Millions of Corn and Soybean Acres in Poor-to-Very-Poor Condition

TOPICS

Soybeans

photo credit: Mark Stebnicki, North Carolina Farm Bureau

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

USDA’s Aug. 13 Crop Progress report revealed that 70 percent of the U.S. corn crop is in good-to-excellent condition, down 1 percentage point from last week, but 8 percentage points higher than the prior year’s 62 percent good-to-excellent. USDA estimates that 10 percent of the corn crop is in poor-to-very-poor condition, unchanged from last week and in line with prior-year levels.

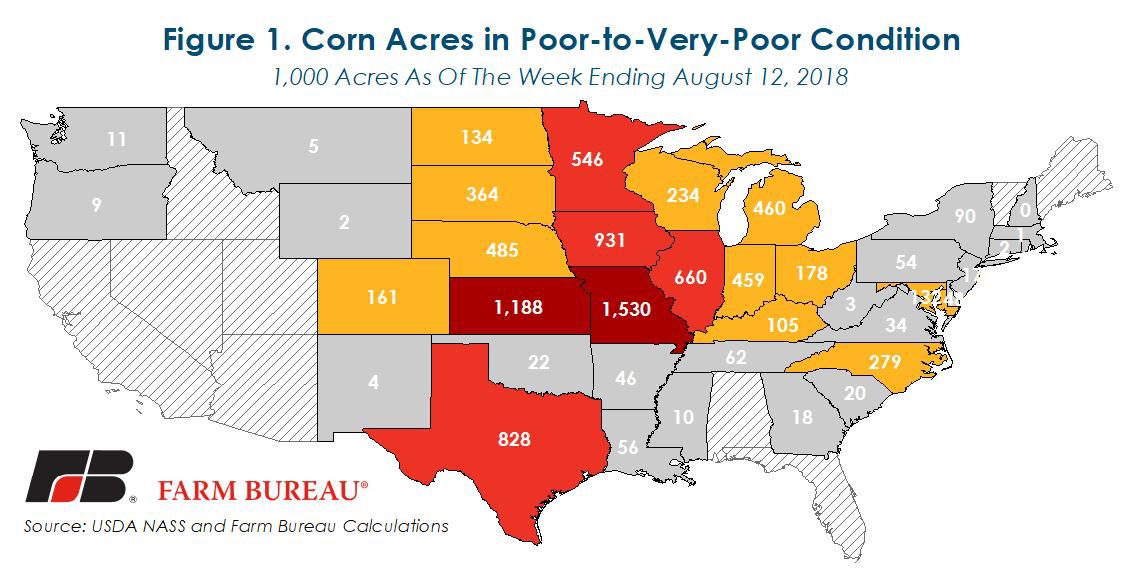

Based on USDA’s June Acreage report, Soybeans Finally Crowned King, and the current state-level crop conditions, an estimated 8.9 million acres of corn are in poor-to-very-poor condition. While the Southwest has experienced very dry growing conditions, most of the acres in poor-to-very-poor condition are in the Upper Midwest, western Corn Belt and along the Mississippi. Missouri and Kansas have the most corn ground in poor-to-very-poor condition at 1.5 million and 1.2 million acres, respectively. Figure 1 highlights the corn acres in poor-to-very-poor condition as of the week ending Aug. 12.

As of the week ending Aug. 12, 66 percent of the U.S. soybean crop was in good-to-excellent condition. The current conditions are down 1 percentage point from last week and up 7 percentage points from last year’s 59 percent. Soybean acres in poor-to-very-poor condition remained at 10 percent this week, showing no change from last week.

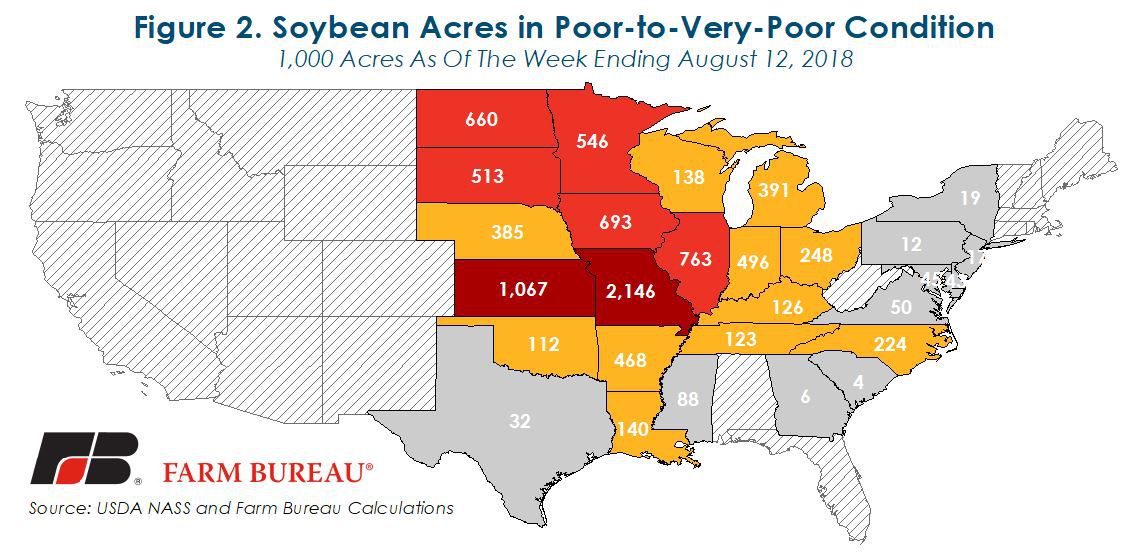

Despite the Southwest having the lowest percentage of soybean acres in good-to-excellent conditions, most of the acres in poor-to-very-poor condition are in the Upper Midwest, western Corn Belt and along the Mississippi. Currently, nearly 9 million soybean acres are in poor-to-very-poor condition. As with the corn crop, Missouri and Kansas have the most soybean acres in poor-to-very-poor condition at 2.1 million and 1.1 million acres, respectively. Combined, Missouri and Kansas have nearly 6 million acres of corn and soybeans in poor-to-very-poor condition. Figure 2 highlights the soybean acres in poor-to-very-poor condition as of the week ending Aug. 12.

Summary

Across the U.S. nearly 18 million acres of corn and soybeans are in poor-to-very-poor condition. This is in line with prior-year conditions for both crops. However, while in aggregate the conditions are in line with prior-year levels, one-third of these acres are in two states disadvantaged by particularly poor growing conditions: Missouri and Kansas.

Currently, USDA projects Missouri corn and soybean yields at 131 bushels per acres, down 23 percent year-over-year, and 45 bushels per acre, down 8 percent year-over-year, respectively. In Kansas USDA projects corn yields to fall 2 percent to 129 bushels per acre and for soybean yields to drop 3 percent to 36 bushels per acre.

Top Issues

VIEW ALL