USDA Launches 2023-2024 Crop Loss Disaster Assistance

photo credit: Texas Farm Bureau, Used with Permission

Daniel Munch

Economist

USDA's opening of applications for Stage 1 of the new Supplemental Disaster Relief Program (SDRP) marks the start of a new chapter in federal efforts to offset crop, tree and vine losses tied to natural disasters in calendar years 2023 and 2024. Authorized by the Disaster Relief Supplemental Appropriations Act of 2025, SDRP is backed by $16.09 billion and will be administered in two stages by USDA’s Farm Service Agency (FSA). This Market Intel focuses on Stage 1, which uses existing crop insurance and Noninsured Disaster Assistance Program (NAP) data to deliver payments equal to 35% of calculated eligible losses, with the potential for increased payments as program funds allow.

While the initial rollout of Stage 1 is a welcome development for many farmers who have faced prolonged uncertainty, key questions remain about the timing and structure of Stage 2. Timely and uniform disaster assistance across states and commodities remains critical, particularly for farmers and ranchers whose losses fall outside standard insurance triggers or who operate in states that rely on alternative disaster assistance delivery systems.

A New Framework Rooted in Past Programs

SDRP builds on a progression of past ad hoc disaster programs, including Wildfire and Hurricane Indemnity Program Plus (WHIP+) and the Emergency Relief Program (ERP). While all three aim to help farmers recover from natural disasters, the way losses are calculated has evolved.

WHIP+, which covered losses from 2018 through 2020, based payments on the difference between expected and actual yields or revenues. Expected values were often tied to a grower’s actual production history (APH), a multiyear average of their own past yields, or to county yield benchmarks. Farmers had to submit detailed documentation, and payment rates varied depending on whether crop insurance was in place.

ERP 2020-2021 was simpler. In Phase 1, it used each producer’s own liability, applied a disaster-adjusted coverage level based on their insurance plan, and subtracted actual production and prior indemnities to determine payment. Applications were prefilled based on USDA data, helping accelerate delivery. Phase 2, by contrast, targeted growers whose losses weren’t fully reflected in insurance records. Payments were based on changes in gross revenue between a disaster year and a benchmark year, requiring more documentation and often producing lower or inconsistent results.

Later, under ERP 2022, USDA introduced progressive factoring – a controversial adjustment that reduced the percentage of calculated losses paid out as loss amounts increased. This tiered formula disproportionately penalized farmers with larger losses and led to frustration across the agricultural community. ERP 2022 Phase 2 again used a gross revenue comparison for those not fully covered under insurance, continuing the pattern of revenue-based calculations for growers with more complex or uncovered losses.

SDRP continues the ERP Phase 1-style model but removes progressive factoring entirely. Instead, it applies a flat 35% payment rate across all qualifying producers, regardless of the size of their calculated loss. This change provides greater predictability and avoids the inequities introduced in ERP 2022, though still drastically reduces payments.

Who is Covered in Stage 1?

Farmers eligible for Stage 1 must have received a crop insurance indemnity or NAP payment tied to a qualifying disaster in 2023 or 2024. Eligible disasters include floods, wildfires, hurricanes, freezes, excessive moisture or heat and qualifying drought. For drought, eligibility is restricted to counties that experienced eight or more consecutive weeks of D2 (severe) drought or any instance of D3 (extreme) drought or higher, as designated by the U.S. Drought Monitor.

Eligible farmers must also meet USDA’s standard conservation compliance and adjusted gross income requirements. Eligible crops include aquacultural species covered by crop insurance or NAP, but aquaculture losses compensated under the Emergency Assistance for Livestock, Honeybees and Farm-Raised Fish Program are ineligible to avoid duplicate benefits. Farmers must not have received ERP 2022 Track 1 or Track 2 payments for the same crop year, as SDRP cannot be used to compensate the same loss twice.

Growers in Connecticut, Hawaii, Maine and Massachusetts will not apply for SDRP Stage 1 through FSA. Those states will administer disaster payments independently using separate block grant funds authorized in the same law. For crops insured under Whole Farm Revenue Protection (WFRP), eligibility depends on the county where the majority of the producer’s expected revenue was reported. If that county is in Connecticut, Hawaii, Maine or Massachusetts, the WFRP unit is ineligible for SDRP Stage 1, even if some of the unit’s land lies outside those states. However, if the majority-revenue county is located outside of those four states, the unit remains eligible, even if some acreage falls within them. Farmers with rainfall index insurance policies for apiculture and pasture, rangeland and forage policies follow the same rule eligibilityand is determined by the county listed on the application.

How to Apply

FSA and RMA will generate and mail pre-filled SDRP Stage 1 applications (Form FSA-526) to farmers with eligible 2023 or 2024 losses based on existing crop insurance or NAP data. Farmers may also request their pre-filled form from their local FSA office. While pre-filled, producers must complete key fields, including selecting the applicable qualifying disaster event and certifying they will maintain crop insurance or NAP coverage for the crop and county for the next two available years. If a farmer received both a NAP payment and a crop insurance indemnity for the same crop and unit, they must choose which dataset to use for payment and indicate that election. For WFRP policies, farmers must also certify and document the percentage of expected revenue from specialty and high-value crops to determine the applicable payment limit. If corrections are needed, farmers must contact their crop insurance agent or FSA office to update official records before submitting. Applications must be signed by all parties with a share in the crop and submitted to FSA by the to-be-announced deadline via mail, email, fax or in person. Altering pre-filled data outside of official channels will void the application.

In addition to the FSA-526 application form, the following forms must be on file for all applicants:

- CCC-902 (Farm Operating Plan)

- CCC-901 (for legal entities)

- AD-1026 (Conservation Compliance Certification)

- Form AD-2047, Customer Data Worksheet

- SF-3881, Direct Deposit

Payment Calculation & Example

SDRP uses a simple, three-step formula to determine payments, which will not exceed 90% of losses as required by the act:

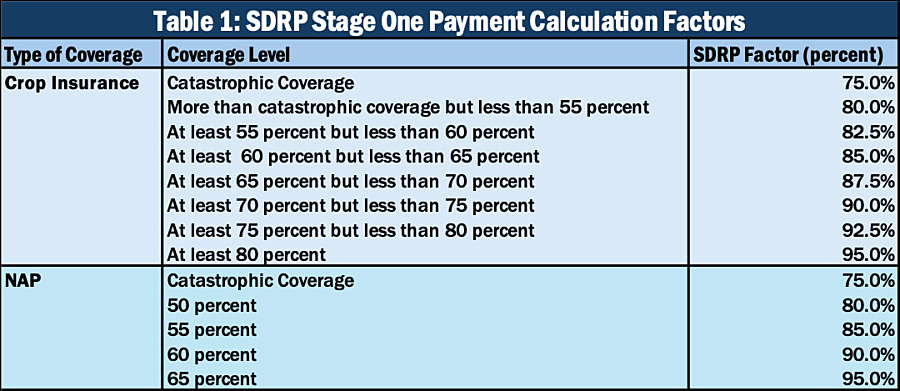

1. A disaster-adjusted coverage factor — ranging from 75% to 95% based on the original coverage level — is applied to the farmer’s expected crop value (Table 1).

2. The producer’s actual production value and net crop insurance indemnity (gross indemnity minus administrative fees and premiums) are subtracted.

3. The resulting value is multiplied by a 35% final payment factor. This means qualified producers get 35% of the calculated payment.

This approach closely mirrors ERP Phase 1, which also used a grower’s reported liability, disaster-adjusted coverage factor, and actual production value to calculate losses. What’s new in SDRP is the use of a flat 35% payment factor for all calculated losses, regardless of loss size or crop type. This change eliminates the confusion and inequity caused by progressive factoring used in ERP 2022.

For crops covered under NAP rather than crop insurance, SDRP uses the NAP yield and guarantee structure to determine coverage levels and payments. Producers are not required to choose between NAP and crop insurance — each crop will be evaluated based on the program under which it was originally enrolled.

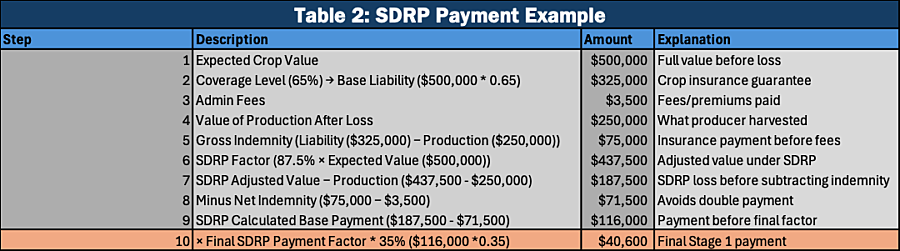

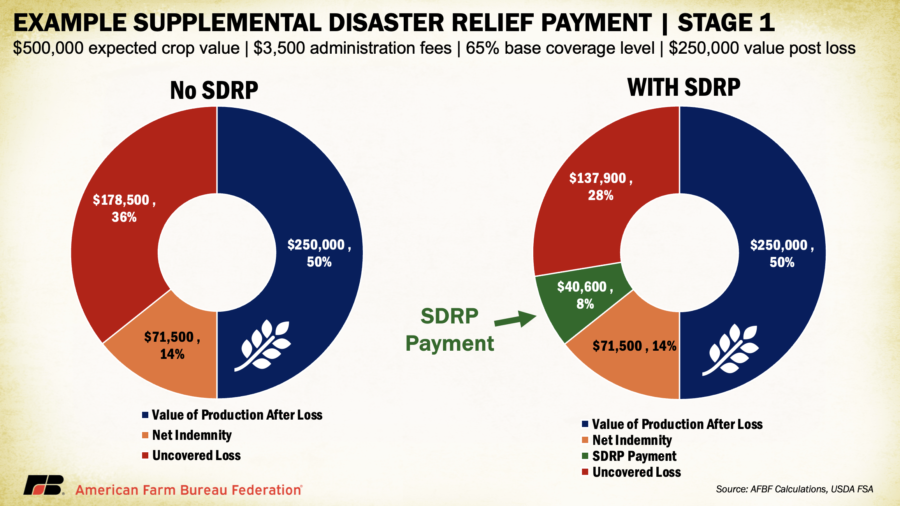

For example, consider a farmer with a crop insurance policy at the 65% coverage level and an expected crop value of $500,000. After suffering a qualifying disaster loss, the producer’s harvested crop was valued at $250,000. This resulted in a gross indemnity of $75,000, based on the difference between the original liability ($325,000, or 65% of the expected value) and the value of production. After subtracting $3,500 in administrative fees and premiums, the net indemnity totaled $71,500. Under SDRP, rather than using the original liability, a disaster-adjusted factor of 87.5% is applied to the expected crop value, resulting in a revised SDRP value of $437,500. Subtracting the $250,000 production value yields an SDRP loss value of $187,500. After subtracting the net indemnity of $71,500, the remaining eligible amount is $116,000. Applying the 35% final payment factor results in a final Stage 1 SDRP payment of $40,600. In all, this farmer reduces their uncovered loss from $178,500 to $137,900 through the additional SDRP assistance.

Payment Limits and Income Requirements

SDRP applies the same income and payment limitations used under ERP, with separate tracks for high-value/specialty crops and all other crops. Farmers whose adjusted gross income is more than 75% farm-derived may qualify for higher limits with proper certification.

Category | Standard Limit | Higher Limit (if AGI >75% farm-derived) |

Specialty/High-Value Crops | $125,000 | $900,000 |

Other Crops | $125,000 | $250,000 |

These limits apply per crop year and are cumulative across SDRP Stage 1 and Stage 2. Payments to legal entities are attributed through up to four layers of ownership.

Ongoing Insurance Requirement

Producers who receive an SDRP Stage 1 payment must maintain crop insurance or NAP coverage for the crop and county in question for the next two available crop years, at no less than 60% coverage. Failure to meet this requirement (unless the crop is not planted in the same county) will trigger full repayment of the SDRP amount, with interest.

This provision mirrors that of ERP and is intended to encourage continued participation in USDA’s risk management programs.

Looking Ahead: Stage 2 and Remaining Concerns

FSA has not yet officially announced the launch of SDRP Stage 2, but the agency is expected to provide additional assistance for uncovered losses, including non-indemnified shallow losses and quality-related losses. Key milestones include a target date of Aug. 19 to submit the final rule to the Office of Management and Budget (OMB), Sept. 9 for OMB clearance, and Sept. 15 for the start of sign-up.

This next phase is critical for producers with shallow or uninsured losses, as well as those operating outside traditional coverage models. Many are also concerned about how losses in diversified operations (particularly those involving specialty crops, timber and infrastructure) will be addressed. Ensuring equitable treatment across states and commodities remains essential as USDA finalizes Stage 2 and allocates funding to states for natural disaster block grants.

Conclusion

The launch of SDRP Stage 1 is an important step in delivering long-overdue relief to producers impacted by weather-related disasters. By leaning on existing crop insurance and NAP data, USDA aims to expedite payments and reduce paperwork burdens. Still, the 35% payment factor leaves a substantial portion of farmer losses uncovered, due to limitations in federal funding.

Additionally, stage 2 will be essential to reach those farmers whose losses were not fully captured by standard indemnities. As the process unfolds, Farm Bureau will continue to advocate for timeliness, transparency and fair treatment across regions and production types, ensuring all growers receive the support they need to recover and remain resilient.

Farmers with questions should reach out to their local FSA offices.

Top Issues

VIEW ALL