Large Placements Revealed in November Cattle on Feed Report

TOPICS

Market IntelMichael Nepveux

Former AFBF Economist

photo credit: AFBF Photo

Michael Nepveux

Former AFBF Economist

The Cattle on Feed report provides monthly estimates of the number of cattle being fed for slaughter. For the report, USDA surveys feedlots of 1,000 head or more, as this represents 85% of all fed cattle. Cattle feeders provide data on inventory, placements, marketings and other disappearance.

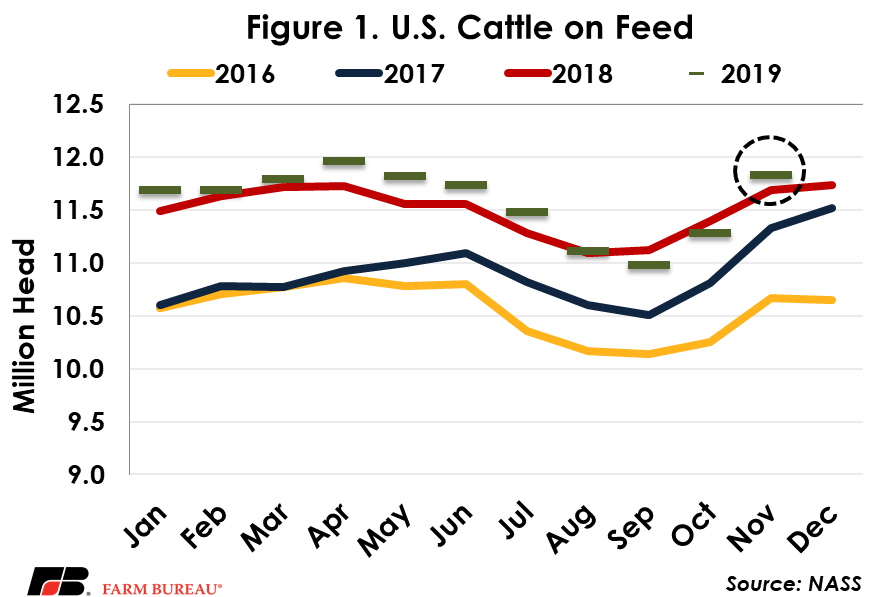

The report showed a total inventory of 11.831 million head for the United States on November 1. This year-over-year increase of 1.2% is right in line with analysts’ expectations of an average increase of 1.3% in feedlot inventories. This month’s increase follows two months of year-over-year decreases.

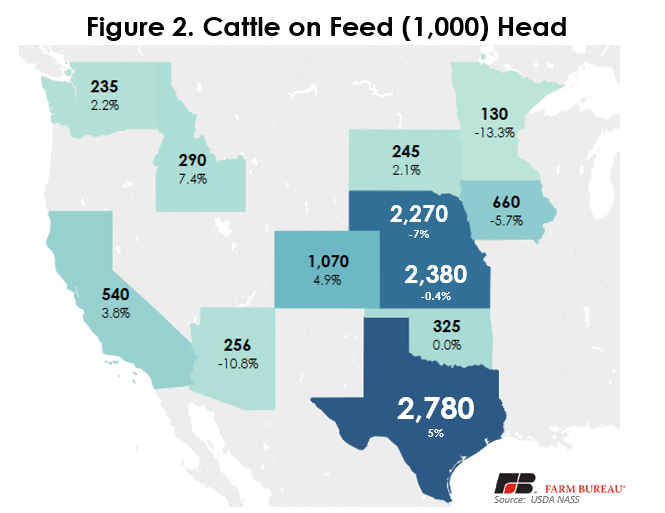

As usual, Texas, Kansas and Nebraska lead the way in total fed cattle numbers, accounting for over 7.8 million head, or approximately 66% of the total on-feed inventory in the country.

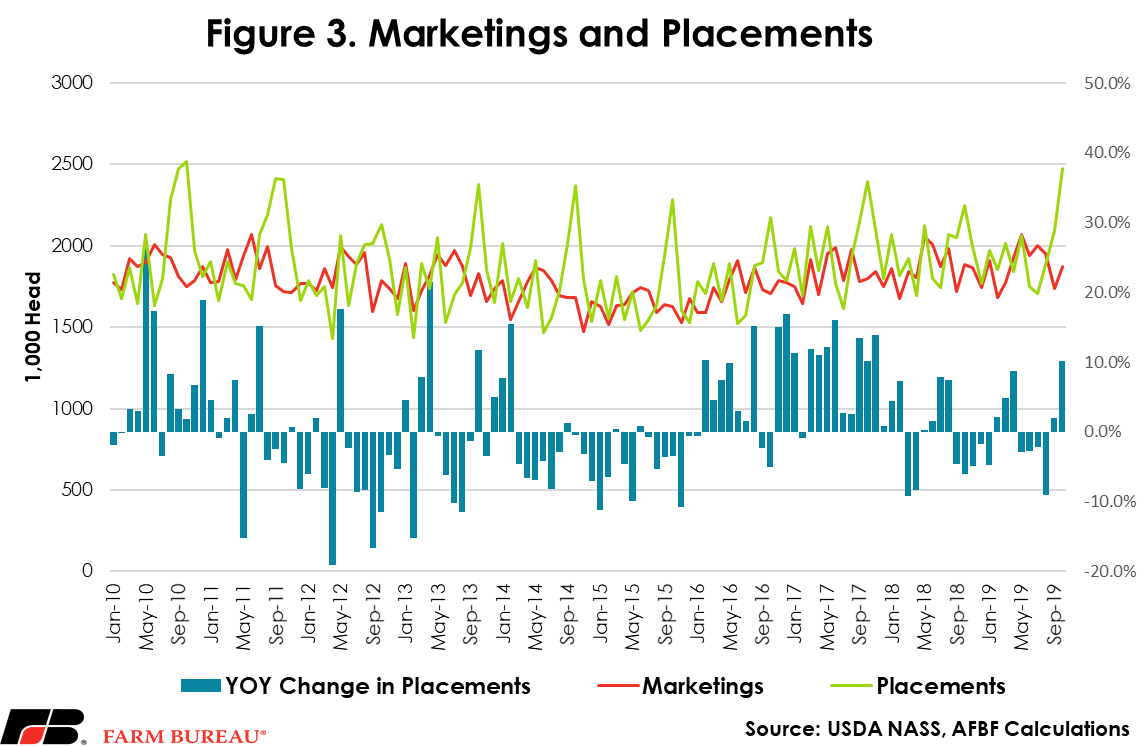

While total inventories are an important component of the report, other key factors include placements (new animals being placed on feed) and marketings (animals being taken off feed and sold for slaughter). Marketings in October were 1.875 million head, down 0.6% from a year ago, exactly matching the average analyst expectation.

In terms of placements during October, analysts predicted an average 12% increase from October 2018. However, there was a great degree of uncertainty in analysts’ expectations for the placement number, resulting in a very large range of a 3.8% decrease to a 19% increase. Placements in October totaled 2.477 million head, 10.2% above 2018 levels. The number of placements came in slightly below the average analyst forecast but remained well within the large range. October placements reported in the November report are typically the largest of the year, so while not necessarily a surprise, a year-over-year increase of over 10% is nevertheless a substantial increase and will impact the future supply of animals available for slaughter. This increase in placements was not only anticipated from a seasonality perspective, but also as a rising fed cattle futures market and cash market over the last month should have supported placements.

However, in the day leading up to the report’s release, feeder cattle futures showed significant weakness, dropping $3.45 for the January contract on Friday, Nov. 22. It seems that the expected higher placements and on-feed numbers were enough of a concern that day and may have driven some profit taking. Overall this report is considered relatively neutral, but the large placement number will push production up in the first half of next year. This production increase has to be met with strong demand to prevent weakness in the cattle market, although improved conditions are anticipated as the closed Tyson plant is expected to resume operations in early December.