Where ARC Thou, Program Payments?

TOPICS

ARC-CO

photo credit: Tennessee Farm Bureau, Used with Permission

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

USDA recently announced commodity support payments for the 2016/17 crop year at $8 billion. This is in line with program payments made for the 2015 crop year and is above payments made for the 2014 crop year. This announcement follows USDA’s Farm Service Agency announcement of 2016/17 marketing year average prices for corn and soybeans. The wheat marketing year average price was announced at the end of June 2017. The marketing year average prices for corn, soybeans and wheat were $3.36, $9.47 and $3.89 per bushel, respectively.

Based on these marketing year average prices, USDA recently released county-level Agriculture Risk Coverage-County Option program payment data for major field crops including corn, soybeans and wheat. The information provided demonstrates how ARC-CO helps growers manage revenue risk by making program payments based on an average revenue guarantee – protecting both prices AND yields.

Lower ARC-CO Prices Boost Yield Coverage

It’s no secret to farmers across the country that prices used by the Agriculture Risk Coverage-County Option were decreasing. A recent Market Intel, The Disappearing Farm Bill Safety Net, reviewed the impact of lower commodity prices on the performance of ARC-CO.

For the 2016/17 marketing year, the Olympic moving average corn, soybean and wheat prices used in the ARC-CO guarantee were $4.79, $11.87 and $6.70 per bushel, respectively. For corn, the price guarantee for the 2016/17 crop year was down 9 percent from the prior two marketing years, for soybeans the price was down 3 percent, and for wheat the price was unchanged from the previous year. For the purposes of determining ARC-CO benefits, the marketing year average prices for corn, soybeans and wheat were $1.43, $2.34 and $2.81 per bushel below the Olympic moving averages, respectively.

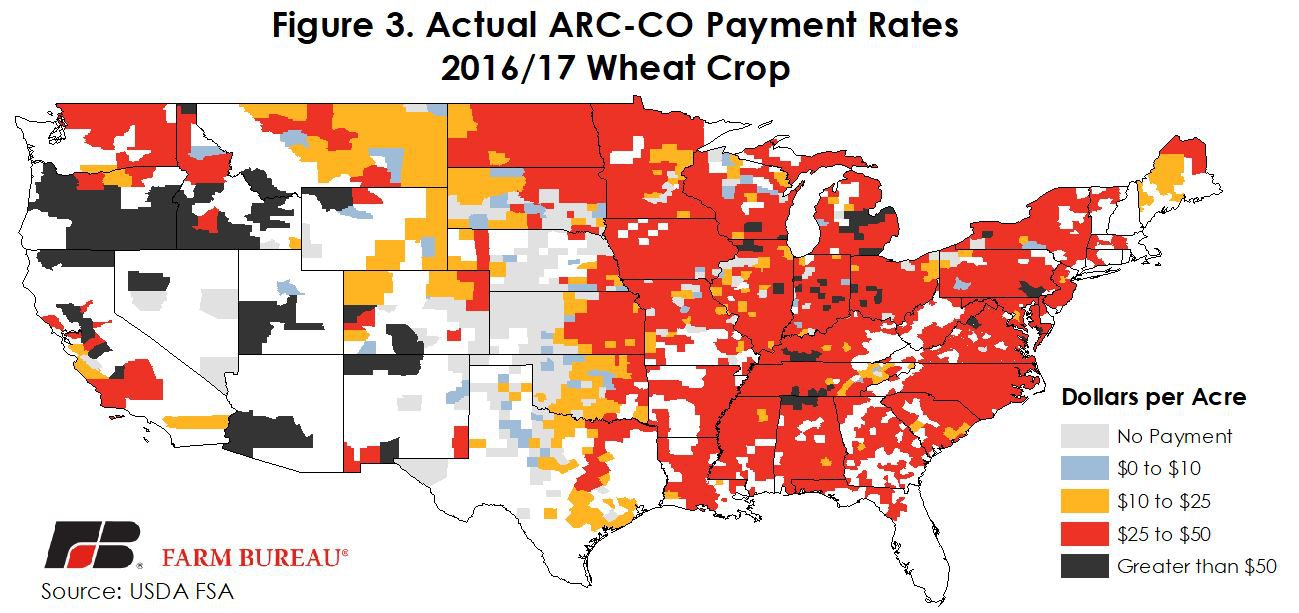

The effect of the marketing year average prices being below the Olympic moving average prices can boost the yield coverage under ARC-CO. Coverage multipliers, defined as the product of 86 percent and the Olympic moving average price divided by the actual price, boost ARC-CO yield coverage. For example, the coverage multiplier for 2016/17 ARC-CO wheat is equal to 148 percent (1.48 = 0.86×$6.70÷$3.89). The coverage multiplier is then multiplied by the Olympic moving average yield. In this example, if the actual county yield is less than 148 percent of the county-level Olympic moving average yield, ARC-CO will trigger program payments. Given the announced prices, the coverage multipliers for corn, soybeans and wheat are 123 percent, 108 percent and 148 percent, respectively.

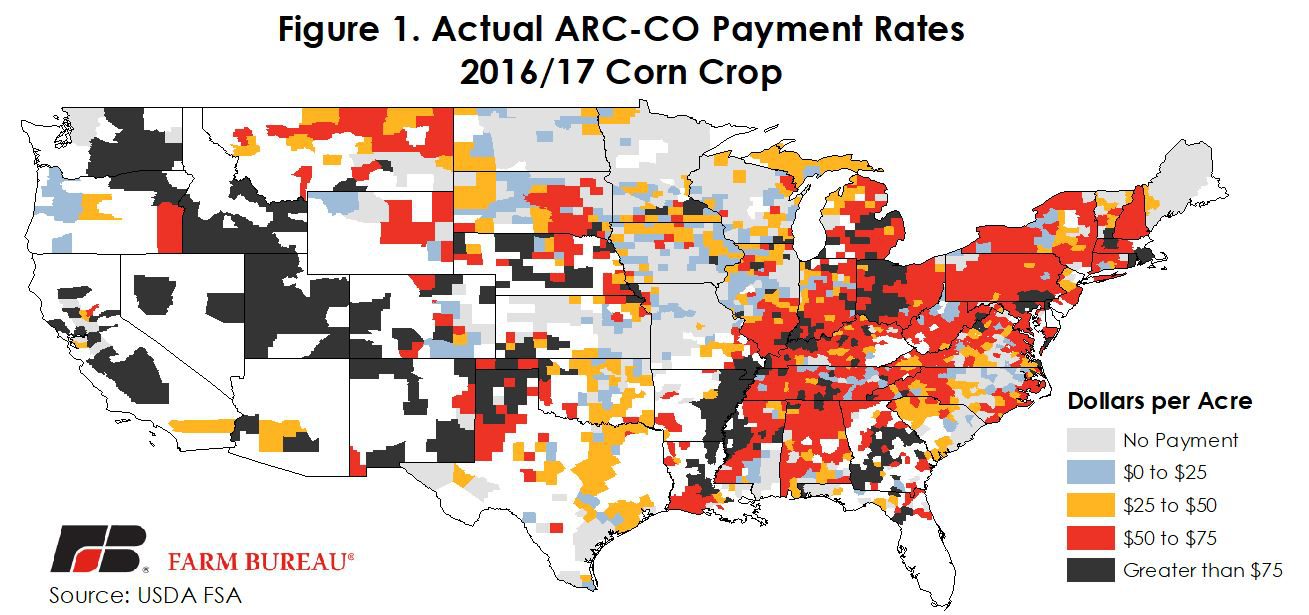

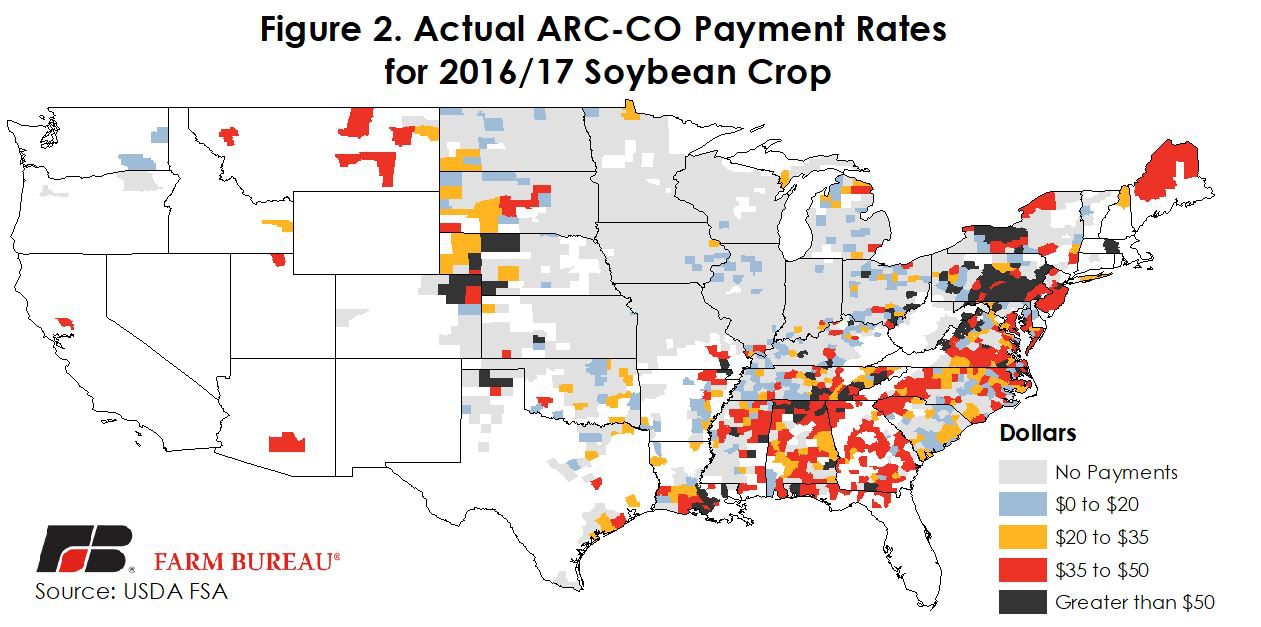

It follows then that ARC-CO payment rates would be the highest in states where yields are at or below these multiplier levels. For example, portions of the Nebraska, New York, Ohio and Pennsylvania, and the Mississippi Delta all had actual corn yields well below the coverage-multiplied-Olympic-moving-average-yield. As a result, forecasted ARC-CO payments reach their maximum levels in these areas. Similar patterns are observed for soybeans and wheat, Figures 1 to 3

ARC-CO payments are the highest in portions of the U.S. where adverse growing conditions in 2016 reduced crop yields. ARC-CO will provide the highest per-acre support in the eastern Corn Belt, along with the Mississippi Delta and in western states for corn. ARC payments for soybeans are the highest in the Southeast and western fringes of the Corn Belt, and wheat ARC payments are the highest in the Pacific Northwest, but due to lower prices, payments above $25 per acre will occur across much of the U.S. In many of these counties, ARC-CO payments will exceed $50 to $75 per base acre. Payment rates for corn and soybeans in the western Corn Belt are substantially lower due to record-high crop yields experienced in many of these counties. In some cases, ARC-CO failed to trigger due to these record-high corn and soybean yields.

Implications Going Forward

With 2016/17 marketing year average prices known, it is now possible to determine the Olympic moving average prices that will be used for 2017/18 ARC-CO benefits. These prices will be $3.95, $10.86 and $6.12 for corn, soybeans and wheat, respectively. With lower Olympic moving average prices and World Agricultural Supply and Demand Estimates for marketing year average prices of $3.20, $9.20 and $4.60 for corn, soybeans, and wheat, respectively, the coverage multipliers for ARC-CO are likely to decrease substantially. If these prices are realized, larger negative yield shocks will be needed to trigger substantial ARC-CO payments this crop year.

A considerable amount of uncertainty on the supply and demand side could drive ARC-CO benefits higher or lower. While yields are expected to be lower than last year for all three crops, the consumption portion of the marketing year is just beginning for corn and soybeans and we are only 3 months into the wheat marketing year. Consumption below current projections in corn or wheat could push prices lower and may boost ARC-CO benefits.

During a time of a prolonged decline in crop prices, support from revenue-based programs are perceived to be lower, however, that is not the case. The relationship between prices and yields, i.e. the natural hedge, can impact how these risk management tools function. The natural hedge is described as the regional yield-price relationship that works to offset yield losses with higher prices, thereby helping to smooth farm revenue across marketing years. In areas where the natural hedge is stronger, low prices are consistently offset by high yields, i.e. the Corn Belt, and ARC-CO complements the existing price-yield relationship. In counties where the correlation is weaker, low prices and low yields or high prices and high yields occur simultaneously with greater frequency. It is in these areas that ARC-CO is even more effective at smoothing revenue across marketing years.

ARC-CO protects against revenue declines due to weakening crop prices or negative yield shocks. When Mother Nature is your business partner, it is protection against these adverse yield events that make ARC-CO a critical farm program safety net. Farm Bureau supports the continuation of revenue-based safety net programs in the next farm bill and will work to make ARC-CO even more effective at helping growers manage revenue volatility.