Farmers Urgently Need Economic Assistance

photo credit: North Carolina Farm Bureau, Used with Permission

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

Key Takeaways

- Farm financial stress is severe and persistent. Margins are below breakeven for many crops, working capital has been eroded, Chapter 12 farm bankruptcies are on the rise and according to a recent survey of commercial lenders, profits will remain elusive going into 2026.

- Trade losses have compounded economic pressures. Farmers have experienced multi-billion-dollar export declines in some of our largest trading markets, including China. Trade frameworks have been announced, but increased export volumes have yet to materialize and cash prices remain at or below levels seen in early 2025.

- Without action, long-term viability is at risk. Additional financial support is critical to offset trade losses and provide a bridge until farm bill enhancements from the One Big Beautiful Bill Act go into effect. This will stabilize the farm economy, sustain rural economies and maintain affordable food prices.

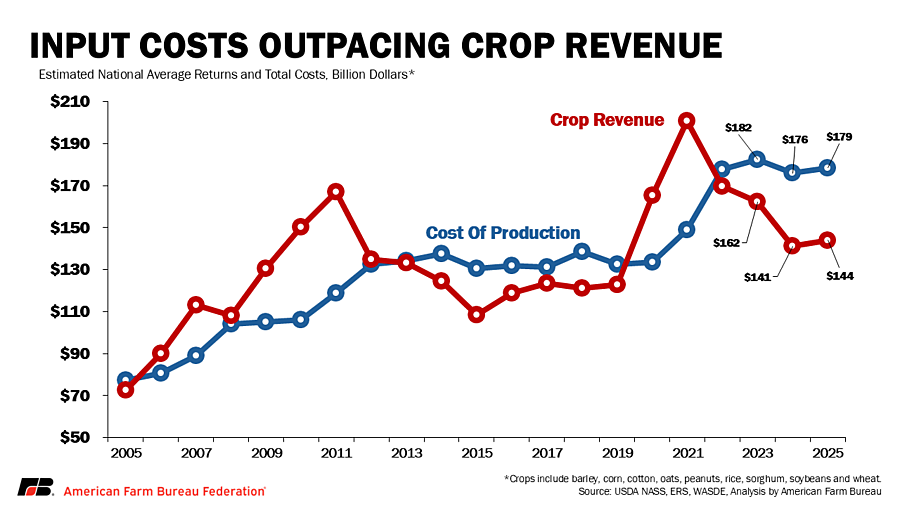

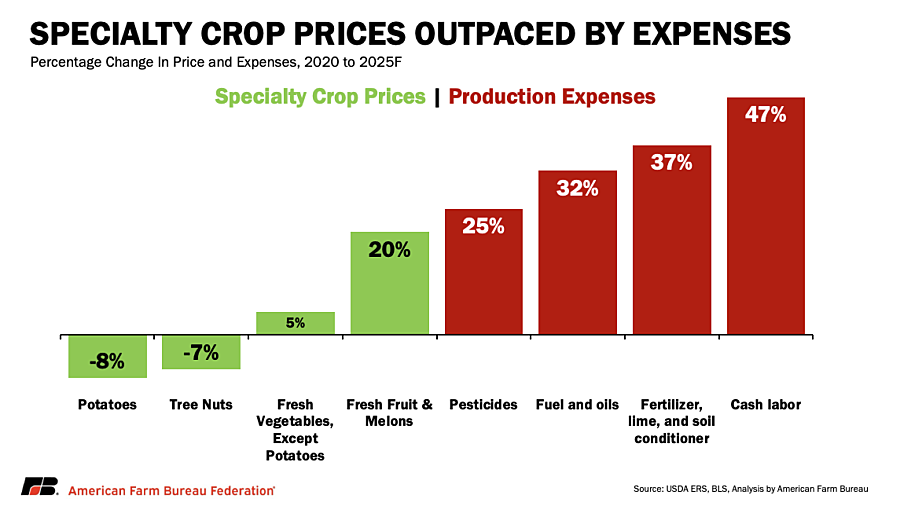

USDA’s most recent Commodity Costs and Returns, World Agricultural Supply and Demand Estimates and Farm Sector Income & Finances reports confirm what those in agriculture have known for several years: U.S. farm income is under immense pressure as input costs have increased dramatically while crop prices have fallen sharply – resulting in crop and specialty crop margins that have been at or below breakeven for several consecutive years.

While recent trade frameworks provide optimism for increased exports and market access, products have yet to move in significant volumes and cash prices for commodities such as corn, soybeans, wheat and cotton remain under pressure and are at or well below levels experienced at the beginning of the year. For farmers who had to sell at harvest price lows due to the lack of storage, the benefits of recently announced trade frameworks will come too late.

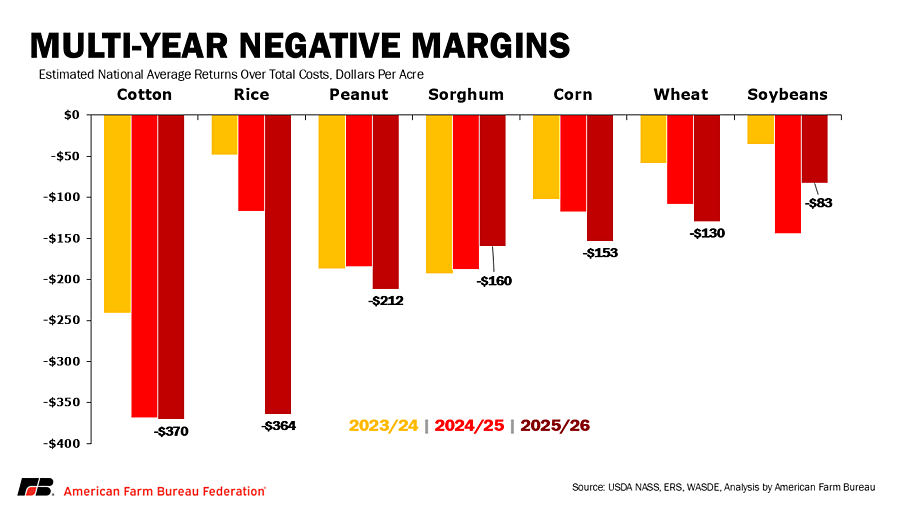

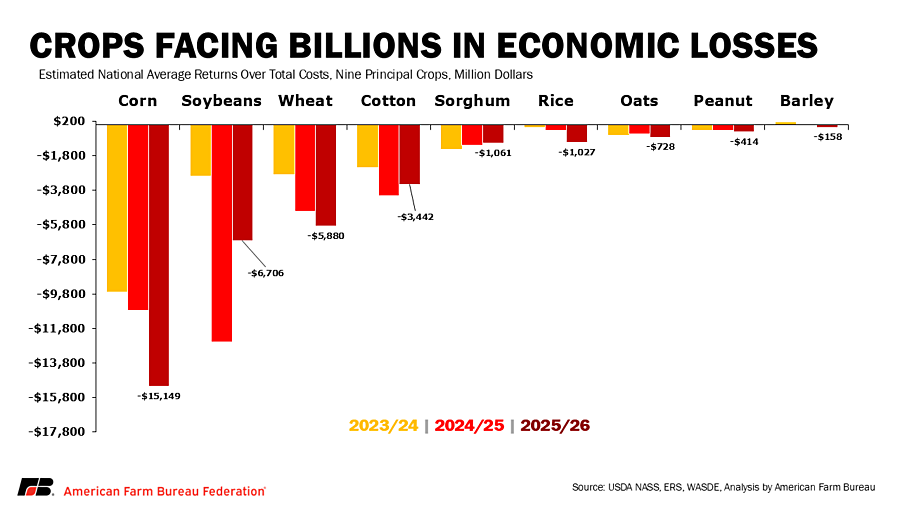

Due largely to the Chinese falling short of their Phase 1 commitments, and more recent trade uncertainty, farmers across the Corn Belt pulled back on soybean acres and instead planted nearly 100 million acres of corn. At an average total cost (including fixed and variable operating costs) of putting the crop in the ground of approximately $900 an acre, corn farmers committed nearly $90 billion to sow a crop this spring. Now, even with an expected record yield of 186 bushels per acre and a $4 per bushel national average price, the return over total cost is estimated at a loss of over $150 per acre, with total losses nationwide eclipsing $15 billion.

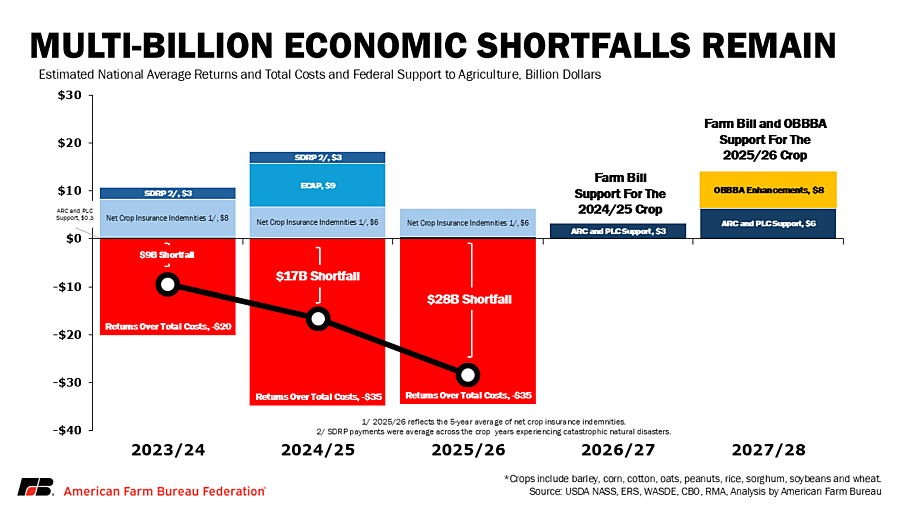

The math is the same for every major crop — as well as specialty crops — and it’s been that way for several consecutive years, with combined annual returns below total costs (for nine principal crops) from the 2023/24 to 2025/26 crop years at -$20.2 billion, -$34.8 billion and -$34.6 billion, respectively, and before crop insurance indemnities and other support.*

Specialty crop farmers also face particularly inflated costs per acre, especially labor costs. Regulation, compliance requirements and workforce shortages further compound challenges for these farmers. Additional support for these sectors can help stabilize the broader farm economy and support consumers’ access to affordable U.S.-grown fruits and vegetables.

These multi-year negative economic returns have contributed to eroding working capital, made it more difficult and expensive to secure financing, and contributed to increasing Chapter 12 farm bankruptcies and rising loan delinquencies, according to the Kansas City Federal Reserve. A recent survey from the American Bankers Association revealed that for a majority of borrowers, profits would remain elusive going into 2026.

Why More Bridge Economic Assistance Is Needed

Congress responded to these economic headwinds through the American Relief Act of 2025 and the One Big Beautiful Bill Act (OBBBA), which provided ad hoc assistance for economic and natural disasters and made historic investments in farm bill risk management programs, respectively. So far, $9.3 billion has been distributed through the Emergency Commodity Assistance Program for 2024 losses and $5.7 billion has been delivered through Stage 1 of the Supplemental Disaster Relief Program for 2023 and 2024 losses.

Even after including this ad hoc support along with support from crop insurance, returns above total costs are estimated to remain negative from the 2023/24 through 2025/26 crop years at -$9 billion, -$17 billion and -$28 billion, respectively. The farm bill and OBBBA enhancements to the farm bill will come in fiscal years 2026 and 2027, but until that support arrives, farmers across the U.S. are left with accumulated losses that are currently estimated in excess of $50 billion over the last three crop years.

Bridge Support Needed Now

Farm financial stress is severe and persistent, and trade losses have compounded economic pressures driven by inflationary pressure on farm input costs and declining crop prices.

For months farmers have awaited details on the administration’s $12 billion trade aid package. Economic aid is urgently needed in the countryside, as most farmers will begin planting their next crop early in 2026, with some crops already planted, and must have their financial commitments in place as they secure lines of credit. Many lenders will not count federal support on a balance sheet until it is certain, heightening the urgency, especially given that $12 billion is only a portion of the economic losses farmers have already accumulated.

Financial support to offset trade-related losses and provide bridge support until OBBBA enhancements reach farmers will bolster the farm economy and rural America as we navigate these challenging economic conditions.

* Farmers across the U.S. will have different cost and revenue structures based on their business model and management decisions, but USDA’s national average data offers a representative view of total costs and returns on the farm.