USDA’s Quarterly Hogs and Pigs Report Comes in Slightly Above Expectations

Michael Nepveux

Former AFBF Economist

photo credit: Alabama Farmers Federation, Used with Permission

Michael Nepveux

Former AFBF Economist

On Sept. 27, USDA’s National Agricultural Statistics Service released its Quarterly Hogs and Pigs report, providing a detailed inventory of breeding and marketing hogs. Producers use this data to determine production and marketing strategies, while the industry uses it to assess the markets and the future supply of product.

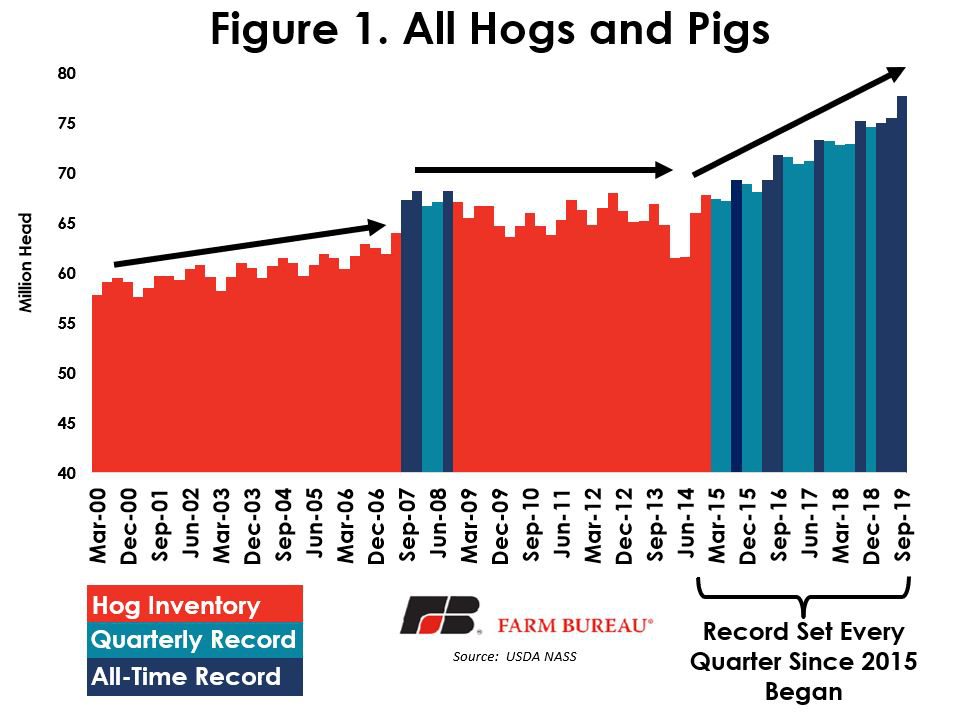

The U.S. inventory of all hogs and pigs on Sept. 1 came in at 77.678 million head, up 3.4% from the previous year and above analysts’ expectations of a 2.9% increase from Sept. 1, 2018. In this report, USDA pegged the market hog inventory at 71.248 million, up 3.5% from last year and above market expectations of a 3% increase. The number of pigs kept back for breeding came in slightly above analysts’ expectations of 1.3%, with USDA reporting 6.431 million head, up 1.6% from 2018.

With analysts’ expectations a bit below USDA’s numbers, this report continues the storyline of record amounts of pork. Every single report since March 2015 has hit a quarterly record in terms of the total hogs and pigs inventory, with eight of those quarterly reports hitting an all-time record across all quarters. As a result of this trend, we are expecting record pork production in 2019 as well. When the boom period of grain prices slowed after 2013, pork producers experienced a drop in their feeding costs. Since then, there has been a steady increase in production as producers expanded capacity. After the Porcine Epidemic Diarrhea crises in 2014, the pork industry essentially sought to “reset” production and ramped up expansion and capacity with an eye on exports. Current trade tensions had been somewhat standing in the way of pork exports, but even with a tariff of over 60% on U.S. pork going into China, we have seen a dramatic increase in exports into the country. However, the U.S. share of China’s pork imports still remains relatively modest, due to tariffs and the overall trade environment.

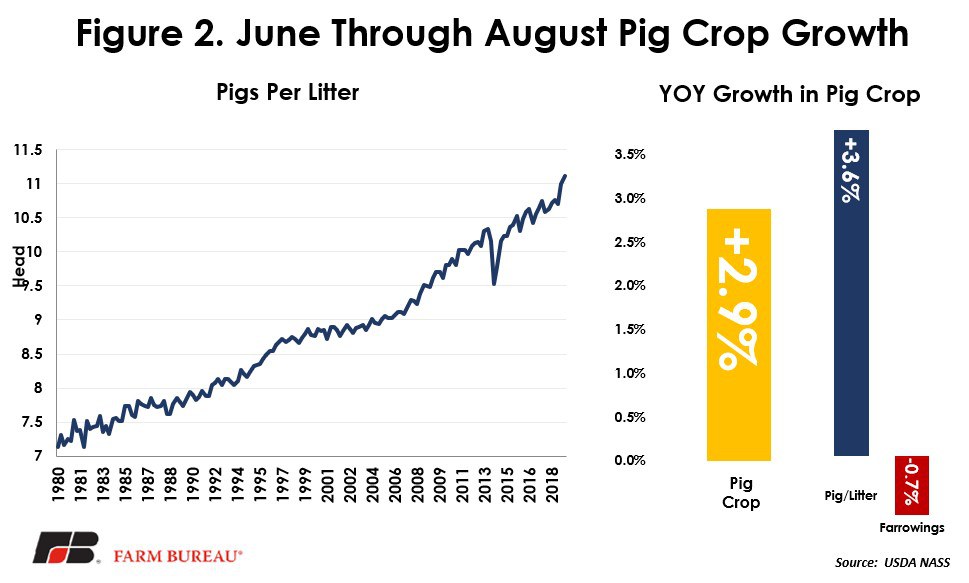

In the last quarterly report, producers communicated lower farrowing intentions for sows, 3.185 million, than a year ago. However, analysts thought differently and were expecting producers to exceed their farrowing intentions given the strong forward profitability priced into futures due to African Swine Fever in Asia. This quarter’s pig crop was slightly above analysts’ expectations at 35.306 million animals, an increase of 2.9%. Analysts had been expecting the number of pigs born during the June-August quarter to increase by 2.4%. The pig crop is ultimately a function of the quarter’s farrowings and the quarter’s number of pigs per litter. This quarter’s increase was largely driven by increases in pigs per litter, as opposed to increases in farrowings by producers, and continues a long trend of increases in the pigs per litter. Last quarter’s report delivered somewhat of a surprise in this regard, with a substantial (relative to normal increases) increase in the number of pigs per litter to 11, a 3.5% increase over a year ago for that time period. The last time the industry saw changes at or above this magnitude was during recovery from the epidemic of PEDv five years ago. This reports pigs per litter increased to 11.11, a 3.6% increase from a year ago.

As far as the future supply of pigs, the report shows producers' farrowing intentions at 3.179 million sows in the September-November quarter, resulting in a decrease of just under 1% from actual farrowings in 2018 if those numbers are realized.

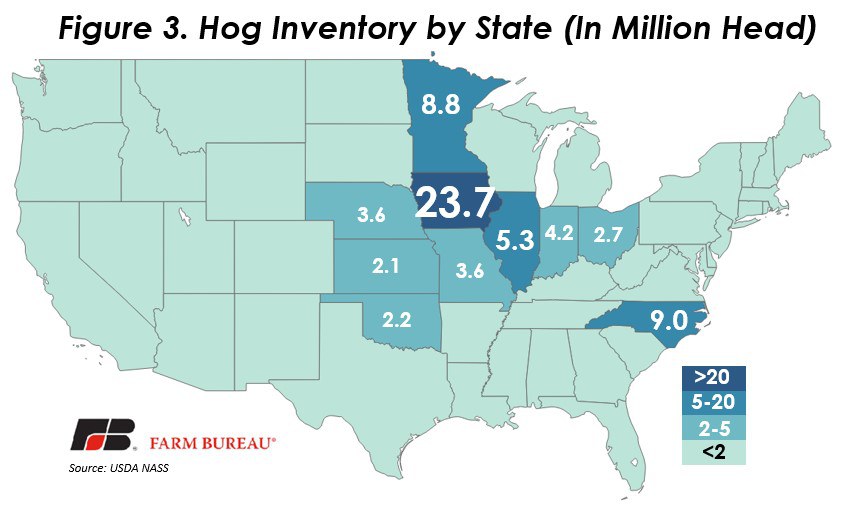

Iowa is once again top in the nation for pork production, accounting for 33% of the nation’s hogs and pigs in inventory. As usual, following Iowa are North Carolina and Minnesota, accounting for 9 million and 8.8 million pigs, respectively. Together, these three states account for 58% of the nation’s hog supply.

Summary

The U.S. inventory of all hogs and pigs on September 1 came in at 77.678 million head, up 3.4% from the previous year. This came in above analysts’ expectations of a 2.9% increase from September 1, 2018. Additionally, this quarter’s pig crop was slightly above analysts’ expectations at 35.306 million animals. This increase was largely driven by increases in pigs per litter as opposed to increases in farrowings by producers and continues a long trend of increases in the pigs per letter over time. Looking forward, increased potential profitability for producers as a result of African Swine Fever in Southeast Asia is likely to continue to incentivize expansion.

Top Issues

VIEW ALL