Sweet Cherry Tariff Profile

TOPICS

Sweet CherriesMegan Nelson

Economic Analyst

Megan Nelson

Economic Analyst

Our Market Intel series on commodity-specific tariff profiles continues with sweet cherries.

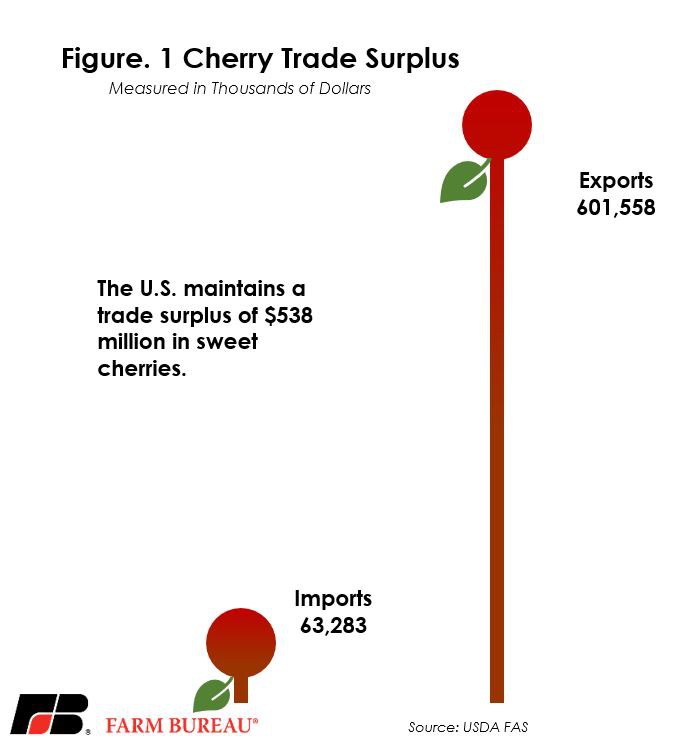

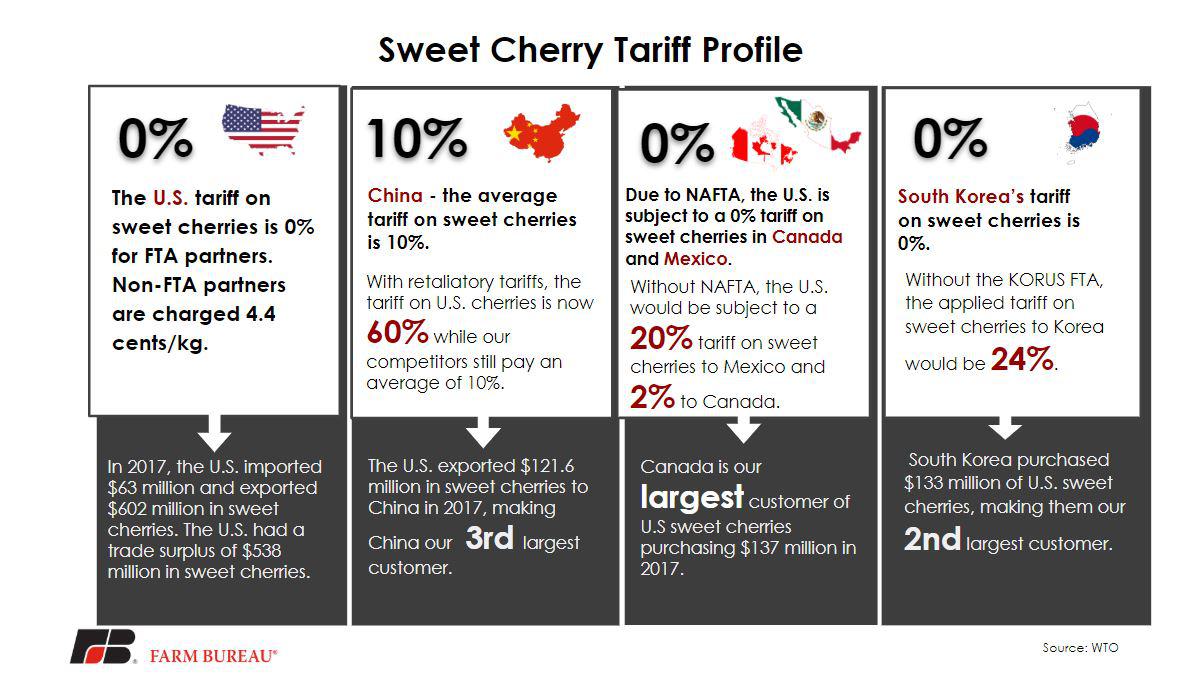

The U.S. is the third-largest producer as well as the third-largest exporter of cherries in the world. Exporting 18.2 percent of the world’s cherries, the U.S. sold over $602 million in sweet cherries during 2017. For all free trade agreement partners, like Canada, the U.S. tariff on sweet cherries is 0 percent. For non-FTA partners, such as Chile and Argentina, the U.S. tariff is on sweet cherries is 4.4 cents per kilogram.

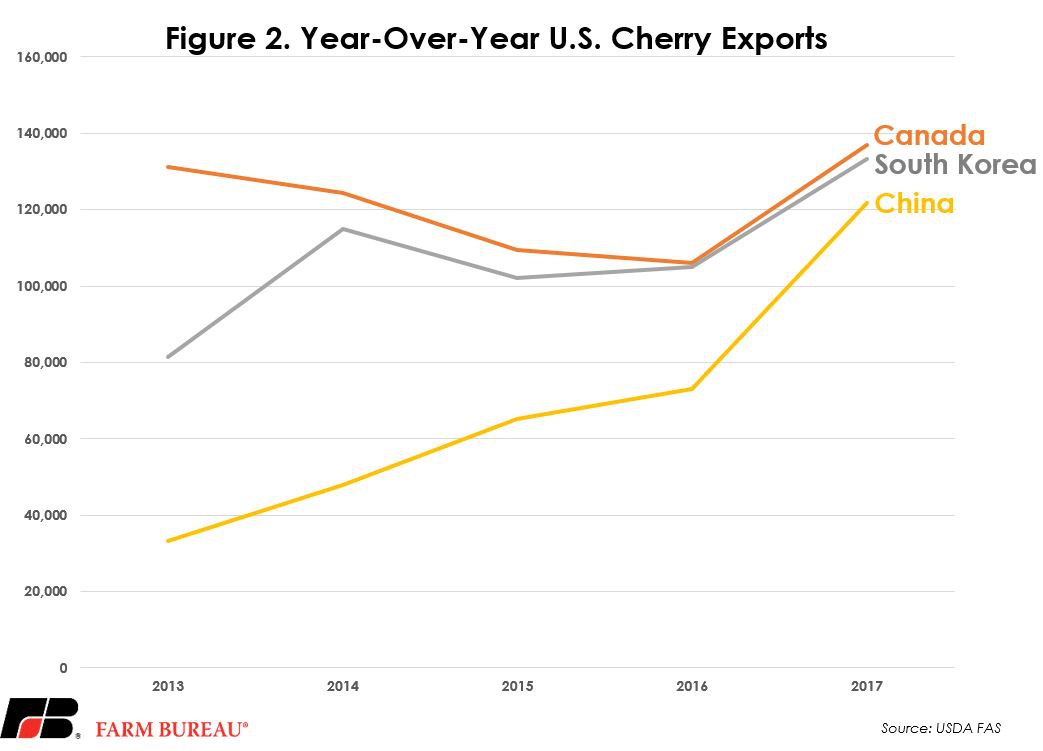

Canada is the largest customer for U.S. sweet cherries, purchasing $137 million worth in 2017. With the North American Free Trade Agreement, U.S. sweet cherry exporters are charged a 0 percent tariff on cherries into Mexico and Canada. Without NAFTA, the U.S. would be subject to a 2 percent tariff on sweet cherries to Canada and a 20 percent tariff on sweet cherries to Mexico.

China imports 40 percent of the world’s cherries and is our third-largest customer for sweet cherries, purchasing $122 million worth of U.S. sweet cherries in 2017. With the largest share of the cherry import market, China charges sweet cherries an average tariff of 10 percent. However, with retaliatory tariffs in place, the current tariff on U.S. cherries is 60 percent, while our competitors are still charged 10 percent.

Our third-largest customer, South Korea, purchased $133 million worth of U.S. sweet cherries in 2017; in total, South Korea currently imports 4 percent of the world's cherries. Due to the U.S.-Korea Free Trade Agreement, U.S. sweet cherries are charged a 0 percent tariff, as opposed to our competitors, which are charged a 24 percent tariff.

To read more in the series, check out our deep-dive into soybean, wheat, corn, pork, cotton, beef and shelled almonds tariffs.

Top Issues

VIEW ALL