Reviewing the CFAP Payment Formula for Non-Specialty Crops

TOPICS

USDA

photo credit: Mark Stebnicki, North Carolina Farm Bureau

Shelby Myers

Former AFBF Economist

On May 19, USDA unveiled the details of the Coronavirus Food Assistance Program, which provides direct payments to farmers and ranchers to partially offset COVID-19-related losses for livestock and specialty and non-specialty crops, e.g., Reviewing Coronavirus Food Assistance Program Details. Sign-up for the CFAP program runs from May 26 through August 28.

The Coronavirus Aid, Relief, and Economic Security Act provided the Agriculture secretary with an immediate $9.5 billion and the Commodity Credit Corporation with a $14 billion replenishment, expected to be available later this summer, i.e., What’s in the CARES Act for Food and Agriculture. For the CFAP direct payments, which will be divided by commodity, USDA combined existing CCC funding of $6.5 billion with the $9.5 billion from the CARES Act.

Reviewing CFAP Payments and Payment Rates

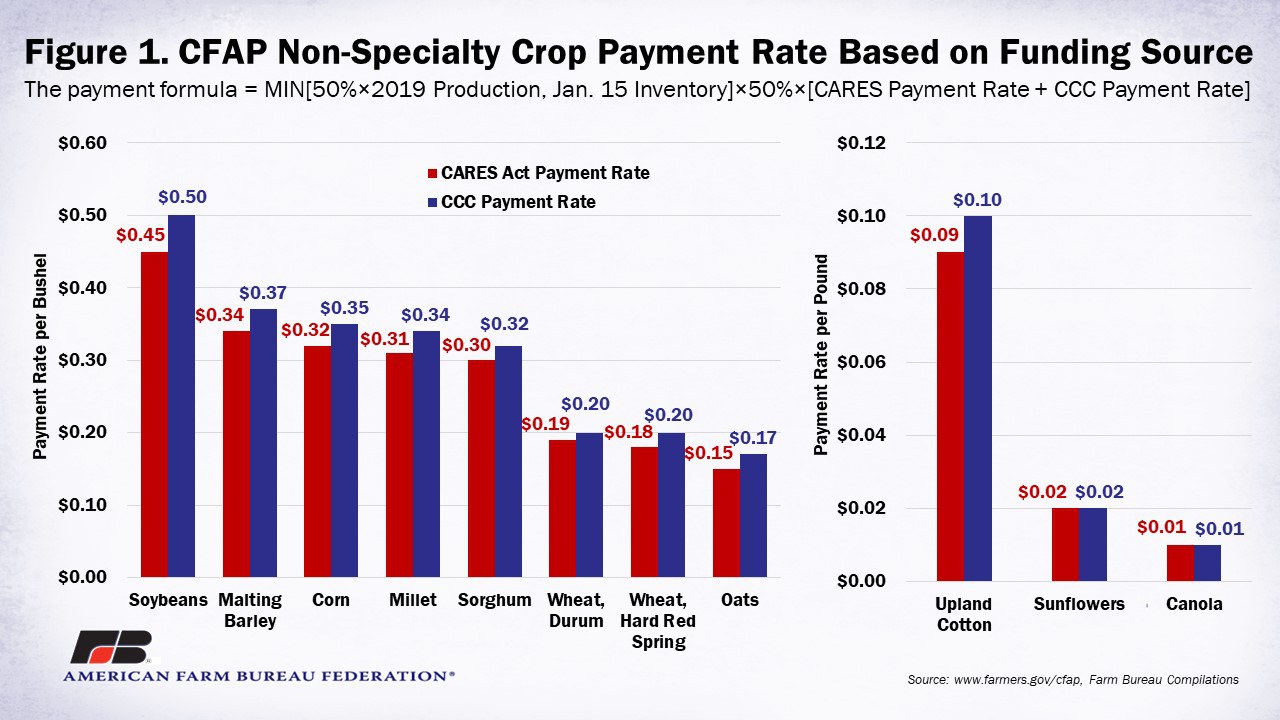

For non-specialty crops, e.g., malting barley, canola, corn, upland cotton, millet, oats, soybeans, sorghum, sunflowers, durum wheat and hard red spring wheat, payments will be attached to actual 2019 production and will be paid based on inventory subject to price risk as of Jan. 15, 2020. Payment rates for the non-specialty crops are identified in Figure 1.

A single payment will be made based on 50% of a producer’s 2019 total production or the 2019 inventory as of Jan. 15, 2020, whichever is smaller, multiplied by 50% and then multiplied by the sum of the commodity’s applicable payment rates. Producers will receive 80% of this CFAP payment up front.

The payment formula: min[50%×2019 Production, Jan. 15 Inventory]×50%×[CARES Payment Rate + CCC Payment Rate]

For example, a corn producer with 300,000 bushels of 2019 production and 100,000 bushels in inventory on Jan. 15 would be eligible for a CFAP payment on the 100,000 bushels at a payment rate of 33.5 cents per bushel, or $33,500. The first CFAP payment would be 80% of this total, or $26,800, i.e., $26,800 = 80%×min[50%×300,000, 100,000]×50%×[$0.32+$0.35].

Similarly, a cotton producer with 2019 production of 1,000 bales and 500 bales in inventory on Jan.15 would be eligible for a CFAP payment on 500 bales at a payment rate of 9.5 cents per pound, or $22,800. The first CFAP payment would be $18,240.

CFAP Payment Limitation

CFAP includes a payment limitation of $250,000 to be applied to the total amount of CFAP payments made for all eligible commodities. Also, entities structured as corporations, limited liability companies and limited partnerships may receive $250,000 per shareholder up to $750,000 for those who contribute at least 400 hours of active personal management or active personal labor. Participation in other farm programs such as Agriculture Risk Coverage, Price Loss Coverage, Dairy Margin Coverage and Dairy Revenue Protection is complementary to CFAP and will not lower a recipient’s CFAP benefits.

To ensure the availability of funds, producers may receive a portion – 80%, or up to $200,000 -- of the maximum total payment within seven to 10 days of the application’s approval. The remaining 20% of the payment that remains below the payment limit, likely no more than $50,000, will be paid at a later date, provided funds remain available.

As producers sign-up for CFAP, many are wondering how quickly the payment limit will be reached. Each commodity covered under CFAP has an associated payment rate, which is also segmented by funding source -- the CCC or the CARES Act. In addition, each segment of the industry, i.e., non-specialty crops, livestock, specialty crops, wool and dairy, has its own payment formula.

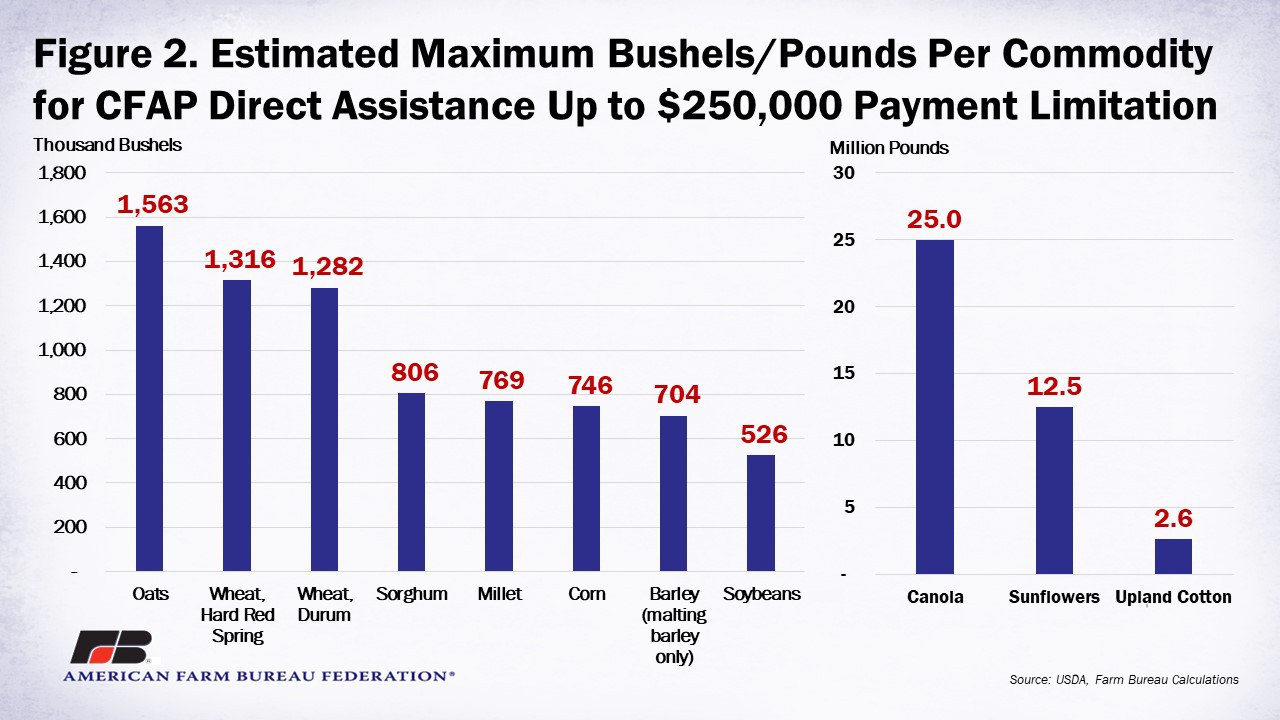

When the previous formula is solved for bushels or pounds and simplified, the payment formula can be used to calculate the largest amount of inventory or half of 2019 production possible, subject to price risk, before a farmer or rancher reaches the payment limitation.

Bushels/pounds = $500,000 / [CARES Payment Rate + CCC Payment Rate]

At 1.5 million bushels, oats have the largest inventory and the highest production cap before reaching the payment limitation. For the two wheat varieties, 1.3 million bushels of hard red spring wheat or 1.2 million bushels of durum wheat would cause a producer to reach the payment limitation. For corn, 746,269 bushels would cause a producer to reach the payment limitation, while soybeans would reach the limit with 526,316 bushels. A canola producer would need to submit 25 million pounds worth of canola to reach the payment limit, while upland cotton producers reach the payment limit with 2.6 million pounds of cotton.

Importantly, these totals are unpriced bushels or pounds defined as one-half of 2019 production or inventory on Jan. 15. Figure 2 displays the maximum bushels and pounds associated with non-specialty crops that would reach the CFAP payment limit of $250,000.

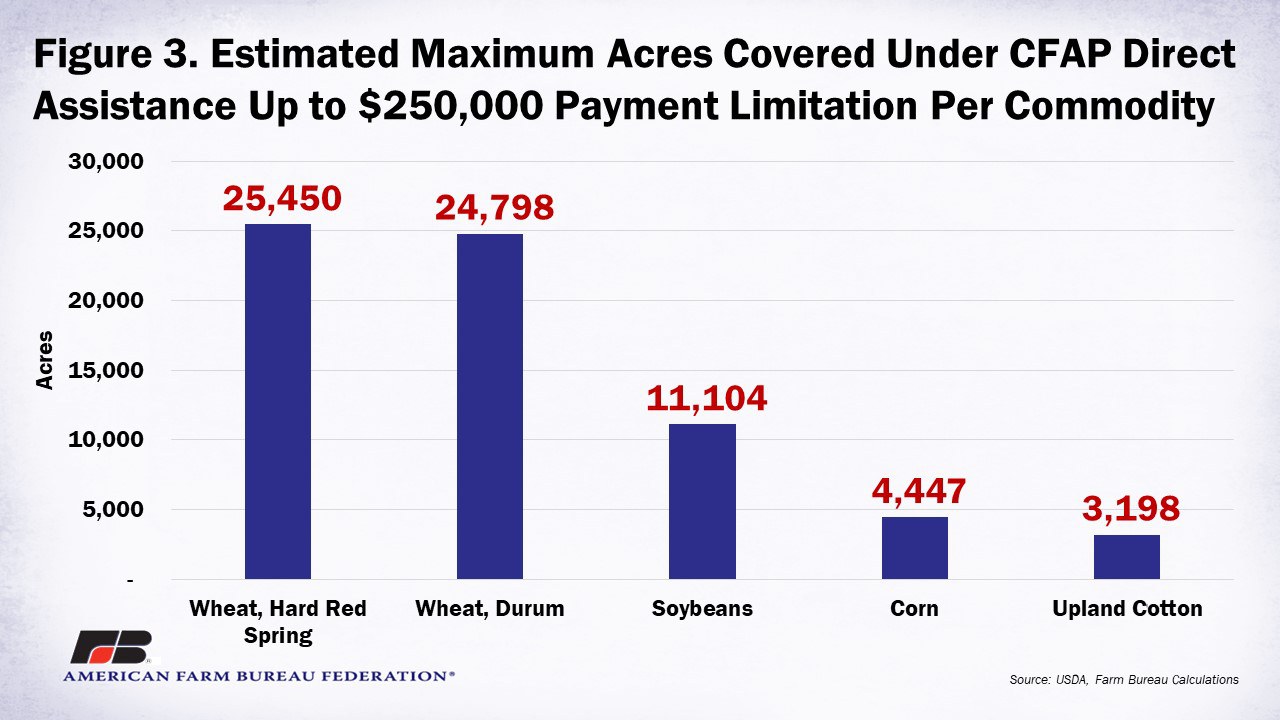

The CFAP formula for non-specialty crops with inventory subject to price risk can be analyzed across commodity acres using the national average 2019 yields. Using this estimation, wheat payments stretch across more acres, meaning there is potential for more acres with wheat subject to price risk that qualify for a CFAP payment. For hard spring wheat, the payment limitation of $250,000 can cover 25,450 acres of hard spring wheat. The payment limitation covers 24,798 acres of durum wheat. The payment limitation reaches 11,104 acres of soybeans or 4,447 acres of corn. For upland cotton, the payment limitation only covers 3,198 acres.

Once again, these acres reflect only the unpriced bushels or pounds. Assuming these acres reflect one-half of 2019 production, a corn producer with a yield similar to the national average would need to farm nearly 9,000 acres to reach the payment limit. Figure 3 shows how far the $250,000 payment limitation will go by acreage for select non-specialty crop commodities.

Keep in mind, while the CFAP payment is calculated on a commodity-by-commodity basis, the payment will come as one lump sum that is subject to the payment limit. So, while these estimates display the maximum amount of a specific commodity that could reach the payment limit, it is more likely farmers will have a mix of commodities to submit and could reach the limit in a variety of ways and amounts under these maximums.

Summary

The direct assistance through CFAP is meant to help bridge the gap for farmers and ranchers as they struggle with the significant financial challenges brought on by COVID-19. To that end, the payment limit of $250,000 was utilized to provide more significant financial support to agricultural producers.

For some of the nation’s largest farmers, $250,000 can be reached quickly, and as a result, the limited funding available to support farmers and ranchers during this time may not be enough. This summer, USDA should see the Commodity Credit Corporation replenished by $14 billion, which can be used to craft additional assistance packages.

In the coming weeks and months, lawmakers are likely to consider more support, especially to sectors of agriculture not included in the current CFAP authority, i.e., poultry, depopulated animals and the biofuels sector. Expanding the Commodity Credit Corporation’s borrowing authority to $68 billion would provide a much-needed and long-term boost to USDA’s authority to help support and stabilize farm income and commodity prices as future challenges emerge, i.e., Reviewing the Commodity Credit Corporation’s Borrowing Authority.