Restaurant Performance Index Falls

AFBF Staff

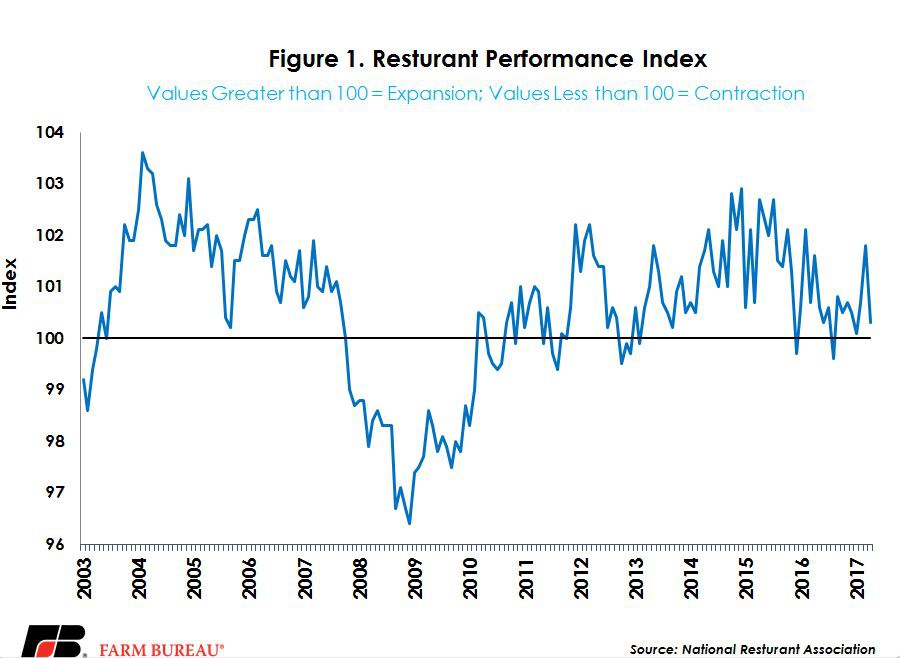

The latest data, released June 1, 2017, reflects a steep drop—1.5 percent-- from March to April in the Restaurant Performance Index. The RPI is a monthly composite of the health of the U.S. restaurant industry and is measured in values relative to 100. Values exceeding 100 indicate performance is expanding, while values below 100 indicate contraction. April currently stands at 100.3, just barely over the 100 mark. The National Restaurant Association cites a net decline in customer traffic and same-store sales, as well as a decline in optimism over the economy, compared to the March survey. Figure 1 shows the RPI 2003 to April 2017.

Using different industry indicators, the RPI can be divided into current situation or expectations. The current situation part of the index uses four industry indicators: same-store sales, traffic, labor and capital expenditures. This too dipped below the previous month, down 2.3 percent from March to 99.1. The current situation would indicate restaurants are currently in a contraction-oriented phase.

The expectation piece of this index remains expansionary--with the expectation index still over 100, at 101.5—although it is down 0.7 percent since March. The expectation index looks at four indicators as well but over the next six months. It takes into account restaurant operators’ outlook on same-store sales, employees, capital expenditures and business conditions. Although the index is still over 100, NRA noted April is the lowest expectation index in the last six months.

An expansionary outlook on the economy bodes well for livestock producers and should provide a boost to demand to help lessen the negative effects of the large production numbers that are expected to post in beef, pork and chicken. However, the decline relative to the first three months of the year in expectations is a bit worrisome and could spell trouble later in the year. For now though, the outlook remains positive. Another boost to the domestic demand picture is the growing interest in new cuts of meat, which NRA named as the top new food trend in 2017. Vegetarian and vegan dishes were listed as cooling trends. These trendy changes will certainly add to domestic consumption as more meat dishes are featured throughout the restaurant complex.

A version of this article first appeared in In the Cattle Markets and is reprinted by permission from Livestock Market Information Center (LMIC). AFBF is a member of LMIC. In the Cattle Markets is an extension newsletter featuring content from a group of rotating agricultural economists. AFBF’s Katelyn McCullock is a regular contributor and wrote this week’s “In the Cattle Markets” highlighting the Restaurant Performance Index. To subscribe to future “In the Cattle Markets” newsletters visit www.lmic.info.

Top Issues

VIEW ALL