Apple Tariff Profile

TOPICS

Commodity Tariff ProfileMegan Nelson

Economic Analyst

photo credit: North Carolina Farm Bureau, Used with Permission

Megan Nelson

Economic Analyst

With apple season upon us, our Market Intel series on commodity-specific tariff profiles continues with this fall favorite.

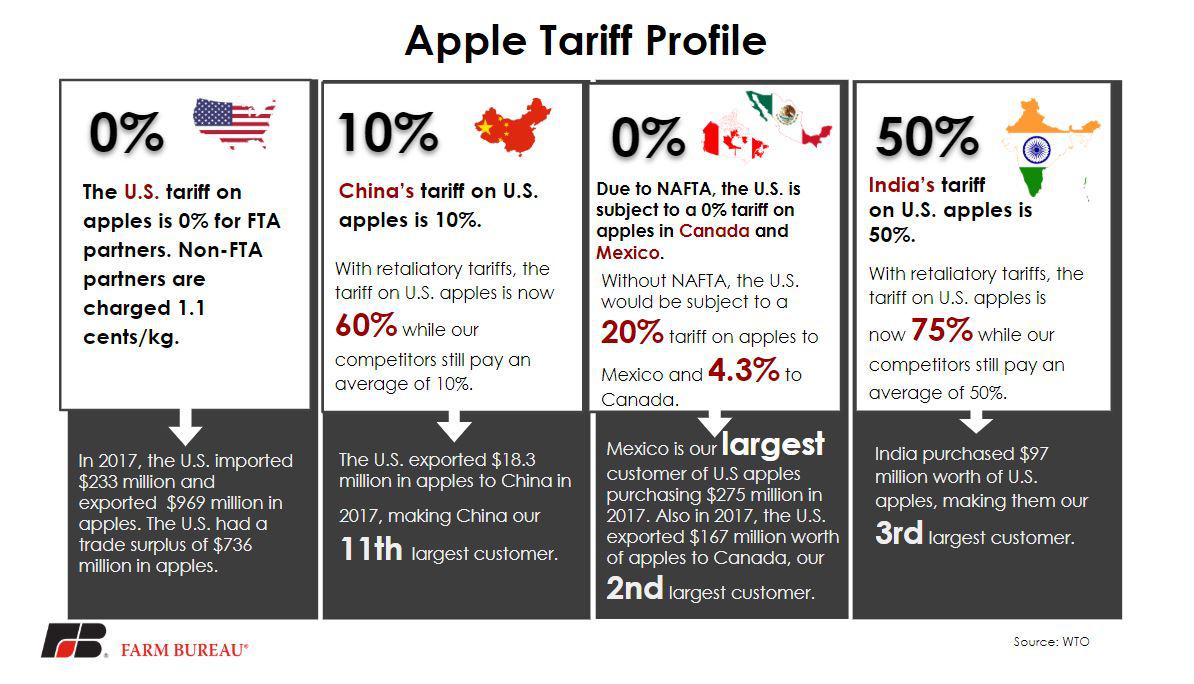

As the third-largest producer of apples in the world, the U.S. exported $969 million worth of apples in 2017. By importing $233 million in the same year, the U.S. maintained a trade surplus of $736 million in apples in 2017. On its apple imports, the U.S. charges a 0 percent tariff for all FTA partners, like Mexico and Canada. For non-FTA partners, the U.S. charges a tariff of 1.1 cents per kilogram.

In 2017, purchasing $18.3 million in U.S. apples, China represents our 11th-largest customer. The tariff on U.S. apples in China is 10 percent. However, with retaliatory tariffs in place, the tariff on U.S. apples has increased to 60 percent. All the while, our competitors are still subject to a 10 percent tariff.

Our North American Free Trade Agreement partners, Mexico and Canada consume the most U.S. apples. Mexico is the largest importer of U.S. apples, purchasing $275 million in 2017. Our second-largest customer, Canada, purchased $167 million worth of U.S. apples in 2017. Due to NAFTA, the U.S. apple exporters are subject to a 0 percent tariff on all apples to both Mexico and Canada. Without NAFTA, the same exporters would be subject to a 20 percent tariff in Mexico, and a 4.3 percent tariff in Canada.

Importing 4.1 percent of the world’s apples, India is the third-largest customer for U.S. apples. In 2017, India purchased $97 million worth of U.S. apples. The tariff India charges on fresh apples is 50 percent, however as of September 18, 2018, the tariff on U.S. apples increased to 75 percent, in retaliation for U.S. steel and aluminum tariffs. India’s average most favored nation tariff rate for agricultural products is 32.7 percent.

To read more in the series, check out our deep-dive into soybean, wheat, corn, pork, cotton, beef, shelled almond and sweet cherry tariffs.

Top Issues

VIEW ALL