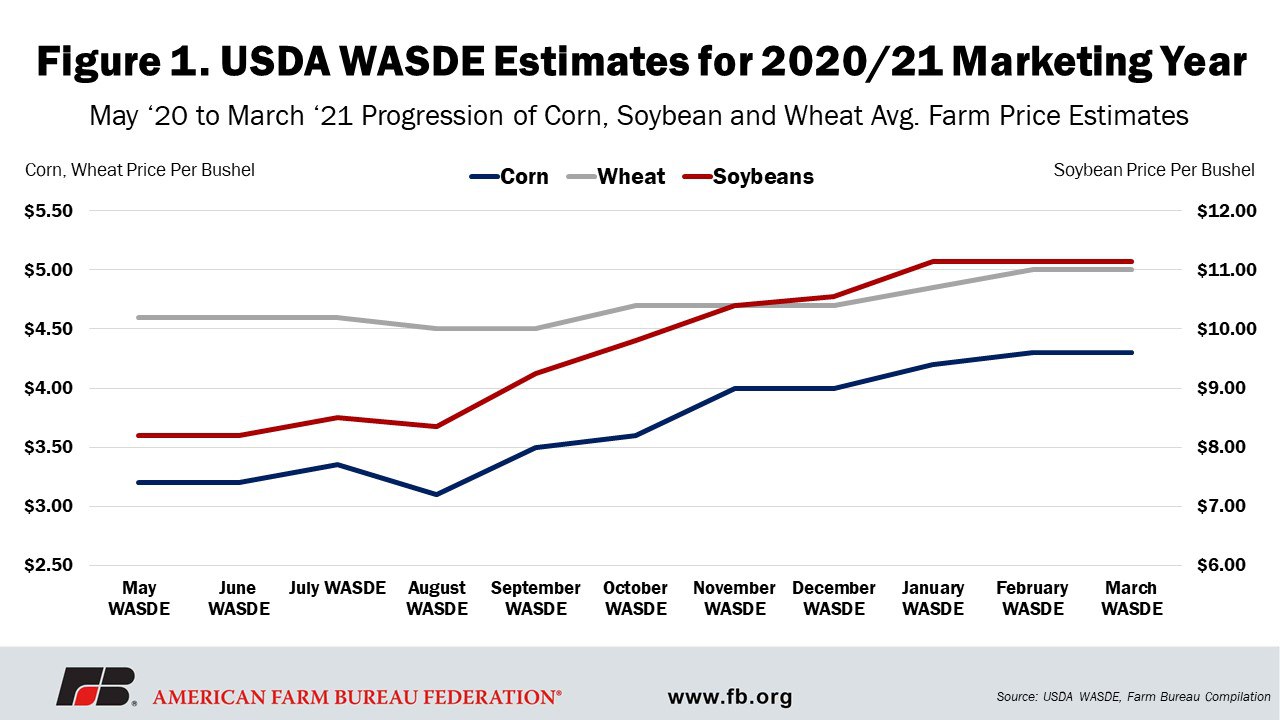

USDA’s March 9 World Agricultural Supply and Demand Estimates is the latest report with the 2020/21 marketing year average price projections for corn, soybeans and wheat. Title I commodity programs utilize marketing year average prices to determine if a deficiency payment is triggered. While, overall, the report includes few changes to the crop balance sheets, the ending stocks, particularly for corn and soybeans, remain low, indicating tight supplies and increased demand, likely contributing to the higher prices. In the March WASDE, USDA has the corn price estimated at $4.30 per bushel, the highest it’s been since 2013. USDA estimates the soybean price to be $11.15 per bushel, also the highest price since 2013. Wheat prices are estimated at $5.00 per bushel, according to USDA, the first time the estimated price has risen this high since 2018. Figure 1 displays the shift of USDA WASDE estimates of the average farm price for corn, soybeans and wheat during the 2020/21 marketing year.

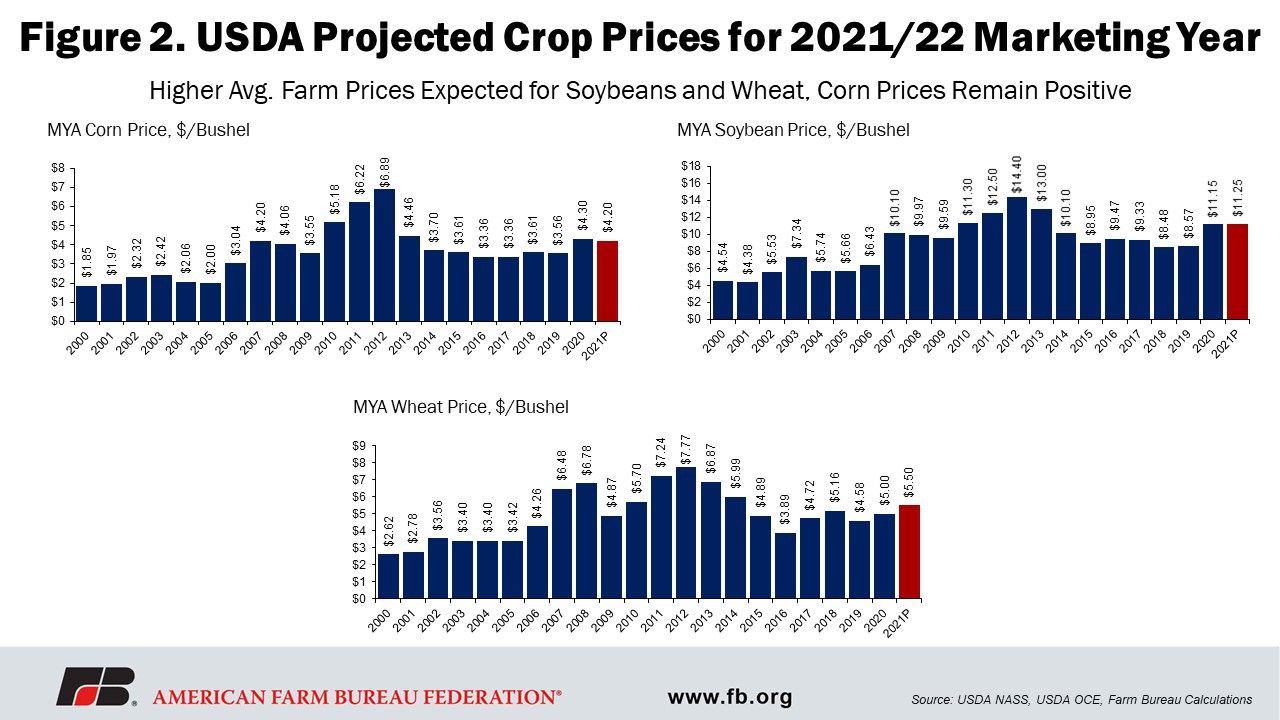

At The first look at the 2021/22 crop year, presented at USDA’s February 2021 Agricultural Outlook Forum, indicated these rising prices are here to stay. In case you missed it, demand is expected to remain strong throughout 2021 and ending stocks for corn, soybeans and wheat are all projected lower in 2021. Soybeans were the highlight, with ending stocks predicted to drop to historically low levels. The tighter supplies are signaling rising marketing year average prices for soybeans and wheat, while corn prices remain positive. Figure 2 displays the projected crop prices USDA reported at the 2021 Agricultural Outlook Forum for the 2021/22 marketing year.

What this means for producers is that regardless of their choice of Title I programs, the current price outlook is optimistic. These price estimates reflect the rising trend in all three commodities, which will drive the starting price points for the 2021/22 marketing year and 2021 program year. The rising prices could indicate a lower likelihood of payments being triggered. However, uncertainty lingers. For this program year enrollment, producers will need to assess potential market shocks for the crops they intend to plant and the weather conditions now and for the rest of the year. They may even want to consider personal preference of program operation.

To review:

PLC is a price-based program that will trigger a deficiency payment when the actual price falls below the Farm Service Agency-established effective reference price. For corn, the 2021 effective reference price is $3.70 per bushel. The soybean 2021 effective reference price is $8.40 per bushel. The wheat 2021 effective reference price is $5.50 per bushel (USDA Farm Service Agency’s 2021 Effective Reference Price Calculations). For PLC to trigger for corn, the market year average price would need to fall at least 50 cents from the current 2021 Outlook price of $4.20 per bushel. The soybean price would need to fall $2.85 per bushel from the current $11.25 per bushel price projected at the 2021 Outlook. For wheat, the projected 2021 price is equivalent to the PLC effective reference price of $5.50 per bushel and would require a market impact that lowers the price below $5.50 per bushel to trigger a PLC payment.

ARC is a revenue-based program that will trigger a deficiency payment when actual revenue falls below 86% of the benchmark revenue. The benchmark revenue is calculated by the FSA annually and is defined as the product of the Olympic moving average yield and the Olympic moving average of the marketing year average price. Producers can select between the county-based coverage option that covers 85% of historical base acres and enroll on a commodity basis or the individual farm-based coverage option that enrolls all the farm’s commodities as a whole and covers 65% of historical base acres.

ARC is different from PLC because it incorporates yield protection into the calculated payment structure. While prices right now are not likely to trigger a payment for corn or soybeans, impacts to yield could potentially trigger an ARC payment. In the event of a major weather event that slightly impacts the national price but impacts local yields significantly, like concentrated winds or rains, ARC could provide shallow-loss protection.

When making the ARC/PLC decision, keep in mind, from the crop insurance perspective, farmers can purchase the new Enhanced Coverage Option regardless of ARC/PLC decisions to add additional county-based endorsement coverage to the underlying crop insurance policy.

Summary

If the 2020/21 marketing year has taught us anything, it’s to expect the unexpected. Rising prices for corn, soybeans and wheat were very unexpected this time last year. As producers are deciding between PLC and ARC, a good rule of thumb is to expect the unexpected and mitigate the risks. For PLC to trigger a payment on corn and soybeans, market shocks that lead to significant price reductions would push prices toward the trigger level. For ARC, prices today may not trigger a price, but impacts to yield from unexpected weather events could potentially trigger an ARC payment. Producers should assess risks from all angles and gauge their farm’s risk tolerance to aid program enrollment decisions.

Producers who have not yet signed a 2021 enrollment contract or who want to make an election change should make an appointment with their local FSA office as soon as possible. In light of office limitations or closures, sign up can also be done via phone, email, and other digital tools. To conduct business, please contact your local USDA Service Center and complete as much of the necessary paperwork as possible to help streamline the enrollment process.

Top Issues

VIEW ALL