Quarterly Hog Report Shows Continued Herd Expansion

TOPICS

USDAMichael Nepveux

Former AFBF Economist

photo credit: Getty Images

Michael Nepveux

Former AFBF Economist

USDA-National Agricultural Statistics Service’s Quarterly Hogs and Pigs report provides a detailed inventory of breeding and marketing hogs, as well as the future supply of market hogs on a quarterly basis. Producers use this data to determine production and marketing strategies, while the industry uses it to assess the markets and future supply of product.

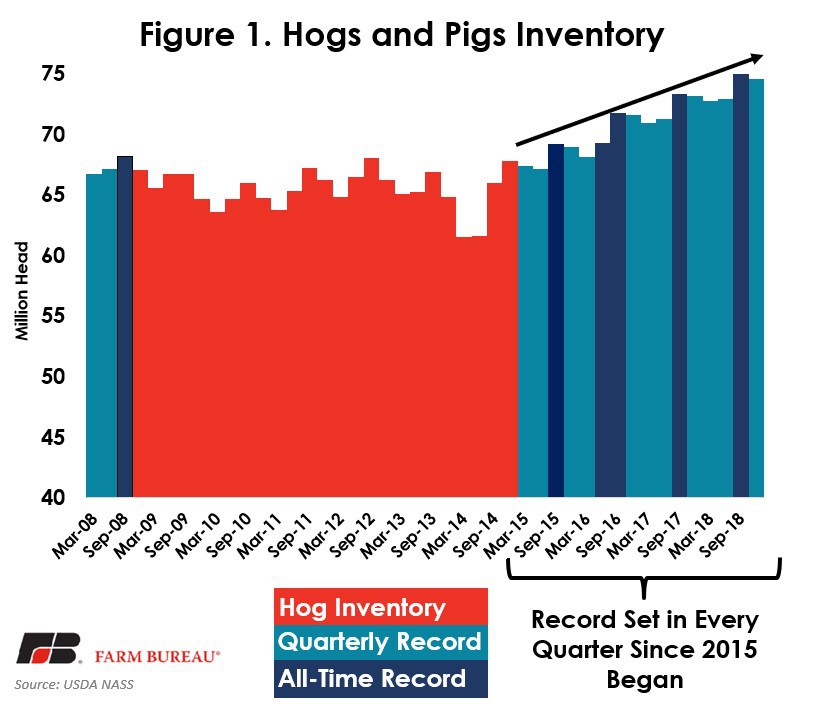

The most recent report, released Dec. 20, revealed a record December inventory of all hogs and pigs at 74.6 million head, an increase of 1.9 percent year-over-year and down slightly from September’s report. This 1.9 percent increase from December 2017 was mostly in line with analysts’ expectations of 2.7 percent, and the report offered no real surprises to the market. USDA announced breeding inventory at 6.33 million head, up 2.4 percent from last year but below the 2.8 percent that market analysts were expecting. USDA also pegged the marketing herd at 68.2 million head, up 2 percent over 2017 but below analysts’ expectations of 2.6 percent.

While this report is mostly in line with expectations, a larger storyline here is continuing supply growth. Every single report over the last four years has hit a quarterly record in terms of the total hogs and pigs inventory, with five of those quarterly reports hitting an all-time record number across all quarters. The U.S. has been producing a mountain of pork and has even more coming down the pipeline, with record pork production expected in 2019 as well. When the boom period of grain prices slowed after 2013, pork producers experienced a drop in their feeding costs as grain prices receded. Since then, there has been a steady increase in production as producers expanded capacity.

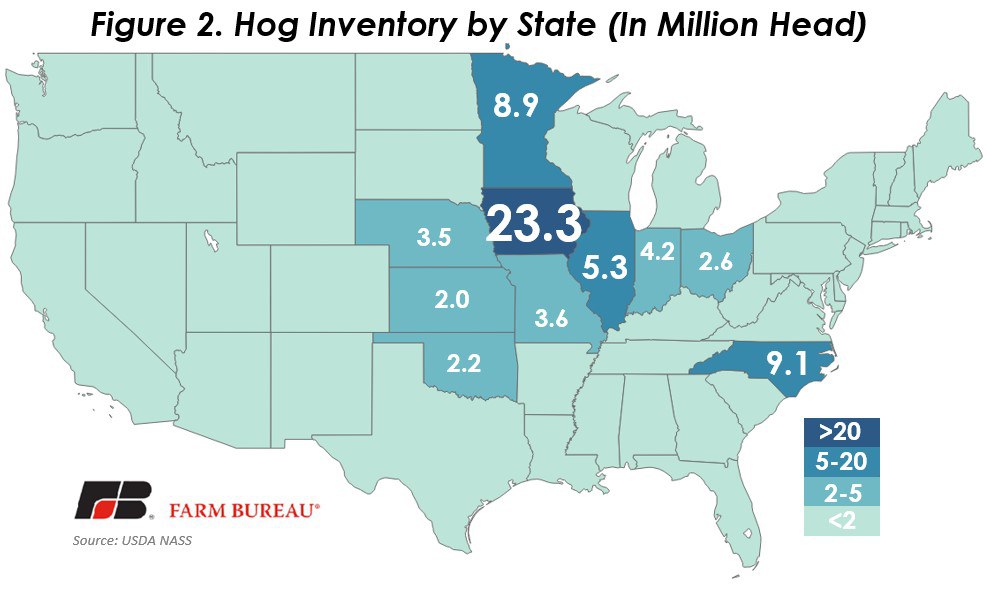

At 23.3 million pigs, Iowa continues to overshadow the nation’s pork production, accounting for nearly a third of all hogs in the U.S. North Carolina and Minnesota are in a race for second, accounting for 9.1 million and 8.9 million pigs, respectively. The top three pork producing states’ sheer size allows them to have a significant impact on the country’s trends; of the 1.4 million net increase in animals over 2017, Iowa, North Carolina and Minnesota accounted for 1 million of the increase. 20 states saw a decline in their hog inventory from 2017 to 2018, with the sum of those states totaling a 595,000-animal decrease. Iowa’s gain alone nearly wiped that out, with the state increasing its December inventory from 2017 by 500,000 pigs.