U.S. Goods Trade Hits Record Low

TOPICS

TradeBob Young

President

photo credit: AFBF Photo, Mike Tomko

Bob Young

President

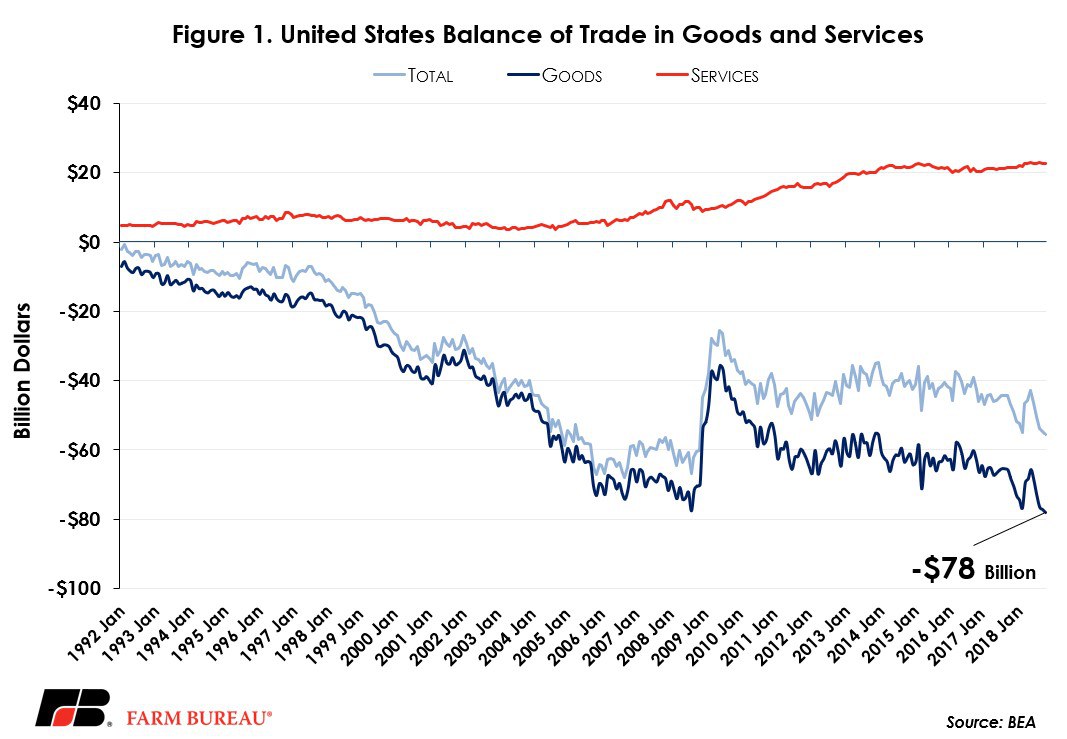

In October 2018 the U.S. set an unwelcome record, hitting—by a few billion dollars--the largest goods trade deficit in history. Admittedly, the Commerce Department’s Dec. 6 report reflects only preliminary estimates for the month and is certainly subject to revision. The report also includes seasonal adjustments that can bounce numbers around and the data are nominal dollars, so there is no adjustment for inflation, but…

On the flip side, in May we set an export record, sending $145 billion worth of U.S. goods to foreign markets. While down from that peak, goods exports have averaged over $140 billion, seasonally adjusted on a monthly basis, since March. At the same time exports have been operating at a very high level, imports have also surged and set a new record every month since July 2018.

For agriculture, no one needs to be reminded of the drop off in soybean exports, which in October were off $837 million from the previous month and $722 million off last year’s value. While there was probably some buying ahead as importers anticipated the imposition of countervailing tariffs in other countries, the chickens have come home to roost. This idea of “buy ahead” is particularly apparent when looking at the overall “Foods, Feeds and Beverages” category used by the Department of Commerce to classify shipments. After averaging just over $11 billion a month for the first quarter of the year, the category jumped to over $12 billion in April, then to over $14 billion in May and June and has slid back to $10 billion in October. None of the other categories of goods exports displayed that same degree of variability.

On the goods import side of the picture, the same “Food, Feeds and Beverages” category has remained boringly steady during this past year, holding at slightly over $12 billion a month in all but January. Consumer goods imports ticked up noticeably in October, jumping over the first six months’ average for the year by nearly 8 percent.

The services side of the equation has not shown the same kind of volatility as goods. Services imports bumped over $46 billion on a monthly, seasonally adjusted basis in September last year and have held near that value ever since. The export side of services has shown fairly steady growth and has run near or above the $69 billion mark since March of this year.

A stronger dollar, dynamic consumer demand with growing wage rates and uncertainty regarding the trade policy environment, along with large deficit spending, are all contributing to the growth in the trade deficit.