U.S. Cattle Inventory Smallest in 73 years

photo credit: Colorado Farm Bureau, Used with Permission

Bernt Nelson

Economist

USDA’s January and July Cattle Inventory reports, released toward the end of each respective month, provide the total inventory of beef cows, milk cows, bulls, replacement heifers, other steers and heifers, and the calf crop for the current year. With drought and high input costs compelling farmers to market a higher-than-normal percentage of female cattle, the most recent cattle inventory dropped to lows not seen in decades. This Market Intel will provide analysis of the Jan. 1 inventory, which will set the tone for cattle markets in 2024.

The Report

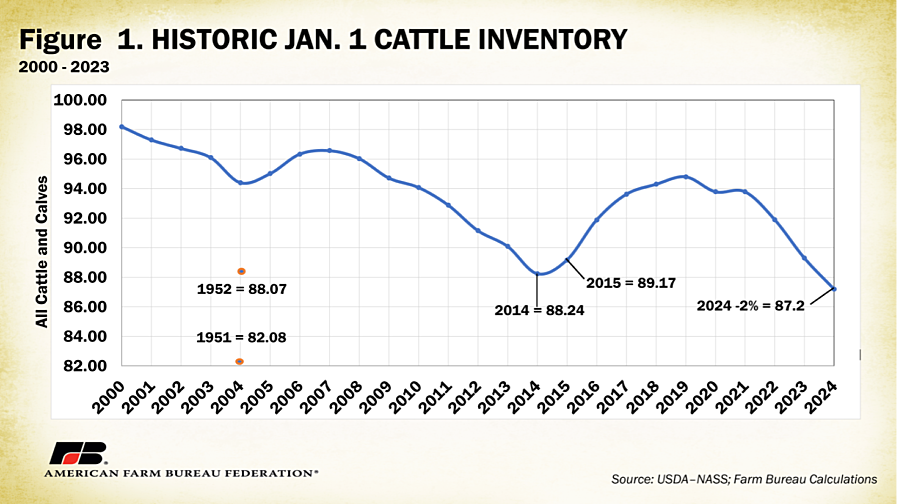

This is a bullish report. All cattle and calves in the United States on Jan. 1, 2024, were 87.2 million head, 2% lower than this time in 2023. This is the lowest Jan. 1 inventory since USDA’s 82.08 million estimate in 1951 (Figure 1). The calf crop is estimated at 33.6 million head, down 2% from last year and the smallest calf crop since 33.1 million in 1948.

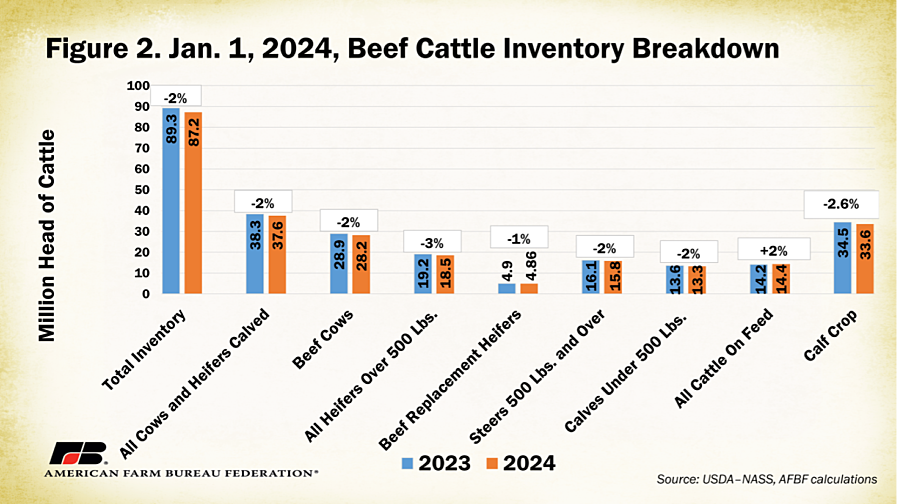

To understand the implications of this report we need to break down the individual inventories including all beef cattle and beef heifers for replacement (Figure 2). The inventory of all U.S. beef cattle on Jan. 1, 2024, was 28.2 million head, down 2%, or 700,000 head, from Jan. 1, 2023. The 2024 decline follows a 4% drop in the beef herd inventory from 2022 to 2023. This is the smallest U.S. beef herd since 1951.

Heifers kept as beef cow replacements were estimated at 4.86 million head, down 1% from 2023. While the inventory of beef cattle is low, this is a small year-over-year decline in replacement heifers compared to the 6% drop in 2022 and may be an indicator that the contraction phase of the cattle cycle is beginning to slow.

Cattle on Feed & The Cattle Cycle

There is a strange situation underway with cattle on feed. Despite the historically low cattle and beef cattle inventory, the supply of cattle on feed for market is curiously high. All cattle and calves on feed for all U.S. feedlots is estimated to be 14.4 million, up 2% from 2023. This means there are still plenty of cattle available to meet packer needs for now, which will keep beef prices from skyrocketing in the short term. However, as the cattle on feed supply begins to shrink based on lower numbers further up the supply chain, packers will have to compete to secure cattle, which should lead to higher prices for cattle feeders, especially in the second half of 2024. The smallest calf crop since 1948 and a 1% decline in replacement beef heifers from last year indicate that when the current supply of cattle on feed dries up, there won’t be as many cattle available to refill the supply chain. This could send beef prices to record levels in 2024 and 2025, as we hit the supply bottom of the current cattle cycle.

Production

USDA estimates beef production in December 2023 was 2.16 billion pounds, 2% below the 2.19 billion pounds produced in December 2022. Average dressed weights were a record high at 849 pounds, 16 pounds heavier than December 2022. Steers were the largest contributor to this increase, with an average dressed weight of 941 pounds in December 2023. This is equal to about 3 million pounds of additional beef entering the supply chain per week in both November and December. As a result of higher weights, USDA raised estimates for 2023 commercial beef production to 26.97 billion pounds. Despite the increase, 2023 production is still about 5% below 2022. Due to the decline in inventory and heavier weights to start off the year, USDA raised 2024 forecasts for total commercial beef production by 120 million pounds to 26.1 billion pounds. The increase brings the 2024 forecast to about 3% below 2023. The higher level of production has helped keep beef prices down for consumers in the short run.

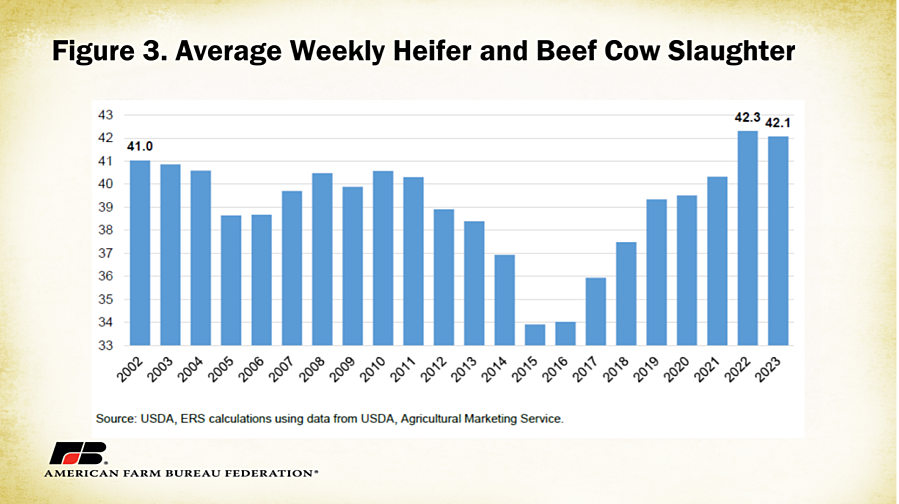

Over the last few years, drought and high supply costs led many farmers to market cattle, particularly female cattle that would typically be held back for replacement (breeding) purposes. This led to an unusually high number of female cattle being placed on feed for market. According to USDA’s Economic Research Service, 2023 had the second-highest average weekly heifer and cow slaughter on record, just .2% behind 2022 (Figure 3). Continued marketing of heifers is one of the leading contributors of contraction in the cattle inventory in the last two years.

Domestic Demand

Despite higher prices, domestic consumer demand for beef remains strong, but is expected to fall in 2024. According to Kansas State University’s Meat Demand Monitor, consumer willingness to pay increased for all retail products other than plant-based patties. However, price has more recently become a top concern for consumers, with 31% more Meat Demand Monitor survey respondents considering price a top four criteria than those who consider it a bottom four criteria. The January USDA WASDE report estimates per capita beef consumption in the United States will fall 1.9 pounds, from 57.9 pounds per capita in 2023 to 56 pounds per capita in 2024.

Global Demand

Global demand for beef lagged in the final quarter of 2023. November Beef exports totaled about 99,000 metric tons, down 14% from last year. Overall exports trailed about 13% behind 2022’s record-setting performance. Demand for U.S. beef has remained strong with our trade partners in the Asia including South Korea, Japan, China and Taiwan. However, difficult economic conditions paired with increased Australian beef production have put downward pressure on global demand for U.S. beef. USDA’s Foreign Agricultural Service forecasts beef exports from all countries will increase by 1.3% to 12.1 million tons in 2024.

Feed and Other Input Costs

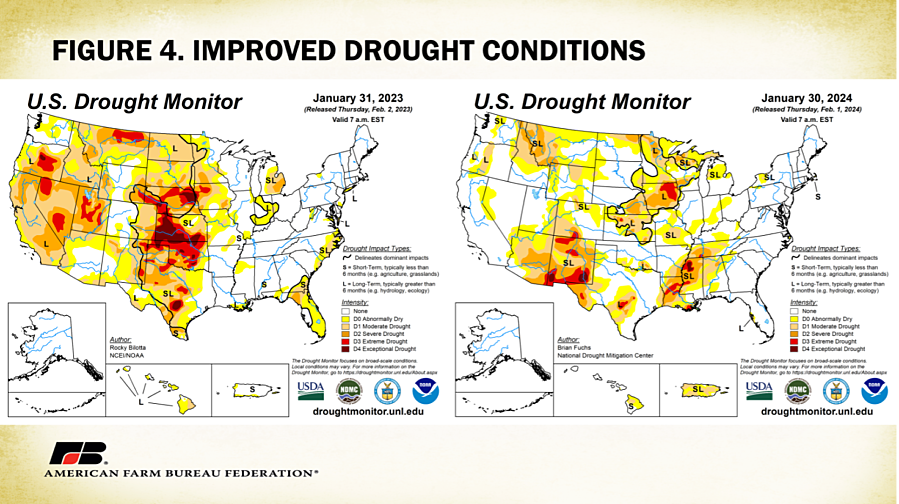

News regarding input and supply costs is a mixed bag. On one hand, El Niño has provided desperately needed moisture and improved drought conditions across the country, particularly in the Midwest and southern Plains where the majority of U.S. cattle are located (Figure 4). In the January WASDE report, USDA forecasted the average 2024 corn price will be $4.80, down 15 cents from $4.95 in 2023 and 27% lower than 2022’s $6.54. Prices have come down largely due to the record 2023 U.S. corn crop and increased production in Brazil. Early acreage surveys indicate U.S. farmers may be gearing up to plant a high number of acres of corn again this year which would put additional downward pressure on corn prices if realized.

On the other hand, higher cattle prices mean purchasing cattle for expansion will cost more. The Federal Reserve on Jan. 31 said it will maintain the federal funds interest rate range between 5.25% and 5.5%,. Interest expenses for farmers are up 43% from this time last year. This means farmers who need to borrow money for expansion will have to pay more in the long run. This will be a significant barrier to expanding the cattle herd in the next couple of years, which could slow herd recovery in this cycle.

Summary and Conclusions

USDA’s semiannual cattle inventory report provided some key insights for cattle markets in 2024. The overall cattle inventory, along with the beef cattle inventory, is historically low, yet the supply of cattle on feed is quite large. The calf crop and beef heifers held for replacement are also historically low, which will hinder cattle inventory growth in 2024 and possibly 2025. This should provide opportunities for profitability in the cattle business in 2024, but with a smaller calf crop and fewer replacement heifers, declining production may also lead to record beef prices for consumers. Domestic consumer demand for beef has remained strong but with record prices on the horizon, consumers’ ability and willingness to withstand higher price levels in 2024 will be the determining factor.

Top Issues

VIEW ALL