NAFTA: No U.S. Barley, No (Mexican) Beer

photo credit: AFBF Photo, Morgan Walker

Veronica Nigh

Former AFBF Senior Economist

Quality Ingredients

There are many potential ingredients in beer to add a variety of color, flavor, bitterness, aroma, mouth-feel and shelf-life, but four primary ingredients stand out: grain, hops, yeast and water. A wide-variety of grains are used, including corn, wheat, rice, rye and oats, but by far the most common brewing grain is malted barley. Hop flowers come from the vigorous, climbing, herbaceous perennial hop plant. These two agricultural products impact all elements of the final products and both are grown in the United States.

Barley is grown in many regions throughout the country. In fact, 27 states grow barley to some extent. Major producing states include Idaho, Montana, North Dakota, Washington, Colorado, Wyoming, Virginia, Minnesota, Maryland, South Dakota, Oregon and Utah. Hops are primarily grown in the Pacific Northwest. According to the Hop Growers of America, 71 percent of U.S.-grown hops come from Washington, 15 percent from Oregon, and 11 percent from Idaho. These quality ingredients were used to produce beer in 4,824 reporting brewery facilities/locations in the United States in 2015, according to the U.S. Alcohol and Tobacco Tax and Trade Bureau, but important to the NAFTA discussion, they also play a key role in the Mexican and Canadian brewing industries.

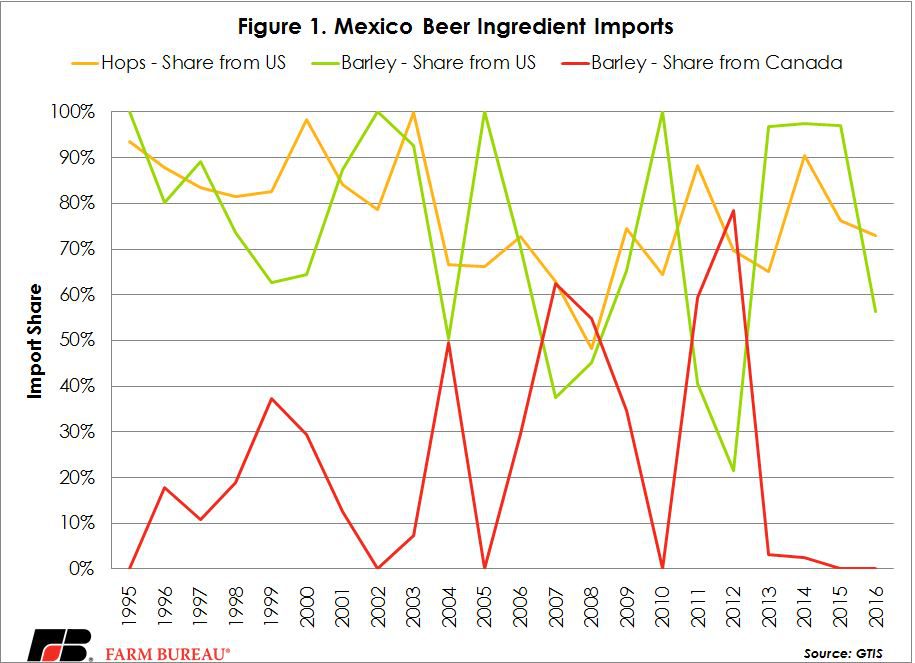

As highlighted in figure 1, the United States is a large supplier of ingredients for the Mexico beer-brewing industry. Between 1995 and 2016 the United States supplied, on average, 78 percent of the hops by value imported into Mexico. The low was 48 percent in 2008 and the high of nearly 100 percent occurred in 2003. The U.S. and Canada are also major suppliers of barley to Mexico. Between 1995 and 2016, the United States supplied, on average, 74 percent of the barley by value imported into Mexico. The low was 21 percent in 2012 and the high of nearly 100 percent occurred in 2010. Over the same period, Canada averaged 23 percent of Mexico’s barley imports, across a wide range.

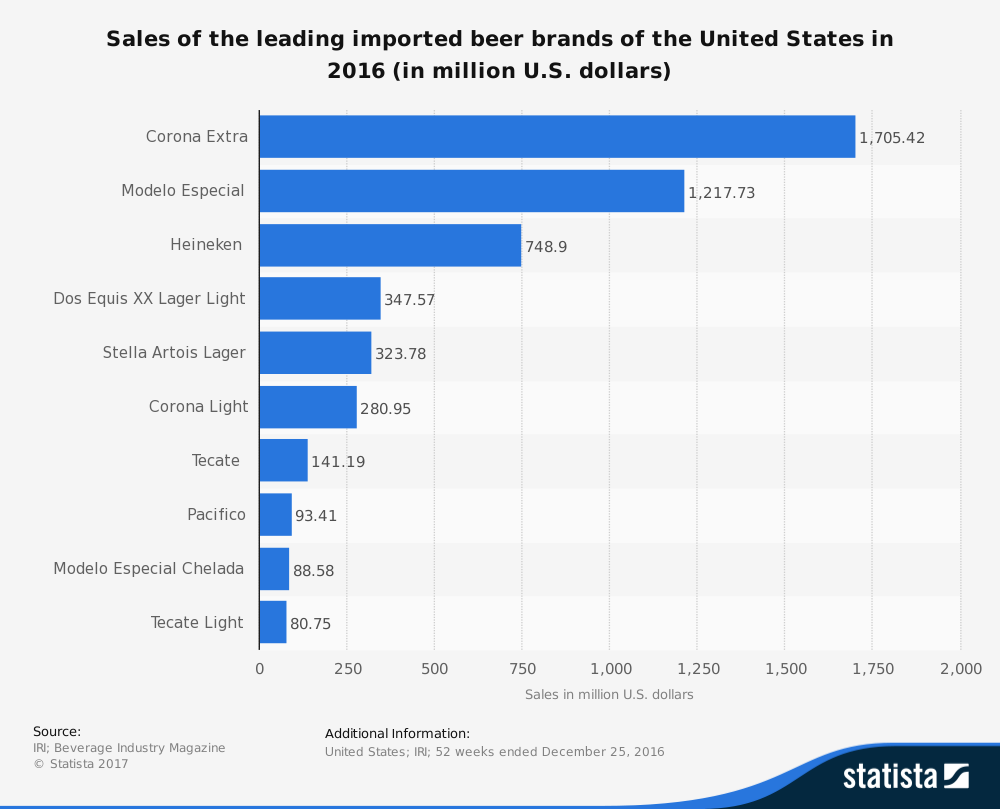

On the finished product side, the United States is the world’s largest importer of beer and our top supplier, far and away, is Mexico. In 2016, the U.S. imported $4.8 billion in beer, of which $3.1 billion came from Mexico. In the same year, the U.S. imported $106 million in beer from Canada. But the U.S. doesn’t just import beer, we export it as well. In 2016, the U.S. exported $611 million in beer. Our top export destination was Mexico, with $160 million in sales. The second largest destination was Canada, with $153 million. Despite these sales, the U.S. is clearly a significant, net importer of beer from our NAFTA partners, primarily Mexico. The net import balance with Mexico in beer in 2016 was nearly $3 billion. To put that figure in context, in 2016, the total net import balance with Mexico was $5.1 billion. Put another way, nearly 60 percent of the negative trade balance with Mexico can be attributed to trade in beer. According to IRI, a beverage industry magazine, eight of the top 10 imported beer brands of the United States in 2016 are Mexican.

The bottom line is: supply chains are integrated in many ways, across many agricultural products. So know that the next time you enjoy an imported Corona Extra®, Modelo Especial® or Dos Equis XX Lager Light®, you’re also supporting barley and hops growers in the United States. Nearly 70 percent of U.S. barley exports and nearly 20 percent of U.S. exports of hops were destined for Mexico and Canada last year.

Top Issues

VIEW ALL