Minimum Wages in Agriculture

Samantha Ayoub

Economist

Key Takeaways

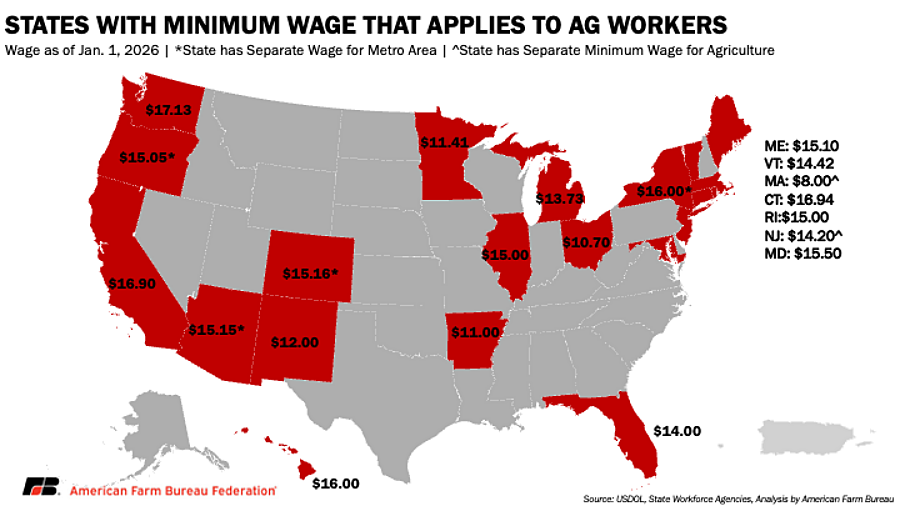

- Many states are setting minimum wages above the federal level. Recent changes to the Adverse Effect Wage Rate (AEWR) methodology for H-2A workers have revived state minimum wages as the required wage for workers in many states. Thirty-one states have unique minimum wages, but only 21 apply to agricultural workers as there are various exemptions across the country.

- The average farmworker makes well above minimum wage. According to Occupational Employment and Wage Statistics (OEWS), the average hourly wage for crop and livestock farmworkers are $18.20 and $18.55, respectively, above even the highest state minimum wage of $17.13 per hour.

- Patchwork regulations cause confusion and administrative burdens for employers. Some farmers work across state lines, sometimes daily, requiring them to navigate a mixture of wages and exemptions across their operations. As guestworker wage requirements change, state minimum wages will become prevalent in agricultural work, needing more consideration of the nationwide variation.

When minimum wages were first established in the 1938 Fair Labor Standards Act (FLSA), agricultural workers were exempt. Over time, amendments to the rule brought groups of farmworkers under minimum wage laws until all agricultural workers were included in 1978. Yet, the federal minimum wage has not risen since the current $7.25 per hour was set in 2009.

Thirty-one states and Puerto Rico have raised their minimum wage above the federal threshold. However, the extent to which these laws apply to agricultural workers varies across the country; in some states, farmworkers are covered by a separate, lower minimum wage than the state’s general minimum wage. Others have separate wages for workers within metro areas. This has created a patchwork of agricultural wages across the country.

Federal and state minimum wage laws have long been surpassed by other wage floors in U.S. farmworker programs: the AEWR, prevailing wage rates and collective bargaining rates. The rising presence of H-2A workers in seasonal employment has caused these other wages to drive agricultural wages up in areas where H-2A workers are presently earning above minimum wage. H-2A guestworkers, and any corresponding domestic employees, must be paid the highest of the federal minimum wage, state minimum wage, prevailing wage, collective bargaining wage or the AEWR. The AEWR was traditionally the most widely used of the wage requirements, but recent changes to the AEWR methodology have caused the AEWR to fall below state minimum wages in multiple states. Farmers will need to understand the patchwork of minimum wages and exemptions across the country given these changes.

Twenty-one states have local minimum wage laws that apply to agricultural workers. State minimum wages range from $8 to $17.13 per hour, as much as 136% above the federal minimum wage. AEWRs are now below these minimum wages for Skill Level I workers in 16 of the 21 states.

Agricultural Exemptions

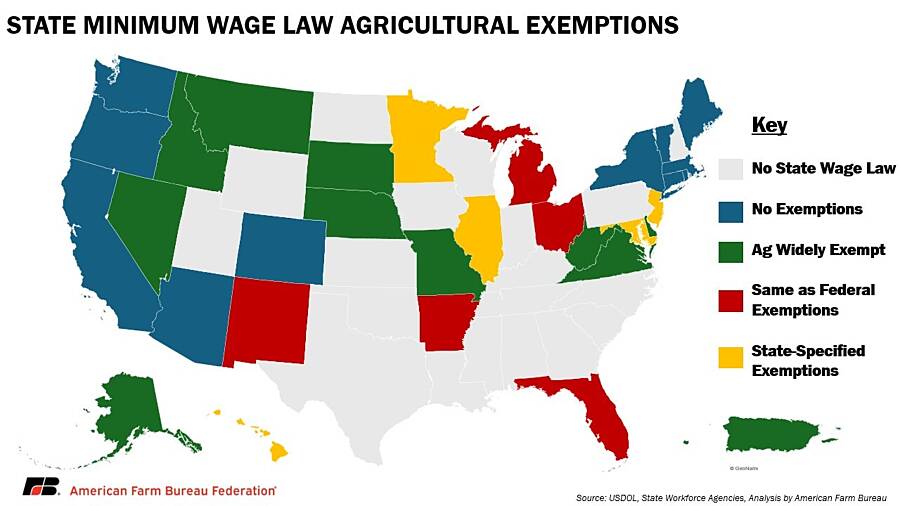

Exemptions from minimum wage laws for farmworkers apply at both the federal and state levels. Federally, small farms that employ less than 500 total “man days” – a day where an employee works at least one hour – across all employees in a preceding calendar quarter are exempt. In other words, in January 2026, small farms are exempt from federal minimum wage laws if they had less than 500 total days worked, where each employee’s workday (of at least one hour) is counted individually, between January and March 2025. This is in addition to small business exemptions for any business with under $500,000 of gross revenue. There are additional federal exemptions for immediate family, range livestock workers and local seasonal hand-harvest workers who are paid by piece-rate.

State exemptions vary widely. Some states exempt all agricultural employment from state minimum wage laws; some match their state laws to federal exemption criteria; and others exempt specific small employers or specific industries.

Conclusion

State minimum wages have become more prominent across the country. Recent changes to wage requirements for the H-2A program will result in guestworkers more frequently being paid state minimum wages. As historical price floors used throughout agriculture fall below state minimum wages, it becomes more crucial to explore the numerous wage standards that exist throughout the country.

Rising price floors limit farmers’ ability to provide additional compensation for experience, tenure or certifications as tightening farm margins cap investments, including in the workforce. The patchwork of state wages has created a complex and fragmented regulatory landscape, especially for farmers who have employees across state lines. Especially as wages rise in some states and not others, farmers within the same sector face competition between states with lower labor, and therefore overall production, costs.

Farmers are dedicated to ensuring their workers are adequately compensated for the crucial work they do to provide food, fiber and fuel for families across the country. According to OEWS, the average hourly wage for crop and livestock farmworkers are $18.20 and $18.55, respectively, well above even the highest state minimum wage. So, even with rising price floors, farmers continue to compensate above even the highest local requirements.

Top Issues

VIEW ALL