Farmer Bridge Assistance Program: Details on $11 Billion in Aid

TOPICS

Farm Aid

Faith Parum, Ph.D.

Economist

Key Takeaways

- Low commodity prices, elevated input costs and ongoing market uncertainty have many farmers facing another year of negative or near-break-even returns.

- The Trump administration’s $12 billion in economic assistance for farmers provides timely relief as farmers prepare for the 2026 planting season but does not fully cover farmers’ losses over the last few years. Of the $12 billion, $11 billion is allocated for the Farmer Bridge Assistance (FBA) Program, which will deliver support to row crop farmers, helping to offset a portion of projected 2025 losses and provide cash-flow assistance.

- The remaining $1 billion has been set aside for specialty crops and sugar growers, but additional information on a timeline, eligibility and how payments will be calculated has not been released.

USDA has announced $12 billion to provide one-time economic aid to farmers facing financial losses during the 2025 crop year. Of that total, $11 billion is directed to row crop producers in the Farmer Bridge Assistance (FBA) Program. The remaining $1 billion is reserved for specialty crops and sugar assistance, though USDA has indicated that additional data collection and analysis are needed to determine how these payments will be structured and distributed.

Even after accounting for crop insurance indemnities and prior ad hoc assistance, the agriculture sector continues to experience multi-billion-dollar losses each year. The FBA program is a needed step toward easing financial strain in the farm economy, but it is not expected to cover the full extent of row crop losses during this prolonged period of elevated costs, low crop prices and weak margins. Additionally, the $1 billion allocated for specialty crops falls short of addressing the total losses that specialty crop producers are facing.

Importantly, the FBA program is designed to serve as an economic bridge until the One Big Beautiful Bill Act (OBBBA) enhancements take effect beginning in fiscal year 2026.

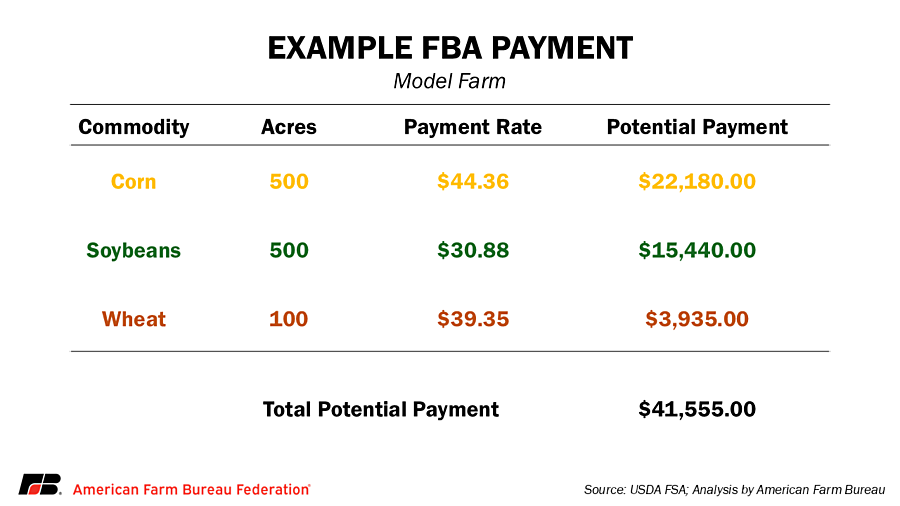

Payment Rates

The FBA Program models losses during the 2025 crop year and applies a flat per-acre payment for all acres planted to covered commodities, with no payment for prevented plant acres. This national loss average is calculated using FSA-reported planted acres, USDA-Economic Research Service cost-of-production estimates, WASDE yield and price projections, and economic modeling assumptions. The final per-acre rates set by USDA for major crops are: Rice: $132.89; Cotton: $117.35; Oats: $81.75; Peanuts: $55.65; Sorghum: $48.11; Corn: $44.36; Wheat: $39.35; Soybeans: $30.88; and Barley: $20.51. The following chart details full payments rates for all covered crops.

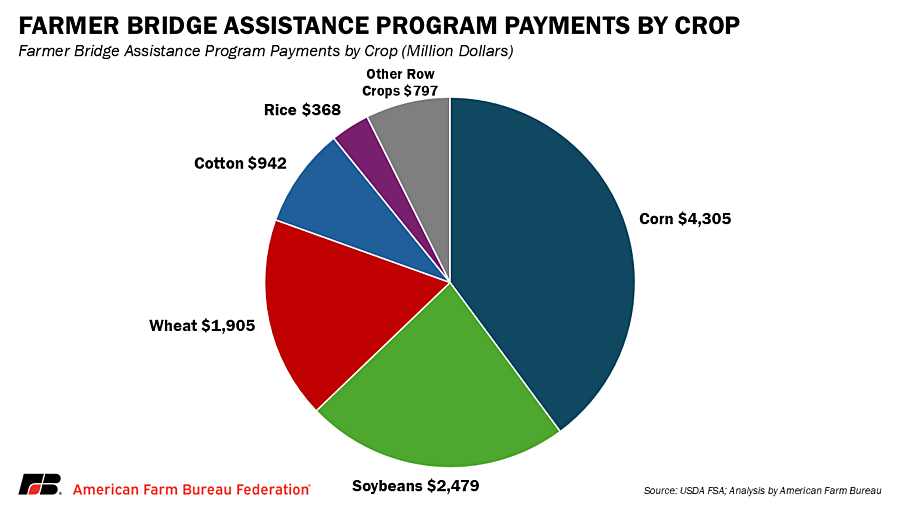

Based on USDA-FSA crop acreage data for 2025, total FBA Program payments are estimated at $10.8 billion, with total projected payments led by corn at $4.3 billion, followed by soybeans ($2.5 billion), wheat ($1.9 billion), cotton ($0.9 billion), rice ($0.4 billion) and sorghum ($0.3 billion). Payments broadly reflect the magnitude of estimated losses by crop. Per-acre losses were higher for rice and cotton, while corn, wheat and soybeans experienced smaller—but still negative—returns. Consequently, payment rates are lower for crops with lower loss intensity.

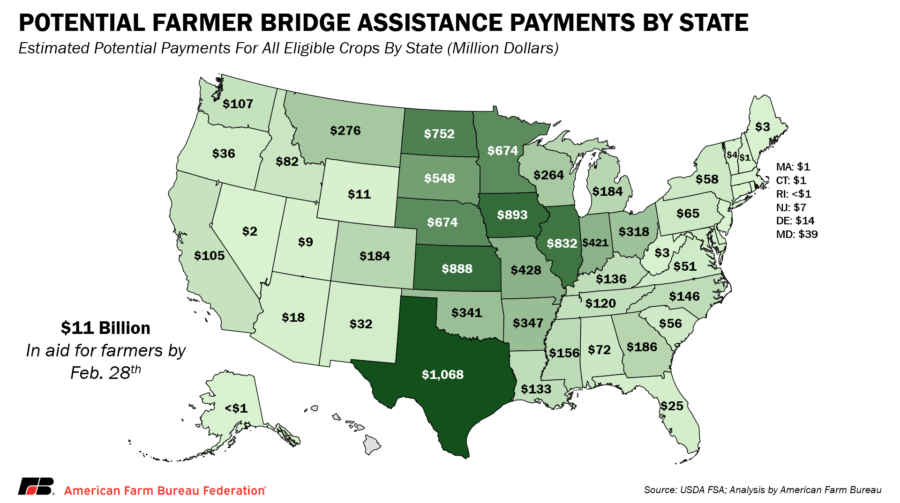

At the state level, FBA Program payments are projected to be highest in Texas at $1.1 billion, followed by Iowa at $893 million, Kansas at $888 million and Illinois at $832 million. Midwest and Corn Belt states in total are expected to receive $6.9 billion (64%), while Southern and Southeast states are expected to receive about $2.8 billion (26%). Western states and states in the Northeast have fewer acres of crops eligible for the FBA Program and, as a result, are expected to receive a smaller share of overall support.

How to Apply

Payments will be based on producers’ Farmers Acreage Reports, which were due to be confirmed by Dec. 19, 2025. Producers who reported eligible acres to FSA by the deadline will have a pre-filled application available and should review, complete and return it to their local FSA county office. More information on the application process is available through USDA.

Participation in FBA is subject to an adjusted gross income (AGI) limitation, with producers whose average AGI exceeds $900,000 ineligible. Payments are also subject to a $155,000 limit per person or legal entity, including corporations, limited liability companies, S corporations and trusts. This payment cap is separate from limits to other USDA programs. While this one-time assistance provides timely support, it is expected to offset only a portion of 2025 losses as producers continue to navigate broader economic challenges in the farm economy.

Top Issues

VIEW ALL