Pace of Harvest and Winter Wheat Planting Remains Below Five-Year Average

TOPICS

Winter WheatMegan Nelson

Economic Analyst

photo credit: AFBF Photo, Philip Gerlach

Megan Nelson

Economic Analyst

Harvest is winding down, as USDA’s Nov. 14 Crop Progress report revealed the U.S. corn harvest is 84 percent complete. The 8-percentage point increase from last week’s 76 percent complete is up from the previous year, representing a 3-percentage point increase from last year’s 81 percent complete.

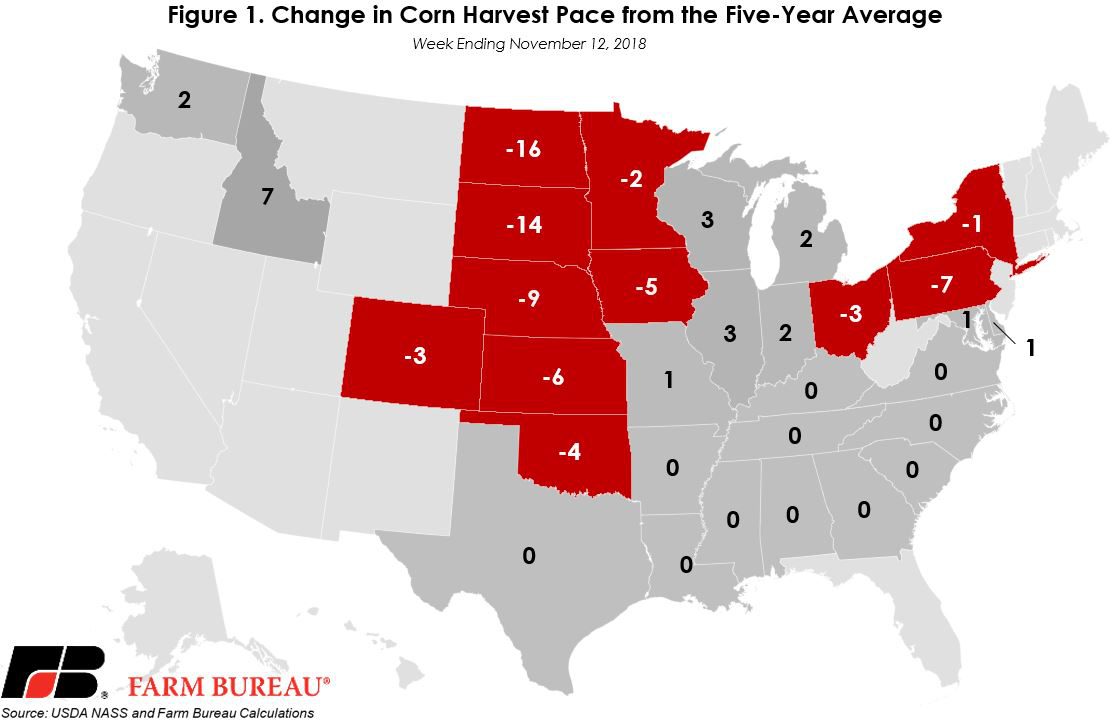

Pace of Corn Harvest

The corn harvest is down from analysts’ expectation of 87 percent complete for this time of year. Inclement weather throughout the Corn Belt has slowed harvest with the slowest pace in the Plains and Upper Midwest. While nationally the U.S. corn harvest is 3 percentage points behind the 5-year average pace, some states are seeing much larger deficits, with 14- and 16-percentage point declines from the five-year average in the Dakotas. Figure 1 illustrates the state-by-state outlook for the change in harvest pace from the five-year average to today for the week ending Nov. 12.

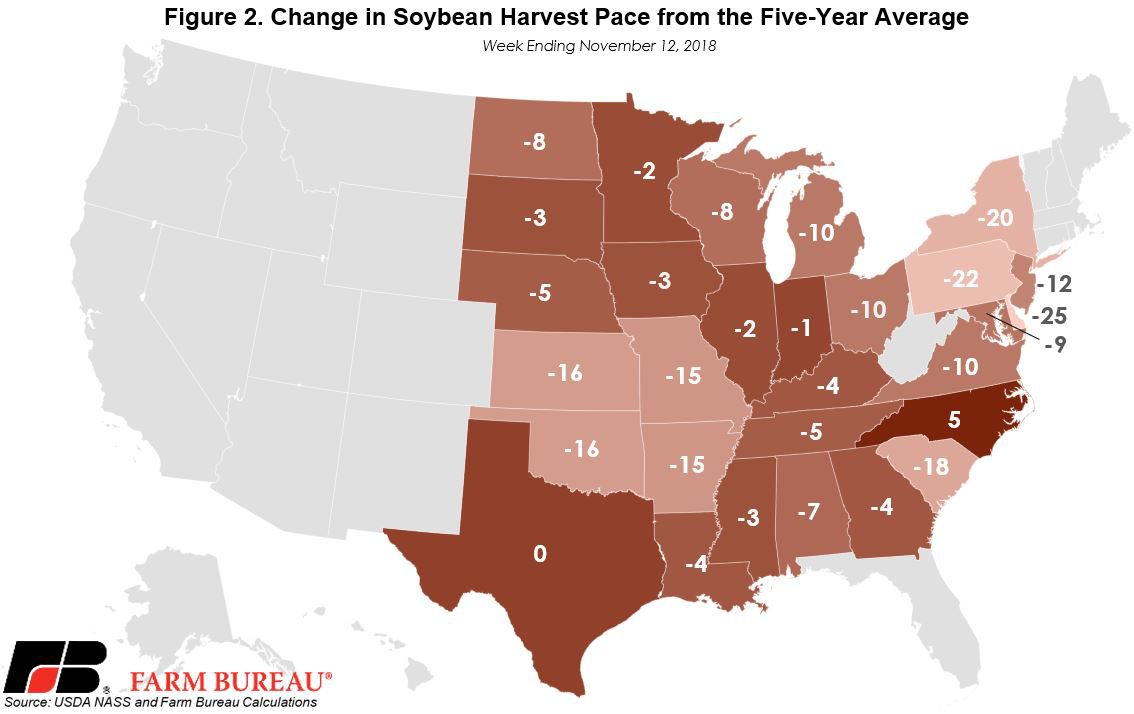

Pace of Soybean Harvest

The U.S. soybean harvest is at 88 percent complete, representing a 5-percentage point increase from last week. For the week ending Nov. 12, the U.S. soybean crop is down 5 percentage points from last year’s rate as well as the five-year average of 93 percent complete for this time of year. On a state-by-state outlook, the harvest pace is behind by 25 percentage points in Maryland and up 5 percentage points in North Carolina from the five-year average, Figure 2. The Northeast and Midwest have been hit the hardest by poor weather conditions during harvest. The current harvest rate is also down from analysts’ estimations of 91 percent complete for this week. U.S. soybean producers have harvested 4 billion bushels of soybeans so far, with only 12 percent of the soybean harvest remaining.

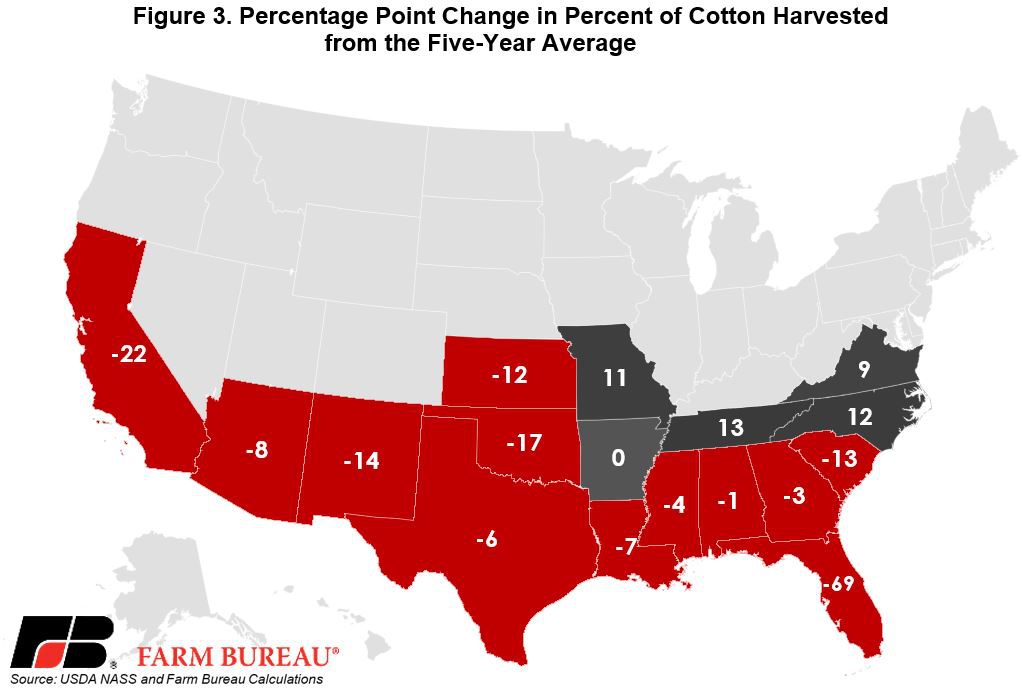

Pace of Cotton Harvest

Similar to the harvest delays for the U.S. corn and soybean crops, the cotton harvest pace is down 7 percentage points from the five-year average. Much of the Southeast experienced adverse weather from Hurricanes Florence and Michael that delayed harvest. Taking the brunt of Hurricane Michael, the Florida cotton crop harvest is currently 69 percentage points below the five-year average of 100 percent complete by this time of year. Figure 3 shows the percentage point change in the cotton harvest pace from the five-year average.

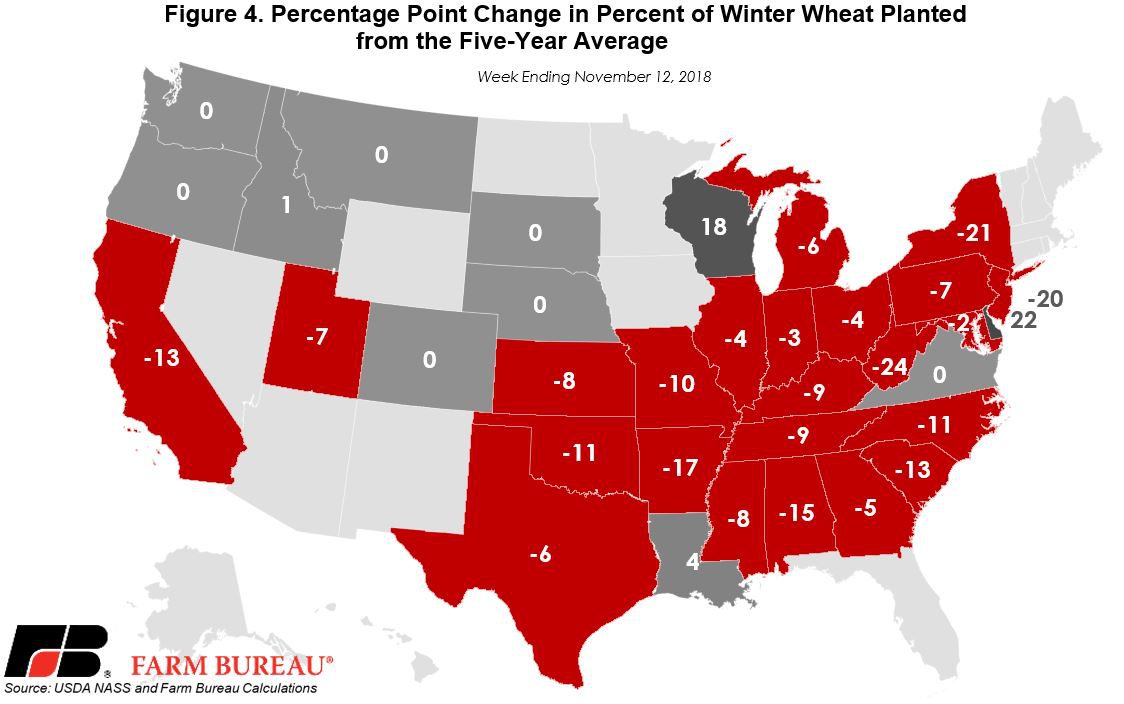

Winter Wheat Plantings

According to USDA’s Nov. 13 report, 89 percent of the U.S. winter wheat crop has been planted, down 5 percentage points from the five-year average. Many of the top wheat-producing states are seeing a slower planting pace with substantial differences throughout the Midwest and South. Kansas, the largest wheat producing state, is currently down 8 percentage points from the five-year average of 98 percent complete at this point in the year. Figure 4 outlines the state-by-state overview of the change in percent of winter wheat planted from the five-year average for the week ending Nov. 12.

Top Issues

VIEW ALL