Outlook Improves for 2019 Farm Economy, but Uncertainty Remains

TOPICS

Farm Economy

photo credit: AFBF Photo, Mike Tomko

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

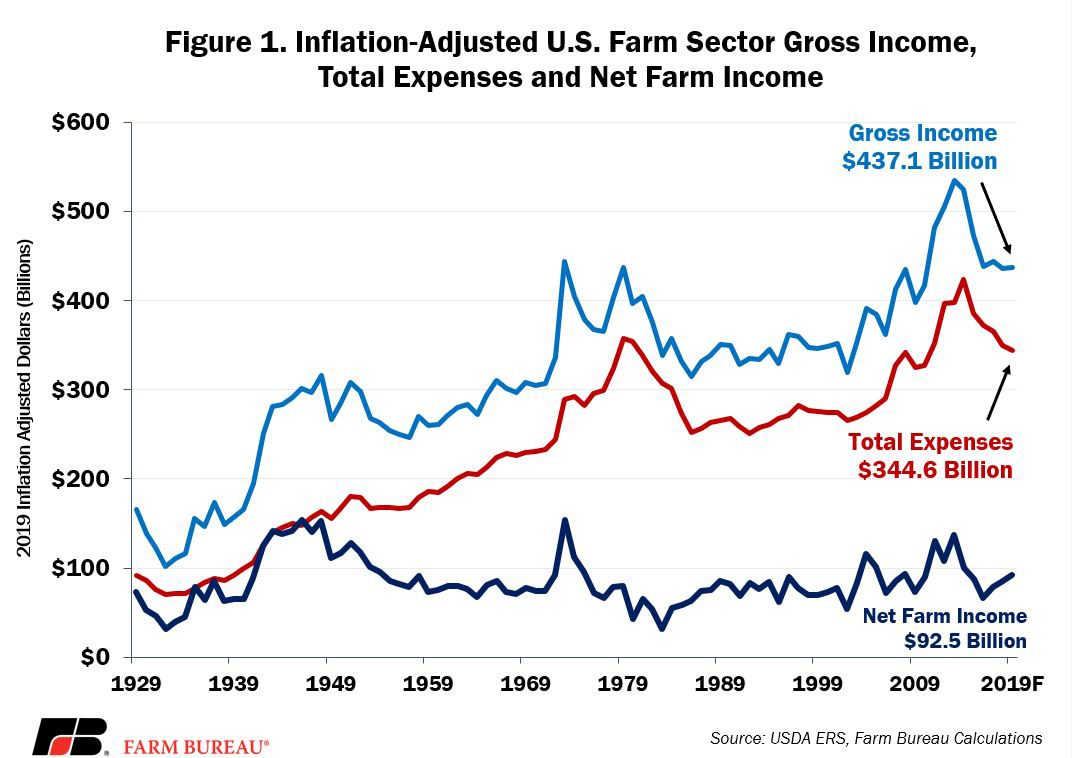

USDA-Economic Research Service’s recently updated forecast for U.S. farm sector income, finances and wealth projects total gross income in U.S. agriculture, which includes cash receipts from crop and livestock sales as well as federal support, at $437.1 billion for 2019, up $9.3 billion, or 2%, from prior-year levels. Total production expenses for 2019 are now forecast at $344.6 billion and are in line with prior-year levels.

A broad measure of farm profitability, net farm income -- the difference between gross income and production expenses -- is now projected at $92.5 billion, up $8.5 billion, or 10%, from 2018. If realized, net farm income in 2019 will be the highest since 2014 but would remain 25% below 2013’s record high of $123 billion and would be marginally higher than the inflation-adjusted average of $90.5 billion. Figure 1 highlights gross income, production expenses and net farm income trends in 2019 inflation-adjusted dollars.

Why the Improved Outlook?

Higher Cash Income

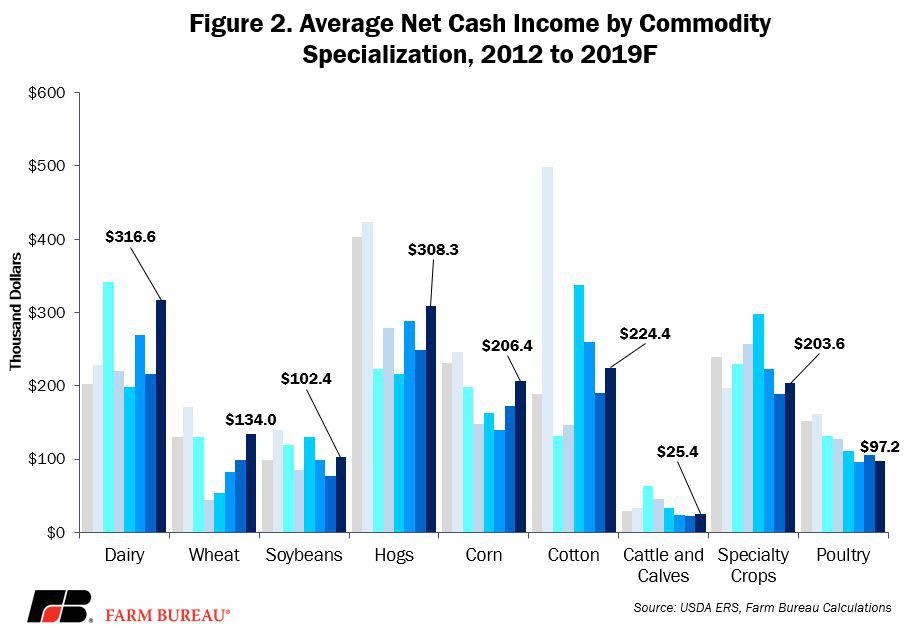

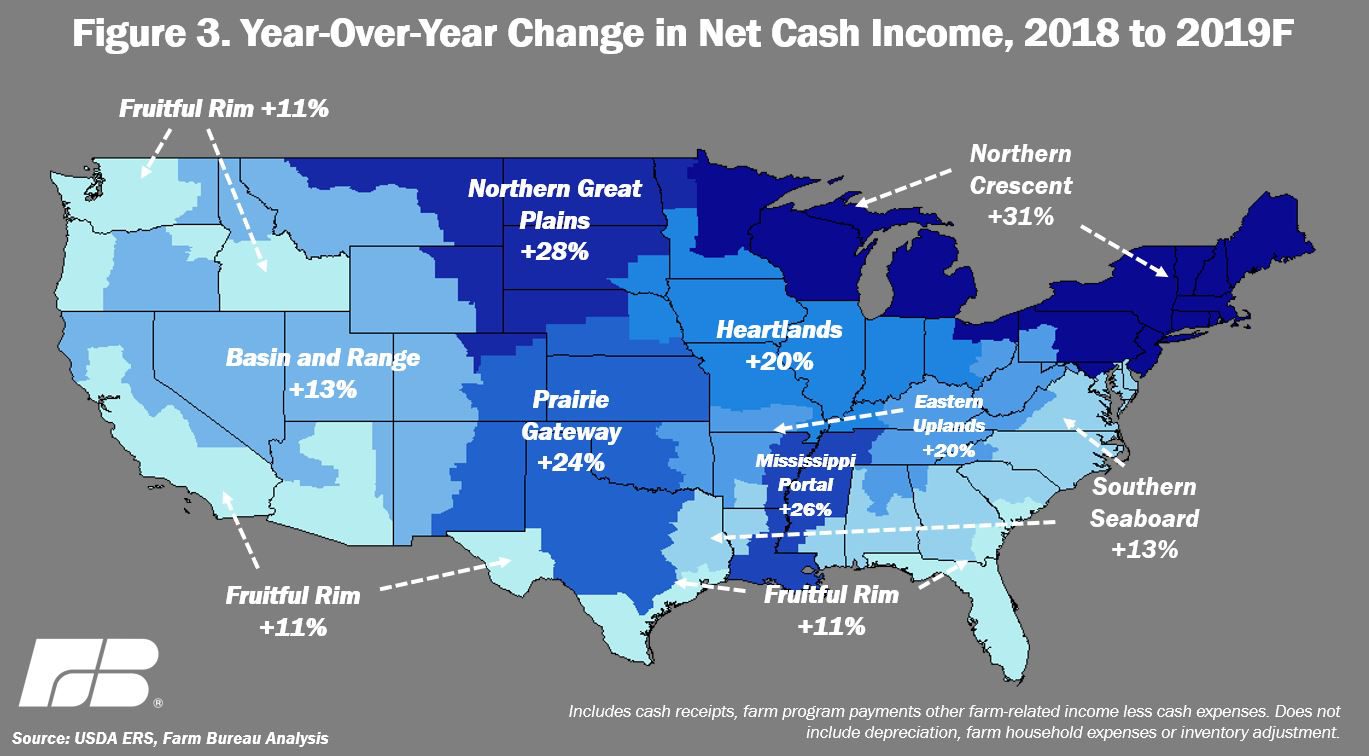

The improved outlook for farm income in 2019 is twofold. First, average net cash farm income across most major commodity categories is projected to be higher in 2019, driving an expected 20% increase in average net income across all of agriculture, Figure 2. Dairy is expected to see the most significant increase in net cash income, rising 47%. In addition, net cash income for wheat is expected to rise 35%, while net cash income for soybeans and hogs are also expected to climb, 34% and 24%, respectively. With a decline of 8%, poultry is the only commodity expected to post a lower net cash income in 2019. Figure 3 highlights the average change in net cash income across all production regions.

Trade and Disaster Assistance

The second reason for the improved U.S. farm economy outlook is the financial assistance provided by the Market Facilitation Program and the ad hoc disaster package approved by Congress, i.e., Second Round of Trade Assistance Coming Soon and What to Expect in the New Disaster Aid Package.

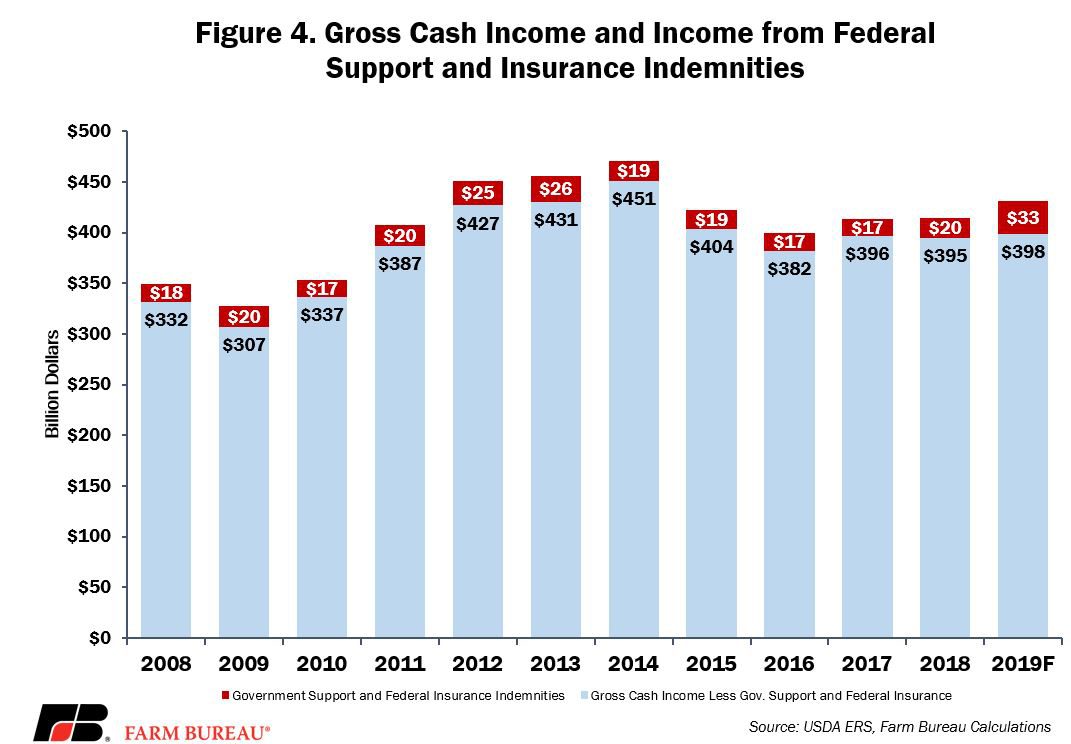

Trade assistance payments for 2018 and 2019 are expected to total$19.5 billion for eligible farmers and ranchers. An additional $2 billion is expected to cover ad hoc payments to help farmers recover from natural disasters including hurricanes, wildfires and excessive flooding, among others. Including these additional assistance programs, alongside traditional farm bill programs, total federal support is projected at $22.4 billion in 2019.

While a higher proportion of net farm income is expected to come from federal assistance programs in 2019 – 31%, according to USDA -- as a proportion of total gross cash income, federal support is less than 10%, and over the last decade has averaged less than 5%. Importantly, this federal support includes more than ad hoc assistance and generally favors market-based assistance related to commodity prices or revenue and conservation-based incentives.

The Outlook Remains Uncertain

While the current expectation is for the farm economy to rebound in 2019, with net farm income up 10% to $92.5 billion, uncertainty remains.

The adverse growing and harvesting conditions experienced in 2019 contributed to a smaller supply of grains and oilseeds. This may not be the case in 2020. A majority of the 20 million acres that went unplanted in 2019 will likely be planted next year. Crop yields would also be expected to rebound in 2020. Red meat and poultry production is expected to increase by more than 2%, and milk production will be a record-high 222 billion pounds. This is just in the U.S. Around the world, agricultural output could likely increase as well if mother nature cooperates.

While supplies are expected to grow, demand is less certain. Successfully passing USMCA and finalizing a phase 1 trade deal with China would provide the market certainty U.S. farmers and ranchers need. Combined, these markets once represented more than $65 billion in agricultural exports and over 40% of total U.S. agricultural trade. In the case of China, a phase 1 deal is likely to be only the first step as the country continues to wrestle with a devastating outbreak of African swine fever. More importantly, it could take some time to regain lost market share.

A return to normal growing conditions and the demand uncertainty in critical export markets could make 2020 another challenging year for the U.S. farm economy.