One Big Beautiful Bill Act: Final Agricultural Provisions

photo credit: Arkansas Farm Bureau, Used with Permission

Daniel Munch

Economist

Samantha Ayoub

Economist

Faith Parum, Ph.D.

Economist

After months of negotiation and debate, the One Big Beautiful Bill Act (OBBB) (H.R.1) was signed into law by President Trump on July 4. The resulting sweeping legislative package preserves Farm Bureau-supported provisions, strengthens the farm safety net and offers longer-term certainty for farmers and ranchers navigating rising input costs, volatile markets and weather uncertainty.

Building on our coverage of the original House-passed and Senate-passed versions, this Market Intel consolidates the agriculture-related provisions of the final bill into a single comprehensive reference for how the final package supports America’s farmers and ranchers.

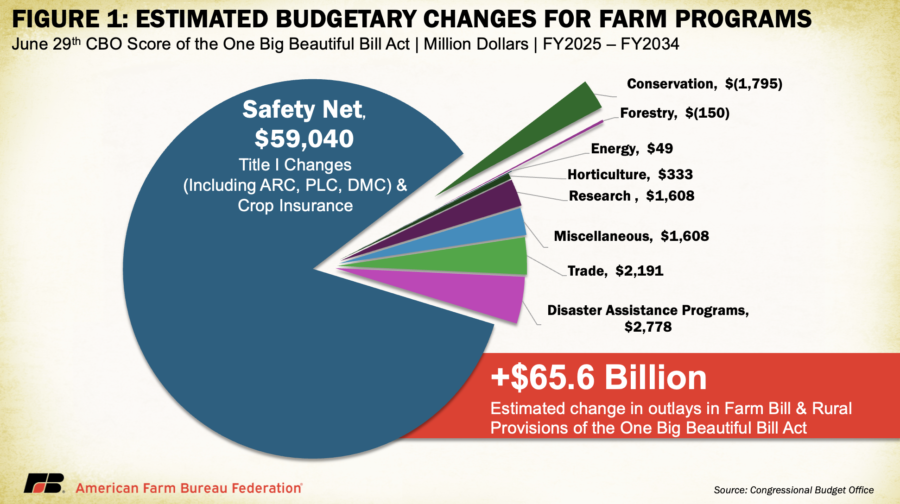

According to the nonpartisan Congressional Budget Office (CBO), the final version of the One Big Beautiful Bill Act is projected to increase agriculture-focused spending by approximately $65.6 billion over the next decade (fiscal year 2025–fiscal year 2034). Of that total, $59 billion is directed toward core farm safety net enhancements, including updates to Agriculture Risk Coverage (ARC), Price Loss Coverage (PLC), Dairy Margin Coverage (DMC) and crop insurance. Out of the $59 billion, crop insurance accounts for $5.98 billion. The remaining $6.6 billion supports a range of other priorities, including $2.8 billion for disaster assistance programs, $2.2 billion for trade promotion, $1.6 billion each for agricultural research and miscellaneous programs and targeted investments in horticulture, energy and rural infrastructure (Figure 1).

One Big Beautiful Bill Act – Digging into the Details

Farm Bill Provisions (Title I): H.R.1 includes a broad reauthorization of the farm bill’s nondiscretionary spending provisions, updating and funding many core agriculture titles through 2031. Important provisions include:

Safety Net Commodity Programs:

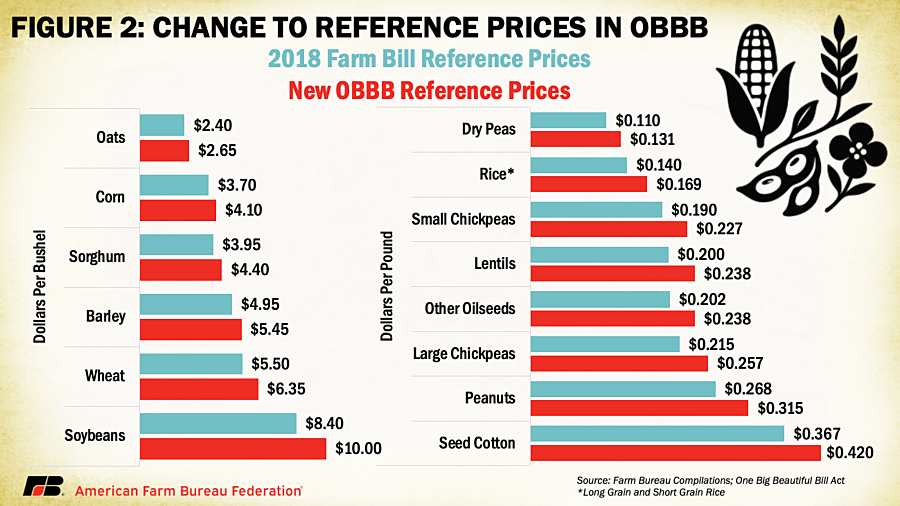

The final bill extends key commodity support programs – including PLC, ARC, marketing assistance loans and Dairy Margin Coverage (DMC) – through the 2031 crop year. The bill raises statutory reference prices (price guarantees) for major covered commodities by 10-21%. Starting in crop year 2031, reference prices will grow by 0.5% annually on a compounded basis, with growth capped at 113% of the original value, reflecting long-term market trends while avoiding unchecked expansion. The effective reference price escalator for PLC was also adjusted from 85% to 88% of the Olympic average (an average that excludes the highest and lowest values from a set of years) of past prices, providing a modest increase in price support as market conditions warrant.

H.R.1 improves the ARC program by increasing the revenue guarantee from 86% to 90% and raising the maximum payment from 10% to 12% of benchmark revenue starting with the 2025 crop year. These changes will help farmers better recover from revenue losses due to price drops or yield declines. Additionally, for the 2025 crop year only, farmers will automatically receive the higher of ARC-CO or PLC payments for each covered commodity — without needing to make an election.

OBBB makes significant updates to base acres — the land tied to farm program payments. For the first time in over a decade, USDA will allow up to 30 million new base acres to be allocated to farms that have historically produced program crops but don’t currently have base acres. Eligibility is based on planting history from 2019–2023. Farmers won’t have to give up existing base to qualify, and allocations are proportionally tied to past plantings. These new base acres can make producers eligible for future PLC or ARC payments starting in 2026.

For dairy producers, the bill enhances the DMC program by increasing Tier I coverage eligibility from 5 million to 6 million pounds per farm. Farms can also use the highest production year from 2021 to 2023 as a new enrollment baseline. Those who commit to multiyear DMC coverage receive a 25% discount on premiums, encouraging long-term participation.

H.R.1 extends marketing assistance loan programs through 2031 and sets updated loan rates for major commodities beginning in the 2026 crop year, providing stronger price floors for crops like wheat, corn, cotton and soybeans. The bill also resumes cotton storage payments, enhances repayment flexibility based on world market prices, and ensures refunds for upland cotton producers when repayment prices exceed market lows, helping farmers manage risk and improve cash flow.

The bill modernizes how farm entities are treated under USDA program rules. It ensures that pass-through entities like partnerships, LLCs and S corporations are treated equitably when it comes to payment eligibility and attribution. The annual commodity payment limit is increased from $125,000 to $155,000, with future adjustments tied to inflation. Additionally, farmers who earn at least 75% of their income from farming, ranching or related activities such as agritourism and direct marketing may be exempt from income-based program eligibility limits. These changes recognize the diverse structure of modern farm operations and help ensure that program support reaches actively engaged producers.

Finally, the bill also includes targeted updates for specific commodity sectors. Economic adjustment assistance for domestic textile mills is enhanced by increasing the payment rate for upland cotton used in textile manufacturing from 3 cents to 5 cents per pound starting in 2025. In the sugar program, the loan rate for raw cane sugar is increased to 24 cents per pound for the 2025 through 2031 crop years, with refined beet sugar rates set proportionally higher. Minimum storage payment rates for forfeited sugar are also updated, and USDA is directed to modernize beet sugar allotment rules and improve the timing of quota reallocations. Additionally, the bill requires a USDA study on potential safeguards for refined sugar imports to protect the domestic sugar industry, with authority to issue new regulations based on the study’s findings.

Crop insurance remains a cornerstone of the farm safety net, and the bill makes several significant updates to strengthen and modernize the program through 2031. It increases premium support for beginning farmers and ranchers by expanding USDA’s definition from five to 10 years of experience, enabling more producers to qualify for assistance over a longer period. Premium assistance is increased during the first four years: an additional 5 percentage points in years one and two, 3 points in year three, and 1 point in year four. These increases are layered on top of the existing 10 percentage point subsidy, resulting in a total subsidy of 15% for the first two years, 13% in year three, 11% in year four, and 10% from year five through year 10.

The bill authorizes a new pilot insurance product for contract poultry growers, helping them manage production risks tied to utility cost volatility and extreme weather — such as spikes in natural gas, propane, electricity or water costs. The program must be developed in collaboration with stakeholders and launched in top poultry-producing states.

It also expands eligibility for the Supplemental Coverage Option (SCO), allowing producers enrolled in ARC to purchase SCO coverage, which was previously only available to those enrolled in PLC. This change offers greater flexibility in tailoring risk management strategies.

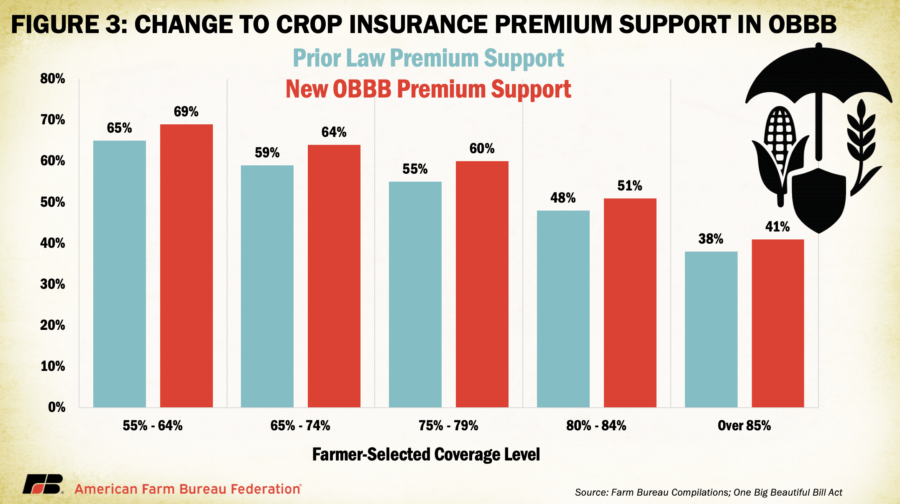

To improve affordability and coverage for all producers, the bill increases the government's share of crop insurance premiums by 3 to 5 percentage points across all farmer-selected coverage levels (Figure 3), making higher coverage more affordable. The maximum coverage level for area-based insurance plans is also increased to 95%, and the premium subsidy for those plans is raised from 65% to 80%.

Additionally, funding for compliance and integrity oversight is increased to $10 million per year, and administrative reimbursements are restructured to better reflect the cost of delivering the program in high-risk areas. Together, these updates aim to ensure continued access to affordable, flexible and accountable crop insurance options that help farmers manage both market and weather-related risks.

Conservation Programs: The bill continues long-term funding authority for USDA’s major conservation programs, including the Environmental Quality Incentives Program (EQIP), Conservation Stewardship Program (CSP) and Agricultural Conservation Easement Program (ACEP) through fiscal year 2031. While these levels exceed those provided under the 2018 farm bill, they primarily reflect the redirection of Inflation Reduction Act (IRA) funding into the permanent farm bill baseline rather than new program expansions. These updates are reflected in amendments to Section 1241(a) of the Food Security Act of 1985, which establish higher annual funding levels than those provided under the 2018 farm bill.

Although this shift reinforces long-term baseline investments in working lands conservation, the bill does not retain all IRA-funded initiatives. For example, it rescinds $450 million in unobligated IRA funds that had been allocated for competitive forestry grants to non-federal landowners. According to the Congressional Budget Office, these adjustments collectively result in a net reduction of $1.8 billion in conservation spending over the next decade.

The bill also renews smaller initiatives that were not funded in the last farm bill extension. This includes the Grassroots Source Water Protection program, which safeguards well water, and the Voluntary Public Access and Habitat Incentive program, which rewards farmers for opening land to hunting and recreation. In addition, the Feral Swine Eradication and Control Pilot Program, a vital initiative to combat over $1.6 billion in annual damages caused by invasive wild pigs, is extended with new funding through 2031.

Trade Promotion: An earlier draft of H.R.1 would have increased funding for USDA’s core trade promotion programs — including the Market Access Program (MAP), Foreign Market Development (FMD), Emerging Markets Program and Technical Assistance for Specialty Crops through 2031. However, due to jurisdictional constraints in the reconciliation process, the final bill instead establishes a new Agricultural Trade Promotion and Facilitation Program that mirrors the purpose of MAP and FMD. Starting in fiscal year 2027, this new program provides $285 million in permanent mandatory funding each year, significantly enhancing USDA’s ability to support international market development. Because existing MAP and FMD authorities remain unchanged at $200 million and $34.5 million, respectively (subject to annual appropriations), this new program represents an increase in trade promotion funding capacity — particularly through a stable baseline mechanism.

Research and Innovation: H.R.1 maintains support for key USDA research initiatives and provides targeted funding to advance agricultural innovation. The bill increases funding for the Specialty Crop Research Initiative to $175 million in fiscal year 2026 — more than doubling current levels — to enhance research on pest control, crop breeding and mechanization for high-value crops. It also invests $60 million in scholarship support for students at 1890 land-grant universities, which serve historically Black institutions with agricultural programs. To modernize aging research infrastructure, the bill provides $125 million in mandatory annual funding starting in 2026 for competitive grants under the Research Facilities Act. The legislation also extends funding through 2031 for USDA’s Urban, Indoor, and Emerging Agriculture Initiative, provides $8 million to support assistive technology for farmers with disabilities, and allocates $37 million to the Foundation for Food and Agriculture Research to promote public-private innovation partnerships. These investments aim to strengthen the nation’s agricultural research capacity through improved facilities, expanded access and science-based approaches to production challenges.

Rural Development, Forestry and Schools: While H.R.1 contains forestry and rural development provisions, it does not include a reauthorization of the Secure Rural Schools (SRS) program. This omission reflects the Senate’s decision to handle SRS separately through the Secure Rural Schools Authorization Act of 2025, which passed the Senate chamber in June. A companion bill has been introduced in the House, but it has not yet advanced. Continued funding for SRS remains critical for counties with large areas of federally owned forestland, particularly in the West, where local tax bases are constrained.

Energy Programs:

The final bill includes a limited extension of USDA’s farm energy programming. Specifically, it reauthorizes the Bioenergy Program for Advanced Biofuels through 2031, which provides payments to producers of renewable fuels like biodiesel, cellulosic ethanol and other next-generation biofuels. While the House-passed bill also proposed extending the Biobased Markets Program (BioPreferred), which promotes biobased (plant-derived) products through federal procurement and labeling, that provision was not included in the final legislation.

Specialty Crops, Horticulture and Organics: The final bill delivers tailored support for specialty crop producers (fruit, vegetable, nut and nursery crop farmers) and the organic sector. It increases funding for the Specialty Crop Block Grant Program, providing $85 million annually through 2025 and $100 million in 2026. It also boosts the Plant Pest and Disease Management and Disaster Prevention Program from $75 million to $90 million in 2026 to help growers combat invasive threats like citrus greening and the spotted lanternfly. For organic agriculture, the bill reauthorizes organic market data collection with $10 million through 2031, provides $5 million in 2026 to modernize systems for tracking organic imports, extends cost-share assistance for organic certification through 2031 and includes $5 million for USDA’s pesticide use survey in 2026.

Disaster Assistance: Section 10401 of the final bill makes several key updates to USDA’s Supplemental Agricultural Disaster Assistance programs, improving both payment levels and eligibility criteria across a range of livestock and specialty operations. For livestock producers, the Livestock Indemnity Program (LIP) is revised to provide 100% of market value for animals lost to predation and 75% compensation for animals lost to adverse weather or disease. The Agriculture Secretary is also authorized to account for regionally documented price premiums above national averages when determining livestock value, offering more equitable support for producers in higher-value markets. Additionally, the bill creates a new payment mechanism for unborn livestock losses occurring after Jan. 1, 2024. These payments, triggered when losses exceed normal mortality, are tied to species-specific multipliers and set at no more than 85% of the payment rate for the lightest weight class of the animal.

The Livestock Forage Disaster Program (LFP) is also expanded to improve access and payment levels. Instead of requiring eight consecutive weeks of qualifying drought, the revised program provides one month of assistance after just four consecutive weeks of qualifying conditions and allows for a second month if drought extends to seven of the previous eight weeks. The Emergency Assistance for Livestock, Honeybees, and Farm-Raised Fish (ELAP) program is amended to include payments for farm-raised fish losses due to bird depredation, with a minimum payment rate of $600 per acre and consideration for revenue loss, deterrent costs and disease-related mortality. The bill also directs USDA to use a standardized 15% normal mortality rate when determining eligibility for honeybee colony loss payments.

Finally, the Tree Assistance Program (TAP) is strengthened by eliminating outdated references to adjusted mortality thresholds. The cost-share rate for tree replacement is increased from 50 to 65%, and losses are now evaluated based on normal damage or mortality without reductions for presumed baseline losses. Collectively, these updates provide more accurate and timely assistance for agricultural producers facing production losses from natural disasters, animal predation and disease pressures.

Miscellaneous and Livestock Provisions: H.R.1 addresses a grab-bag of important programs that don’t neatly fit into a farm bill title but matter on the ground. A major highlight is animal agriculture health: the bill injects significant new funding into the three-pronged National Animal Disease Preparedness, Detection and Vaccine Bank programs. Starting in 2026, USDA must spend $233 million per year on animal disease prevention and response, a seven-fold increase over previous levels. This means more resources to stockpile vaccines, bolster veterinary diagnostics and train state responders – a timely investment to protect livestock farmers from devastating outbreaks. This increases resources to counter significant threats like foot-and-mouth disease, highly pathogenic avian influenza and screwworm. As poultry producers in multiple states have learned the hard way, an outbreak of avian influenza can decimate flocks overnight. Similarly, a single case of foot-and-mouth disease in U.S. livestock could halt billions in exports. Starting in 2031, annual funding continues at $75 million, with a focus on sustaining preparedness infrastructure.

The bill also directs USDA to conduct a mandatory biennial cost survey of dairy processors to assess the actual manufacturing costs of converting raw milk into cheese, butter and nonfat dry milk — products used to set Class III and IV milk prices under the Federal Milk Marketing Orders. Developed with direct input from Farm Bureau, this provision ensures that future make allowance updates are based on consistent, up-to-date data, a long-standing request from dairy farmers seeking fairer and more transparent pricing formulas.

It also expands funding for the Sheep Production and Marketing Grant Program through 2026 to support innovation and marketing efforts in the sheep and lamb industry.

Several previously expired or “orphaned” programs are revived and funded through 2031, including the Pima Cotton Trust Fund and Wool Apparel Manufacturing Trust Fund, which assist U.S. textile manufacturers, as well as the wool research and promotion program. The bill also extends the Emergency Citrus Disease Research and Extension Program — focused on combatting huanglongbing (citrus greening) — through 2031, providing researchers with sustained funding to develop long-term solutions to protect citrus groves in Florida and other key growing regions.

Nutrition Title: Alongside farm programs, H.R.1 also reauthorizes nutrition assistance, chiefly the Supplemental Nutrition Assistance Program (SNAP), with reforms aimed at balancing continued support for vulnerable families with efforts to reduce fraud and program inefficiencies. The bill extends SNAP and related nutrition programs through 2031, while updating work requirements for able-bodied adults without dependents, modifying utility allowance rules, and introducing targeted program integrity reforms. Continued funding is also provided for food banks through The Emergency Food Assistance Program (TEFAP).

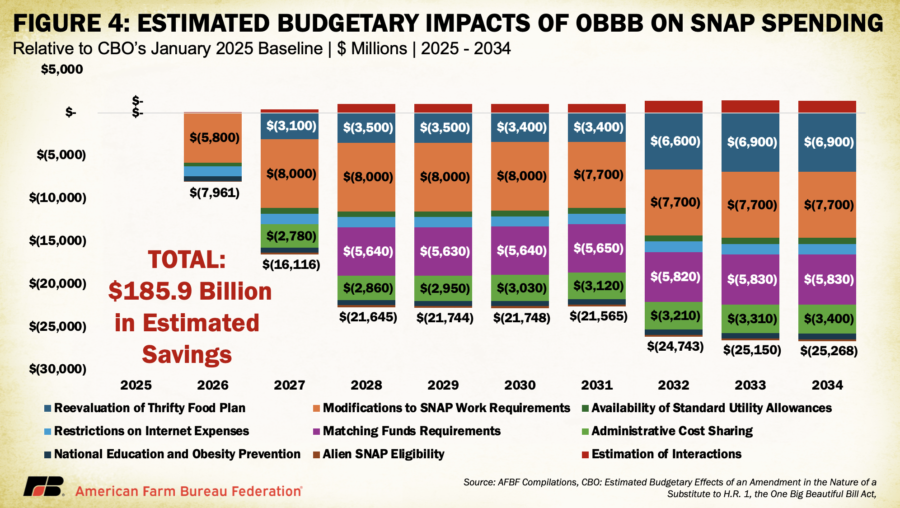

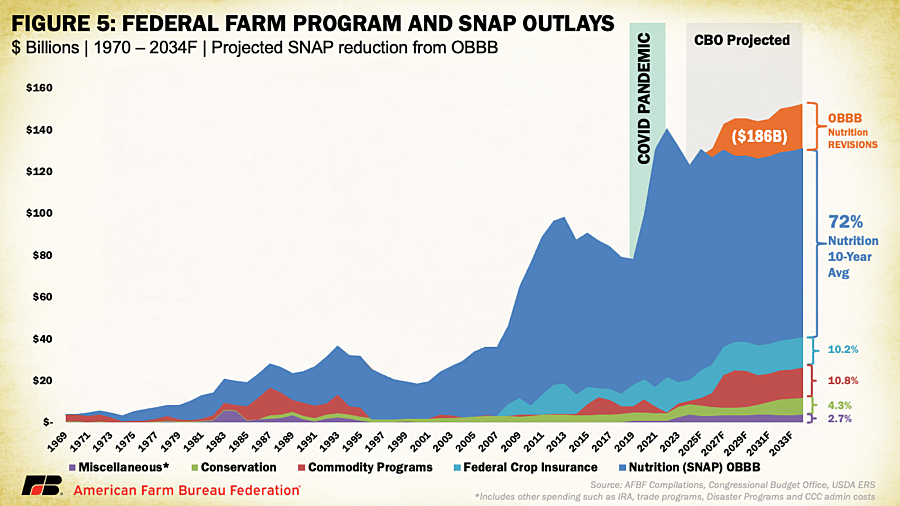

According to the Congressional Budget Office, these changes result in an estimated $186 billion in SNAP-related savings over the next decade. As illustrated in Figure 4, the bulk of these savings stem from adjustments to the Thrifty Food Plan reevaluation, work requirement modifications, utility allowance limits and administrative cost-sharing reforms. These savings played a central role in offsetting increased farm program outlays, enabling Congress to reinvest in the farm safety net, rural development and agricultural infrastructure without increasing total agricultural spending under the bill.

Even with $186 billion in projected savings, SNAP remains the largest USDA program, making up 72% of expected total spending over the next decade. As Figure 5 shows, nutrition outlays surged during the pandemic to meet urgent need but even after those temporary spikes, spending is projected to remain well above pre-pandemic levels. This underscores the lasting shift in baseline nutrition costs, despite reforms aimed at curbing growth.

Tax Provisions Benefiting Farmers, Ranchers and Rural Businesses (Title VII): H.R.1 also delivers major tax relief and incentives that can directly impact farm and ranch families. These include:

Permanency of 2017 Individual Tax Code Provisions: Nearly 98% of farms and ranches operate as sole proprietorships, partnerships or S corporations and did not benefit from the permanent tax relief granted to corporations in 2017. H.R. 1 grants permanency to numerous tax provisions important to families and farms in Title XI, Part 1, preventing their tax rates from increasing if they had been left to expire at the end of 2025. These provisions include expanded tax brackets with a lower maximum tax rate, increased standard deductions of $15,750 and child tax credits of $2,200 per child and increased thresholds for alternative minimum tax (AMT) liability.

Qualified Business Income Deduction (Section 199A): For pass-through entities, H.R.1 makes permanent the 20% qualified business income deduction introduced in 2017. The final bill makes permanent the 20% deduction while also providing a minimum deduction of $400 for any business with $1,000 or more in qualified business income. This lowers the share of farming profits spent on taxes and is a big win for small businesses nationwide that compete alongside corporations with lower tax rates.

Estate Tax Relief for Family Farms: H.R.1 makes the estate tax exemption permanent at $15 million per individual (or $30 million per couple), indexed for inflation. Without this change, the exemption was set to drop back to $5.5 million after 2025, a level that’s wildly out of step with today’s farm economy. With skyrocketing land values, equipment costs and input prices, even modest-sized farms can easily exceed that threshold, meaning upon the owner’s death, far more family operations would face massive tax bills than previously estimated. By locking in a higher, inflation-adjusted exemption, the bill helps ensure more family farms can transition smoothly to the next generation without being forced to sell off land or assets to pay the IRS.

Enhanced Business Expensing and Depreciation:The act raises Section 179 small business expensing limits to $2.5 million (up from about $1.29 million), with a higher phase-out threshold of $4 million. In addition, H.R. 1 permanently restores full bonus depreciation for capital investments, canceling the remaining phase-down of this expensing benefit. While full bonus depreciation will not retroactively apply to the last two years of phase-down, it will be active for anything purchased in 2025, even if purchased before the enactment of the One Big Beautiful Bill Act. Practically, these provisions mean farmers can continue to write off the entire cost of new equipment, land improvements like drainage tile, modernized barns and other essential capital upgrades in the year of purchase, rather than depreciating them over many years.

Clean Fuel Production Credit (Section 45Z): H.R.1 delivers a significant win for agriculture-linked, domestic renewable fuels by extending and modifying the Clean Fuel Production Credit (45Z) through 2029. The credit supports the production of low-emission transportation fuels — including ethanol, biodiesel, renewable diesel and sustainable aviation fuel (SAF) — by offering a tax credit tied to lifecycle greenhouse gas emissions reductions. To qualify, eligible fuels must be produced by American-controlled firms using feedstocks from the U.S., Mexico or Canada. These changes support a broad range of agricultural feedstocks such as corn, soybeans and other biomass-based materials, expanding markets for farmers while reducing reliance on fossil fuels. The act also amended Sections 45Z and 6426(k) to ensure makers of sustainable aviation fuel (SAF) do not receive overlapping tax credits, and increased credits for small biodiesel producers. Combined, the changes to 45Z reinforce domestic and regional production capacity, strengthen supply chain security, and encourage investment in U.S. agriculture and biofuel infrastructure. Extending this credit provides long-term certainty and sends a clear market signal that incentivizes cleaner fuels, agricultural innovation and rural economic development.

One Big Beautiful Bill Act – Conclusion and What’s Next

Farmers and ranchers face uncertainty from every direction — markets, weather, input costs and regulation. The One Big Beautiful Bill Act delivers long-overdue policy certainty by strengthening core safety net programs, enhancing risk management tools and locking in important tax provisions for family farms. It reflects many of Farm Bureau’s top priorities and offers measurable wins for producers navigating an increasingly complex farm economy.

At the same time, H.R.1 is not a complete substitute for a full farm bill reauthorization. Crafted through the reconciliation process, the bill was shaped by budget and jurisdictional limits that excluded several important areas of farm and rural policy.

A follow-up Market Intel will outline what’s still left to be done — and where Congress may go next to finish the job for farmers and ranchers.

Top Issues

VIEW ALL