Smaller Cattle Herd Creates Market Volatility

TOPICS

Cattle

Bernt Nelson

Economist

Key Takeaways

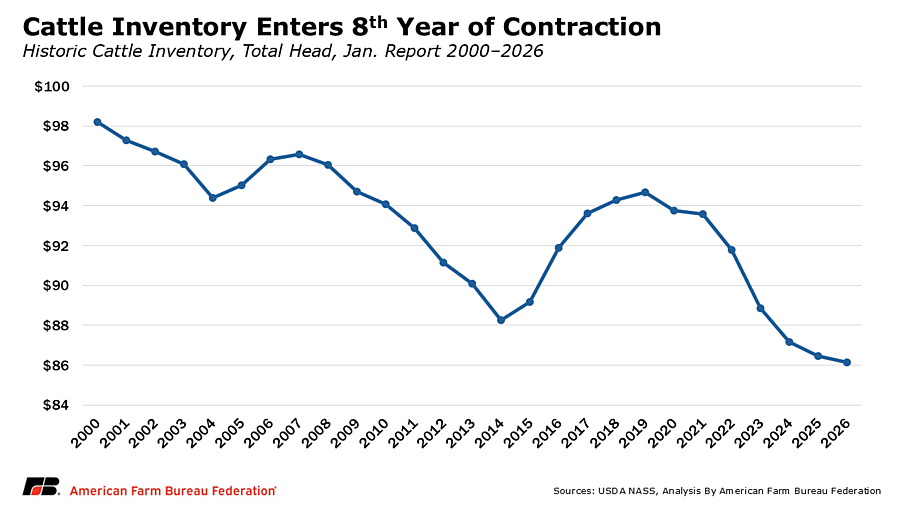

- The U.S. cattle herd continues to shrink. The January U.S. Cattle Inventory report shows the cattle inventory on Jan. 1, 2026, is 86.2 million head, down 300,000 head or 0.3% from 2025. This decline indicates that the cattle inventory is still in the contraction phase of the cattle cycle.

- Cattle inventory will likely not expand until at least 2028. The combination of fewer beef cows and a declining calf crop means the 2026 calf crop will likely continue to trend downward because there are fewer calves available for the breeding herd, even if more heifers are kept for breeding purposes.

- Tighter cattle supplies will contribute to higher prices and volatility for cattle and beef in 2026. Smaller cattle supplies paired with strong consumer demand for beef has driven up prices for both cattle and beef. With cattle supplies this tight, markets have become more responsive to news and events that could impact supply and demand. This has resulted in a tremendous amount of volatility in cattle markets.

2025 was a remarkable year for cattle with prices setting records on several occasions. USDA’s most recent net farm income forecast adjusted net farm income downward for 2025 and is projecting lower incomes again in 2026. One of the few bright spots in the agricultural economy has been beef cattle with cash receipts for cattle rising 39% from 2020 through USDA’s forecast for 2026.

The Cattle Inventory

USDA’s January Cattle Inventory report provides state-level and national data on the number and value of cattle and calves, the number of operations, and detailed breakdowns by class. This report sets the tone and direction for cattle markets for the upcoming year. The Jan. 30 report was bullish. All cattle and calves on feed in the United States on Jan. 1, 2026, totaled 86.2 million head, a 75-year low, down about 300,000 head, or 0.3%, from 86.5 million head in 2025. While this is a much smaller decline than the 1.6% average inventory decline from the last five years, it is still an indicator that the U.S. cattle supply is continuing to fall. The continued decline in cattle, though small, means we are now in year 13 of the current cattle cycle and year eight of contraction. Other data contained in the report provides clues about when expansion could begin.

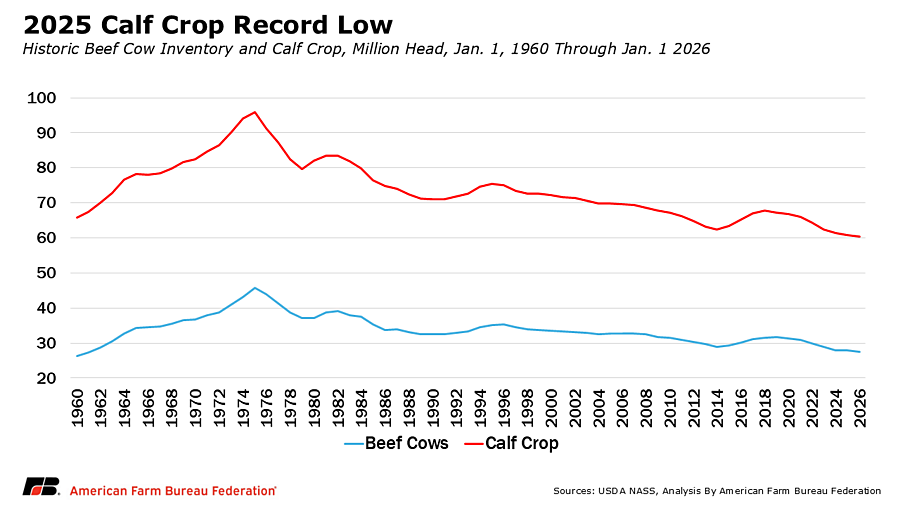

Beef Cows and Calf Crop Decline

Beef cows that have calved totaled 27.6 million, down 285,000 head, or 1%, from 27.9 million in 2025 and the lowest since 1961. Heifers for beef cow replacement were 4.71 million, up 1% from 4.67 million in 2025. Heifers for beef cow replacement expected to calve were 2.96 million, also up 1% from 2025. This increase in replacement heifers means that farmers are beginning to keep some heifers for breeding rather than placing them on feed for beef production. This does not necessarily mean the cattle herd is about to expand, but it is one of the first steps of expansion.

The 2025 calf crop is estimated at 32.9 million head, down about 521,000 head, or 2%, from 2024. This is a record low and is the second consecutive year a record low has been set. For any expansion in the cattle inventory to occur, the calves from this year’s calf crop (particularly heifers) will have to be kept for breeding rather than placed on feed for beef production. If this happens, these calves could produce a calf of their own in 2027 and present the possibility of some herd expansion by 2028. However, the lower number of beef cows combined with the smaller calf crop means a smaller calf crop can be expected in 2027.

A smaller 2025 calf crop also means there are fewer cattle available to be placed on feed in 2026. The U.S. border to Mexico remains closed to imported livestock including beef cattle to combat the spread of New World screwworm. Approximately 1.2 million-1.5 million head of cattle placed into feedlots for beef production are imported to the U.S. from Mexico when the border is open each year. This supply constraint will keep prices for feeder cattle elevated in 2026 and 2027.

Beef Production

Even though cattle numbers are continuing to fall, USDA’s Economic Research Service (ERS) increased its beef production forecast toward the end of 2025 (still below 2024 levels). However, lower beef production is expected in 2026. This is because the average live weight of fed cattle was record high for every quarter in 2025. The average live weight of all fed cattle for quarter four in 2025 was 1,460 pounds, 50 pounds, or 3.5%, higher than the five-year average live weight of 1,410 pounds. USDA’s National Agricultural Statistics Service’s (NASS) Cattle on Feed report indicated marketings of fed cattle well below year-ago levels in every month in 2025 since April. However, the increase in live weights has been enough to offset much of the decline in marketings and keep production estimates for 2025 at 25.95 billion pounds, just 3.8% below 2024. Based on the trend of higher weights and lower marketings, USDA’s latest World Agricultural Supply and Demand Estimates (WASDE) report estimates beef production in 2026 will be 25.735 billion pounds, less than 1% lower than 2025.

The Markets

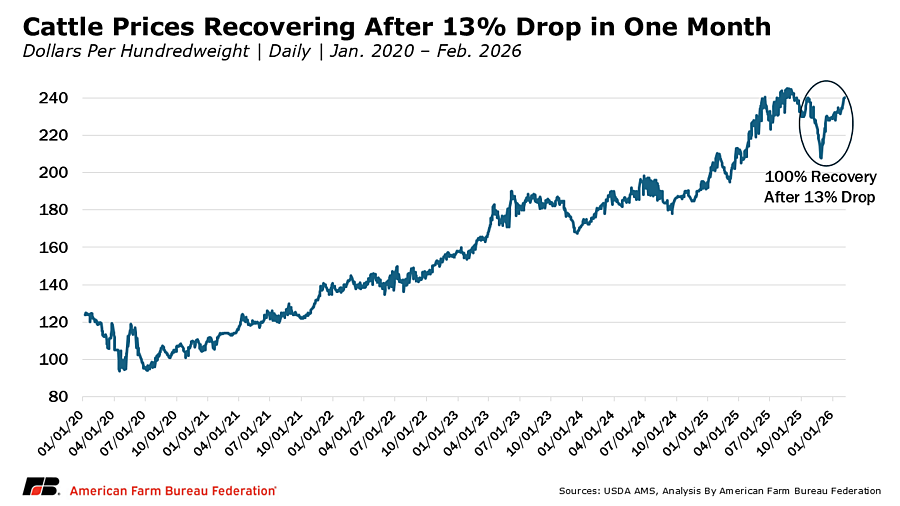

Cattle markets set several records in 2025, along with experiencing tremendous volatility. Most notable, the 5-market monthly weighted average negotiated price for fed steers hit a record $243/cwt in August 2025.

Higher cattle prices are due to historically tight cattle supplies, but also consistently strong consumer demand for beef. The most recent data from USDA’s ERS estimates the composite all-fresh retail price of beef was a record $9.55 per pound in December 2025 after posting a new record high in every month since June 2025. Demand for beef has remained strong even while these prices have continued to climb.

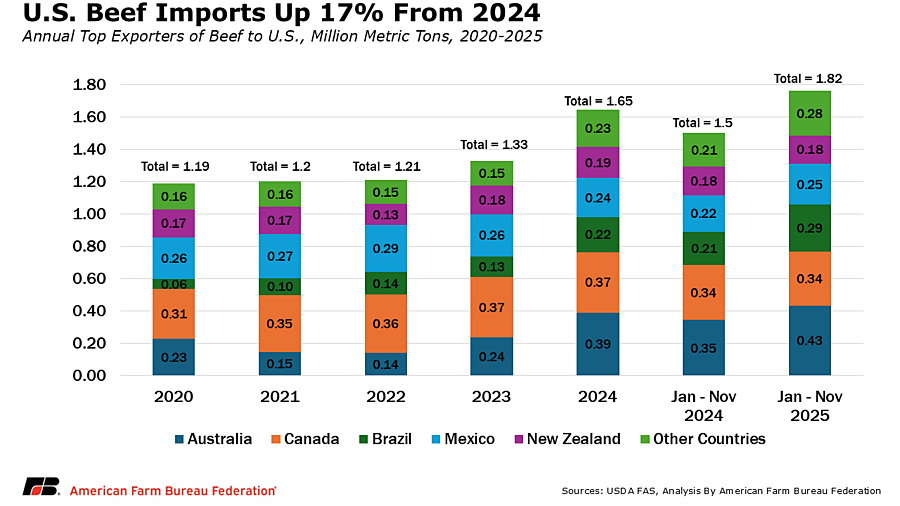

Imports and Argentina

Tighter supplies of cattle have led to tremendous volatility in the cattle and beef markets. When supplies of commodities are low, they become more sensitive to news or changes that can impact supply or demand, and the result is market volatility. One example of high volatility is the October 22 announcement to increase the tariff rate quote (TRQ) on beef from Argentina.

An additional expected market response to lower cattle supplies for beef is increased imports. As the cattle inventory continues to decline, beef imports climb. According to data from USDA’s Foreign Agricultural Service, beef imports increased by 258,490.1 metric tons, or 17%, from 1.5 million metric tons from January through November 2024 to 1.76 million metric tons for the same period in 2025. Put another way, the U.S. cattle inventory has declined by 7.7% from 2020 to 2025 while beef imports during the same time period have increased by about 48% by volume. Australia was the number one source of imported beef

Since 2020, approximately 2% of U.S. beef and veal imports originated from Argentina. Argentina has a tariff rate quota into the U.S. of 20,000 metric tons per year with exports above this volume tariffed at 26.4%. Beef coming into the U.S. from Argentina is grass-fed beef and is used as lean trimmings for ground beef. The October announcement proposed to increase the TRQ from 20,000 metric tons per year to 80,000 metric tons per year. Industry experts do not believe increased imports from Argentina will have a measurable impact on prices paid by consumers for beef. However, the market response following the October announcement was substantial. Following the announcement, the 5-market average cash cattle price fell 13%, from $239/cwt before hitting its low price of $207 on Nov. 28. In addition, feeder cattle and live cattle futures experienced several limit down (the maximum range for a futures contract in a single trading session) trading sessions following the announcement. Since that time, cash cattle prices have recovered all of the

On Feb. 5 the United States Trade Representative (USTR) signed the United States–Argentina Agreement on Reciprocal Trade and Investment (ARTI). The agreement improves some sanitary and phytosanitary barriers that limit beef and pork exports to Argentina. It also allows temporary duty-free importation of U.S. beef into Argentina by removing the 9% duty for beef imported up to the 20,000 metric ton TRQ and an additional 20,000 metric tons per quarter for a total of 100,000 metric tons for 2026 only.

On Feb. 6, the White House released a Presidential Proclamation allowing additional temporary access of Argentine beef into the U.S., increasing the TRQ by 80,000 tons of lean trimmings. This means Argentina will be able to export an additional 20,000 metric tons of beef per quarter at a tariff rate of 4.4 cents per kilogram of beef for Argentina’s World Trade Organization TRQ of 20,000 metric tons and for their additional 20,000 metric tons per quarter for a total of 100,000 metric tons to the U.S. in 2026 only. Any additional exports are subject to the 26.4% tariff rate. This 100,000 metric tons would account for approximately 5% of U.S. beef imports or about 1% of total U.S. consumption. The market response has been calm compared to the first announcement. Futures markets edged gently higher on Feb. 9 following the ARTI and Presidential Proclamation.

Conclusions

USDA’s Jan. 1 Cattle Inventory report confirms the U.S. cattle herd remains in the contraction phase of the cattle cycle with little opportunity for meaningful expansion until at least 2028. Declines in beef cows and the calf crop underscore just how tight supplies have become, even while modest increases in replacement heifers suggest farmers and ranchers are cautiously considering rebuilding. In the short run, fewer calves, limited feeder cattle availability, and restricted live cattle imports will continue to constrain cattle markets.

These fundamentals have translated into historically high prices and pronounced volatility across both cattle and beef markets. Strong consumer demand has allowed higher prices to persist, offsetting broader weakness in the agricultural economy and making beef cattle one of the few bright spots in agriculture.

Looking ahead, cattle producers still face substantial uncertainty that clouds herd rebuilding decisions. Ongoing animal health threats, including New World screwworm, along with the potential for another severe drought year, continue to raise costs and production risk despite strong underlying demand.