Emergency Livestock Relief Program: How it Works

Daniel Munch

Economist

Persistent drought and devastating wildfires across much of the U.S. in 2023 and 2024 significantly impacted livestock producers’ ability to maintain herd sizes and grazing operations. In response, USDA’s Farm Service Agency (FSA) is delivering relief through the Emergency Livestock Relief Program (ELRP) 2023 and 2024. The program was formally implemented through a final rule published in the Federal Register on May 29, 2025.

ELRP 2023 and 2024 builds on a series of ad hoc livestock disaster assistance efforts launched after successive years of extreme weather. Like its predecessors, this latest iteration leverages data from the Livestock Forage Disaster Program (LFP) to streamline delivery. Authorized under Title I of the Disaster Relief Supplemental Appropriations Act of 2025 (American Relief Act), the program allocates up to $2 billion for livestock-related losses, with approximately $1 billion committed to ELRP specifically for drought and wildfire damage. This article provides background on the program, how it works, who qualifies and key considerations for producers.

Background

ELRP was first introduced following widespread forage losses in 2021 and 2022. Its purpose then, as now, is to help livestock producers recover foregone profits or earnings that could have been realized if severe drought or wildfire had not diminished grazing conditions. The 2023 and 2024 versions of the program continue that mission, reflecting USDA’s recognition that exceptional weather events have had lasting effects on the forage base, herd sizes and ranch-level profitability.

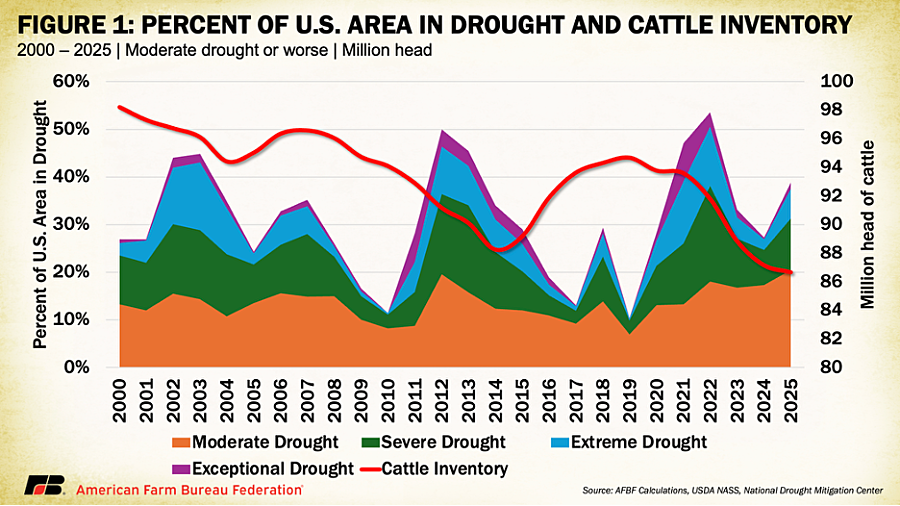

Forage availability is the foundation of U.S. beef production and when drought conditions persist, the consequences cascade across the entire cattle sector. Insufficient rainfall depletes pasture quality on private and public lands, reduces hay yields and drives up feed costs, ultimately forcing ranchers to reduce stocking rates or liquidate herds. Data from the U.S. Drought Monitor and USDA’s National Agricultural Statistics Service show a clear connection: periods of extended drought correlate with periods of cattle inventory contraction. Between 2010 and 2017, when the percentage of U.S. area categorized in moderate drought or worse increased to 50% and then dropped to 13% national cattle inventories followed suit — falling from 94 million head in 2010 to a low of 88 million in 2014, before partially recovering to 94.66 million by 2019 when the percent of U.S. area in drought dropped to 10.3%.

This inventory rebound was short-lived. Beginning in 2020, drought conditions reemerged and intensified. From 2021 through 2023, more than 40% of the country remained locked in moderate drought or worse. These conditions drove another sharp contraction in the national herd, with inventories falling by more than 8 million head between 2019 and 2025, from 94.7 million to 86.7 million, the lowest level since 1951.

This mismatch between high cattle prices and declining herd sizes reflects just how hard it has become for producers to respond to market signals. In a typical year, stronger prices would encourage herd rebuilding and investment in future production. But when the cost of feed, water and basic care climbs too high, especially during prolonged drought, many ranchers simply can’t afford to grow or even maintain their herds. That’s where programs like ELRP come in. By helping offset losses tied to drought and wildfire, ELRP provides critical support for ranchers facing both immediate financial strain and longer-term challenges to keeping their operations viable.

How ELRP 2023 and 2024 Works

Unlike other disaster programs, ELRP 2023 and 2024 does not require a new application process. Instead, USDA will automatically issue payments to livestock producers with approved 2023 or 2024 LFP applications on file. The same eligibility rules that applied to LFP — such as livestock type, grazing land location and drought severity — carry over, with one notable exception: the average adjusted gross income (AGI) limit from LFP does not apply to ELRP.

To be eligible, producers must:

- Have an approved LFP application (form CCC-853) for 2023 or 2024.

- Meet all other LFP eligibility requirements, with the exception of the LFP AGI limitation.

- Ensure required forms are on file, including:

- CCC-902: Farm Operating Plan

- CCC-901: Member Information (if applicable)

- AD-1026: HELC/Wetlands certification

- FSA-510: For higher payment limits (if applicable)

While ELRP does not enforce the average adjusted gross income (AGI) limit that applied under LFP, payment limits do still apply. Most producers are subject to a $125,000 annual payment cap, though those who derive at least 75% of their income from farming or ranching may qualify for an increased cap of $250,000. To receive the higher limit, eligible producers must submit Form FSA-510 and supporting documentation.

Payment Calculation

Payments under ELRP 2023 and 2024 are calculated based on what each producer received through LFP in the same year. If a producer didn’t receive LFP, they won’t receive ELRP (see section below). But if they did, ELRP takes that amount and applies a fixed payment factor of 35% to determine the assistance.

To understand how ELRP is derived, it helps to first understand how LFP payments are calculated. LFP provides assistance to eligible producers who experienced grazing losses due to qualifying drought or fire. For drought, LFP payments reimburse 60% of USDA’s estimated monthly feed cost per animal unit (AU), for up to five months in the most severely impacted counties. In 2023, this amounted to $34.87 per AU per month (based on a $58.12 feed cost), while in 2024 the monthly payment dropped to $31.54 per AU (from a $52.56 feed cost).

For wildfire-related losses, producers are eligible for assistance if grazing on federally managed lands was prohibited due to fire. In these cases, LFP reimburses 50% of estimated feed costs for the number of days grazing was not permitted, up to a maximum of 180 days. While less common, these payments also contribute to a producer’s total gross LFP payment and are included in ELRP’s 35% calculation if applicable.

To determine the ELRP payment, USDA multiplies the producer’s gross LFP payment by a fixed factor of 35%. For example, if a rancher received $1,000 in LFP payments in 2023, they would receive an ELRP payment of $350 ($1,000 x 0.35). The amount a producer received under LFP depends on their number of eligible livestock, the severity and duration of drought conditions in their county and the standard monthly LFP rate assigned to their livestock type.

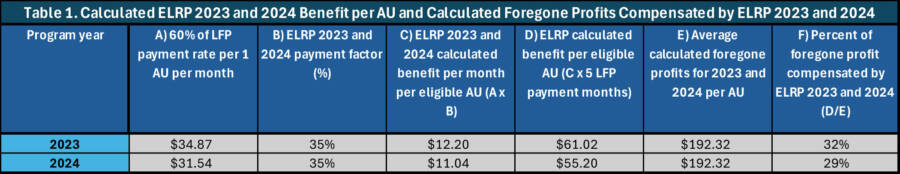

To provide additional clarity, USDA included Table 1 in the final rule, which summarizes the expected national average per-animal-unit ELRP benefit. For producers who received the maximum five-month LFP benefit (typically those in counties experiencing D4, or “exceptional drought”) ELRP payments equate to $61.02 per AU in 2023 and $55.20 per AU in 2024. These values are derived from multiplying the base LFP payment, which is set at 60% of USDA’s estimated monthly feed cost per AU, by five months and then applying the 35% ELRP factor. For context, USDA estimates the full annual foregone profit per AU was $165.95 in 2023 and $218.70 in 2024, with a two-year average of $192.32. While the program does not fully compensate for the total lost income from forage-based operations, it aims to provide meaningful partial relief using an objective, drought-based formula.

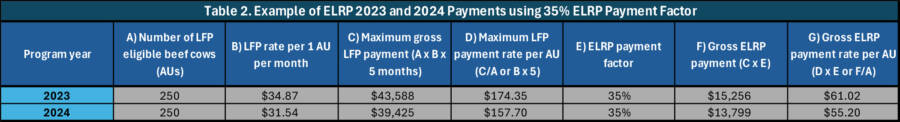

To help producers better understand how these numbers translate to real-world operations, USDA also included Table 2, which walks through a sample scenario. In this example, a producer with 250 beef cattle eligible for the maximum five-month LFP payment would have received $43,588 in LFP assistance in 2023. Applying the 35% ELRP factor results in an ELRP payment of $15,256. In 2024, under slightly lower LFP monthly rates, the same operation would receive $39,425 in LFP and an ELRP payment of $13,799. These values correspond closely with the standardized per-AU estimates provided in Table 1 and offer a practical benchmark for producers estimating their own ELRP benefit.

What If a Producer Didn’t Receive LFP?

ELRP 2023 and 2024 is only available to producers with an approved LFP application for the applicable year. If a producer did not apply for LFP in 2023 or 2024, or was ineligible due to livestock type, location or drought intensity, they will not qualify for ELRP. USDA is not opening a separate application period or alternate pathway for non-LFP participants. This mirrors the structure of prior ELRP iterations, which also relied on LFP data as a proxy to streamline delivery and avoid duplicative processes.

However, USDA has reserved up to $1 billion for other livestock-related losses from 2023 and 2024, including flooding, which will be addressed in a separate rule. Producers who did not qualify for ELRP may still be eligible for support under future announcements.

Final Considerations

While USDA has not announced a specific timeline for disbursing ELRP 2023 and 2024 payments, producers can expect payments to begin once eligibility reviews based on LFP records are complete. Historically, ELRP payments have been issued within one to two months following the publication of the final rule, suggesting assistance could reach producers relatively quickly in 2025.

If funding remains after USDA addresses other categories of livestock-related losses, such as flooding, the agency may issue a second round of ELRP payments to further offset drought-related impacts. Producers are encouraged to keep their information up to date with FSA and ensure all required forms are on file to avoid delays.

Those who believe their eligibility or payment calculation is incorrect may pursue resolution through USDA’s standard appeals process. While no disaster program can fully compensate for the financial losses caused by prolonged drought, ELRP helps provide producers with a timely bridge to recovery — and greater certainty in an otherwise uncertain operating environment.