Rice Outlook Remains Uncertain

Brandy Carroll

Director, Commodity Activities and Market Information

photo credit: Getty

Brandy Carroll

Director, Commodity Activities and Market Information

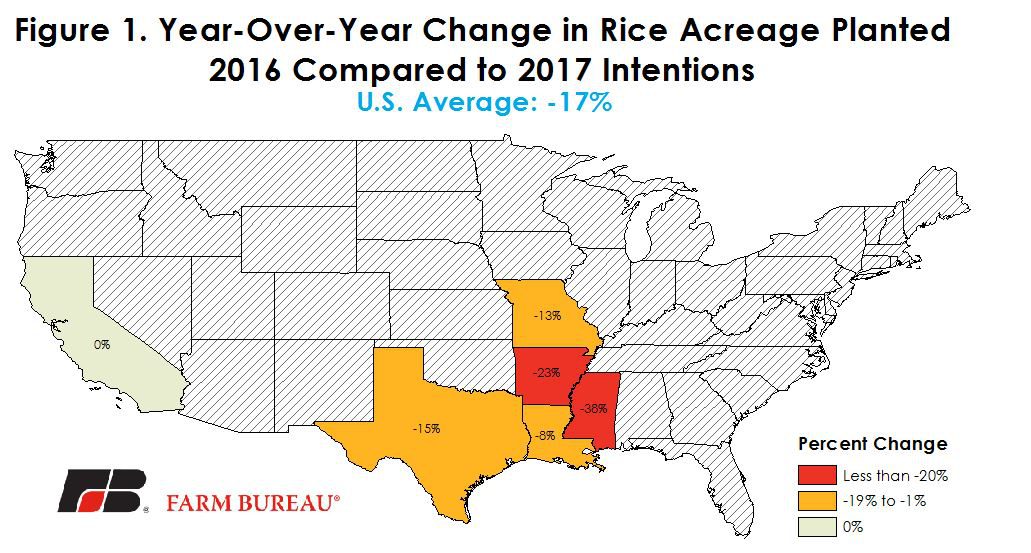

USDA’s March 31, 2017 Prospective Plantings report revealed U.S. rice producers intend to plant 2.626 million acres in 2017, down 17 percent from 2016. Medium grain rice acreage is projected at 666 thousand acres, up a scant thousand acres from 2016. Long grain rice acreage is projected at 1.909 million acres, down 22 percent from the prior year. While these acreage declines seem significant, it is important to note that 2016 saw the largest rice plantings since 2005 at 3.15 million acres.

Disappointing yields – off three percent from prior year levels – kept 2016 production in line with recent years at 224.1 million hundredweight. Lower yields were due in large part to flooding in parts of Louisiana and Arkansas late in the growing season that damaged crops. Additionally, hot nighttime temperatures, heavy rains, and wind during pollination led to blanking and poor milling yields in many areas. Thus, while 2016 production was 16 percent above 2015 levels, it was only one percent above 2014 production due to the poorer growing conditions and rice yields.

At USDA’s Annual Agricultural Outlook Forum 2017 rice yields were projected to return to more normal levels – up seven percent from prior year levels to 7,716 pounds per acre. However, despite improved yields, lower rice acreage should contribute to a reduction in total rice production. USDA estimates 2017 rice production at 199 million hundredweight, down 11 percent from the 2016/17 crop year.

Currently, U.S. rice stocks have not grown. USDA’s March 31 Rice Stocks report had levels even with the previous year’s total. Long grain rice made up 67 percent of rough rice stocks, medium grain accounted for 31 percent, and short grain rice was 2 percent. Milled rice stocks were reported as 3.71 million cwt of whole kernel rice and 2.52 million cwt of brokens. While USDA’s April 11, 2017 World Agricultural Supply and Demand Estimates (WASDE) revised stocks lower due to higher than anticipated export volumes, rice ending stocks are still projected to be at the highest levels since 1986/87. Ending inventories are forecasted at 49.1 million hundredweight and implies a stocks-to-use ratio of 20 percent.

USDA’s WASDE projected total use for old-crop rice at 245 million hundredweight, up 12 percent from prior year levels. Total use in 2017/18 is projected at 238 million hundredweight, and ending stocks are projected to decline to less than 40 million hundredweight in 2017/18. It is on lower ending stock levels that USDA projects a modest improvement in all rice prices for 2017/18 by 20¢ per hundredweight to $10.70.

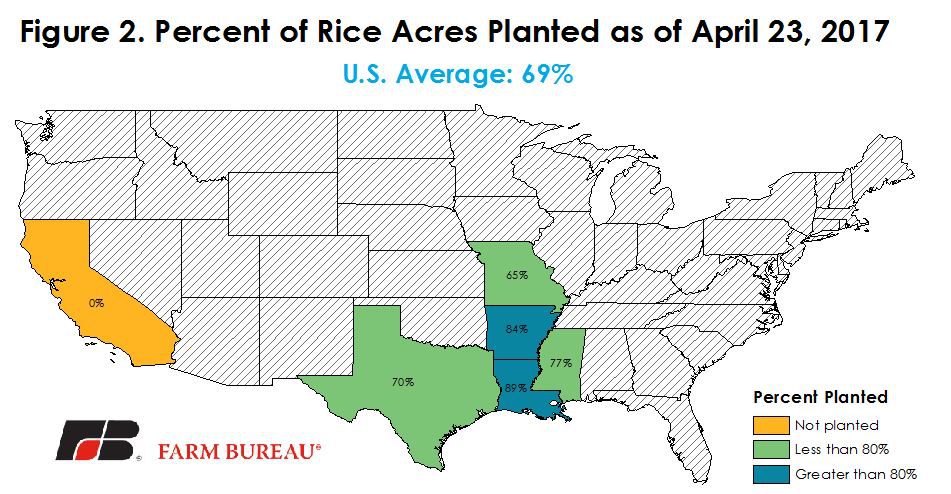

Despite the marginal improvement in rice prices, uncertainty remains. Rice planting began several weeks ago and USDA’s April 24, 2017 Crop Progress report revealed 69 percent of the rice crop had been planted as of April 23, 2017, Figure 2. This pace of planting is 9 percent above last year and 22 percent above the five-year average. USDA’s most recent crop progress report confirms that California rice farmers continue to struggle with flood conditions and have not begun planting.

Favorable weather in the South, as evidenced by the April 18, 2017 Market Intel article “Corn Planting is Stalled in the Midwest”, has allowed many southern states to accelerate their planting pace above prior year and five-year average levels. Warm, dry conditions have allowed farmers to get in the field earlier than usual in many areas, but now they need rains to get a stand. The National Weather Service forecasts above average precipitation in the next eight to 14 days. The rice crop is 45 percent emerged compared with a five-year average of 30 percent. Managing for quality will be on the minds of farmers after last year’s crop.

With 814 thousand acres of rice unplanted as of April 23, 2017, most of which is in California, much of the planting uncertainty is resolved. Growing conditions, the pace of consumption, and global inventory levels will be important to monitor as fundamental indicators for rice prices moving forward. Better than anticipated crop yields could lead to larger U.S. inventory levels and lower prices.

USDA currently projects global ending stocks this year at 118 million metric tons, the highest level since the 2001/02 crop year. With climbing inventory levels and prospects for a larger than anticipated U.S. crop, rice prices continue to move lower. July futures are currently trading below $10 per hundredweight and are near the contract low of $9.77 per hundredweight. These lower prices will impact the marketing year average prices for rice.

USDA’s most recent projections are for a total rice yield of 7,716 pounds per acre and an average farm price of $10.70 per hundredweight. Combined, average revenue for all rice in 2017/18 is projected at $825 per acre, down 20 percent from 2014/15 level of $1,015 per acre. This value obviously differs for long- and medium-grain rice.

To assist rice producers during this low-price environment, USDA’s Price Loss Coverage (PLC) program has a reference price of $14 per hundredweight on medium and long grain rice and $16.10 per hundredweight for japonica rice. Both the Congressional Budget Office and USA Rice forecast for these lower prices to be offset by payments of approximately $3 per hundredweight, or $150 to $200 per base acre, for the 2017/18 crop year. There are 4.6 million base acres of rice, and for rice farmers with base acreage, this PLC payment goes a long way to getting the value of rice closer to the higher levels experienced in recent years.

Top Issues

VIEW ALL