Largest Decline in U.S. Dairy Farms in 15-Plus Years in 2019

TOPICS

USDAMichael Nepveux

Former AFBF Economist

photo credit: Alabama Farmers Federation, Used with Permission

Michael Nepveux

Former AFBF Economist

Introduction

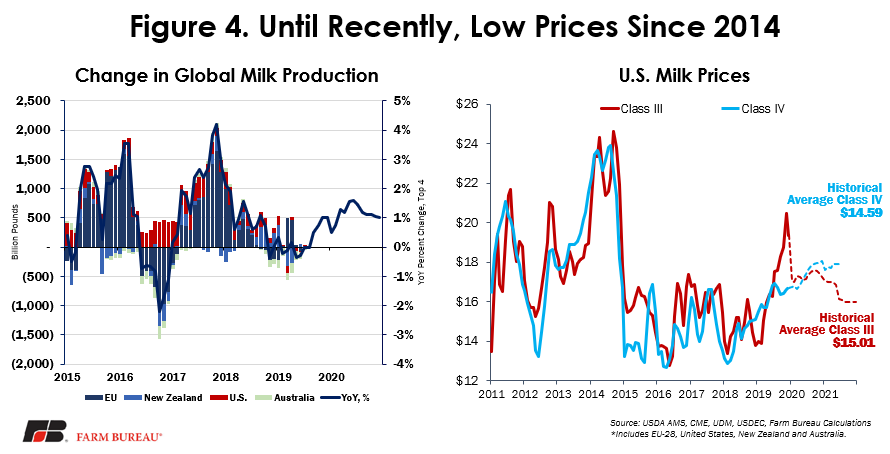

USDA's National Agricultural Statistics Service’s monthly Milk Production report, released on Feb. 20, showed the largest annual decline in the number of licensed dairy operations since 2004. Since the end of 2014, dairy farmers have struggled with low prices resulting from large supplies outweighing demand, in the U.S. and around the world. While we have historically seen year-over-year declines in the number of dairy operations, the data from 2019 shows this challenging price environment proved to be too much for many operations throughout the country.

Dairy Herd and Milk Production

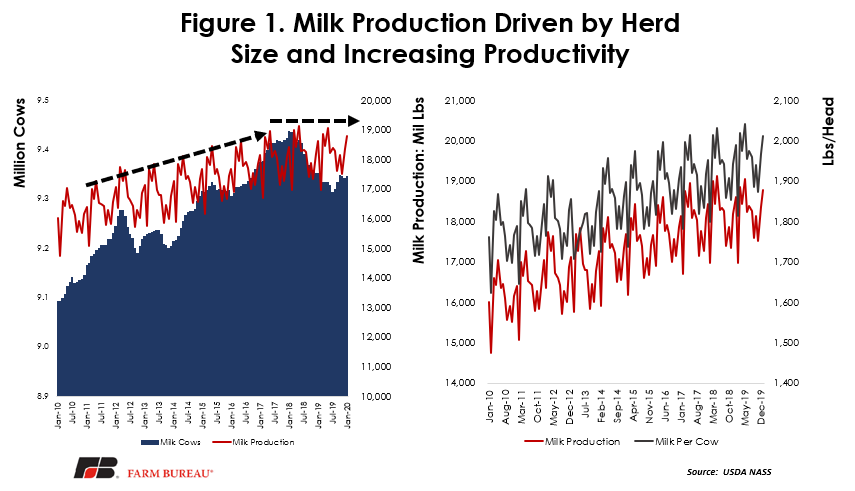

The report showed that annual milk production in the United States in 2019 was 218.4 billion pounds, increasing 0.4% from the 217.6 billion pounds produced in 2018. Milk production in the U.S. has grown every year over the past decade, but that growth has somewhat leveled off the last few years. 2019 year-over-year growth represents the slowest growth since 2013, when production grew 0.3% from 2012. Over the past few years, we have also seen a pullback in the number of milk cows in the U.S., with 2019 averaging 9.34 million head, down 0.7% from 2018. However, even with the recent pullback in cow numbers, the average annual number of milk cows has increased 2.3% from 2010.

Annually, the U.S. has seen the average number of milk cows decline since 2017, from an average of 9.406 million head to an average of 9.336 million head in 2019. However, the growth in milk production has only slowed, not declined. This is due to the ever-increasing productivity of the milking cows. Milk produced per cow in the U.S. averaged 23,391 pounds for 2019, 241 pounds above 2018’s 23,150. Unlike the fluctuating overall number of cows, milk production per cow has steady increased approximately 10.6% from 2010.

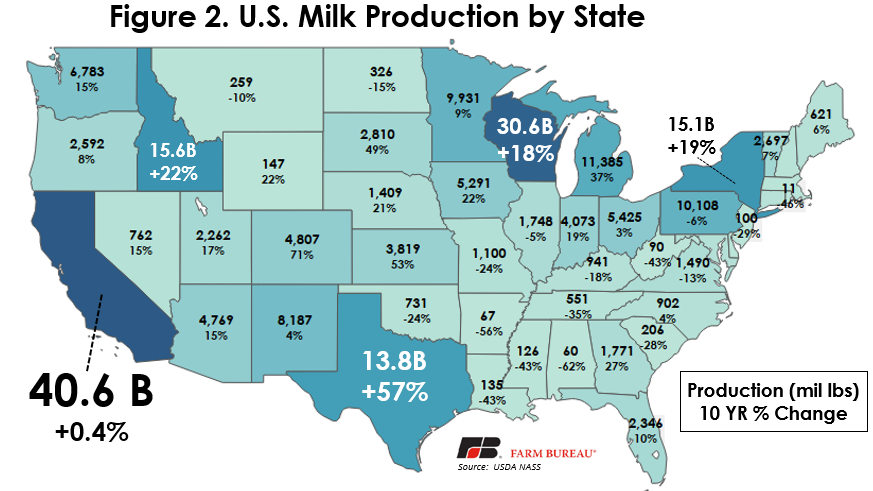

California is the largest milk-producing state in the U.S., clocking in at 40.6 billion pounds. The state is followed by Wisconsin, Idaho, New York and Texas, with 30.6, 15.6, 15.1 and 13.8 billion pounds, respectively. Growth in production over the past decade has not been evenly distributed; While production has grown in most of the country, it since 2010 is has declined in certain regions, such as much of the Southeast. Colorado has experienced the largest growth in percentage terms, growing 71%, albeit from a smaller base production number. Growth in Texas has been stupendous, rising 57% since 2010 into the fifth largest milk-producing state in the country.

The Decline of Licensed Dairy Herds in the U.S.

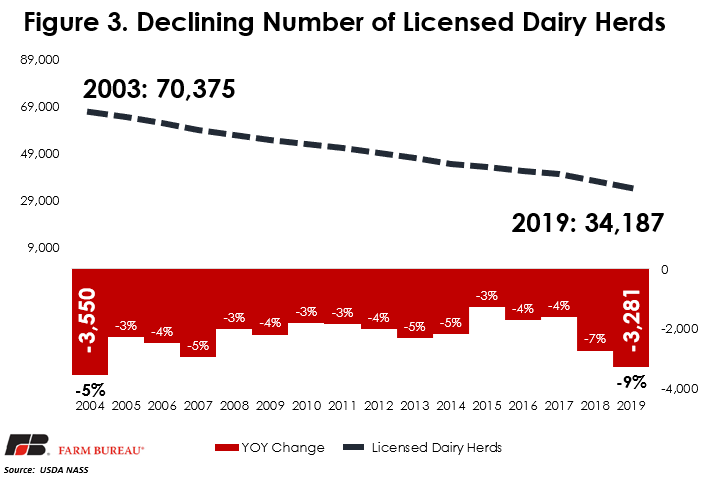

This Milk Production report also showed the largest year-over-year decline in the number of licensed dairy operations since 2004, and the largest year-over-year percentage decline since 2003, the first year for which the data is available. There were 3,281 fewer licensed dairy operations in 2019 than in 2018, when the number dropped by 2,731. The overall number of licensed operations in the U.S. has marched steadily downward since data collection began, declining by more than 50%, from 70,375 in 2003 to 34,187 in 2019.

The recent acceleration of the decline reflects how difficult it is to operate a dairy, particularly in the last several years. Since the end of 2014, dairy farmers have struggled with low prices resulting from large supplies outweighing demand, in the U.S. and around the world. However, toward the end of 2019, milk prices surged to levels not seen since 2014. These prices were a function of increasing milk powder prices along with higher cheese prices helping to lift both Class III and Class IV milk prices. Unfortunately, this surge happened too late to assist many of the producers who had already reached a breaking point.

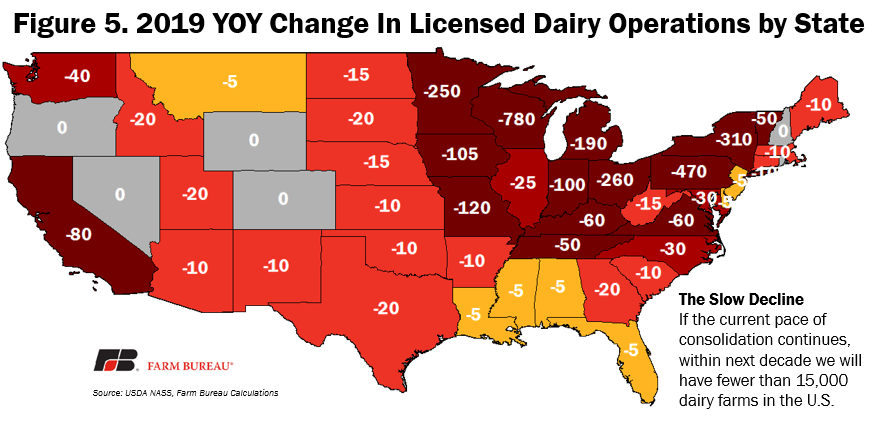

No state registered an increase in licensed dairy operations from 2018 to 2019. In terms of the decrease in the number of licensed operations, Wisconsin led the country with 780 fewer operations in 2019 than a year earlier. Following Wisconsin was Pennsylvania, New York, Ohio and Minnesota, with declines of 470, 310, 260 and 250, respectively. The Upper Midwest and the Eastern Corn Belt lost the most licensed dairy farms.

Summary

NASS’ most recent monthly Milk Production report showed the largest decline in the number of licensed dairy operations since 2004, and the largest year-over-year percentage decline registered since 2003, when the data was first collected. Much of this was driven by large supplies outweighing demand and pushing prices down. While year-over-year declines in operations are nothing new, the striking increase in the loss of dairy farms in 2019 shows this challenging price environment proved to be too much for many operations throughout the country.