USDA Cuts 2025 Farm Income as Weakness Persists into 2026

TOPICS

Farm Income

photo credit: AFBF

Daniel Munch

Economist

Faith Parum, Ph.D.

Economist

Key Takeaways

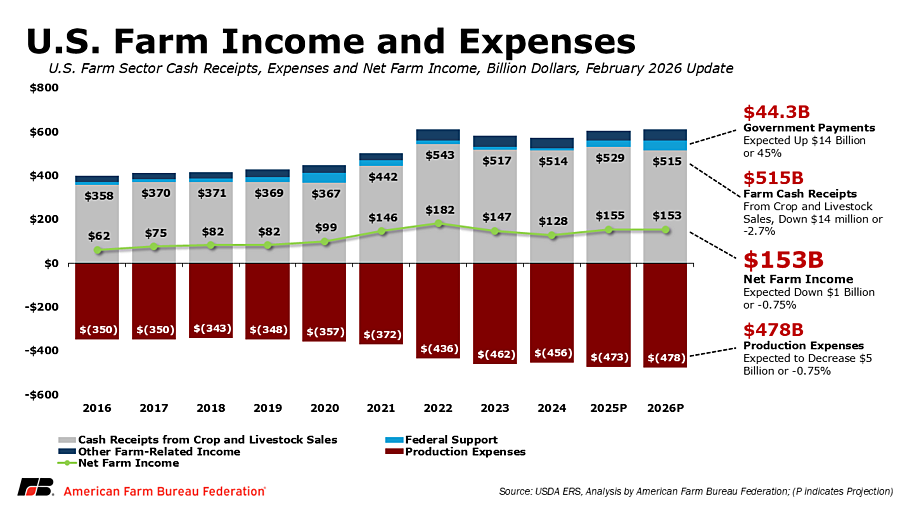

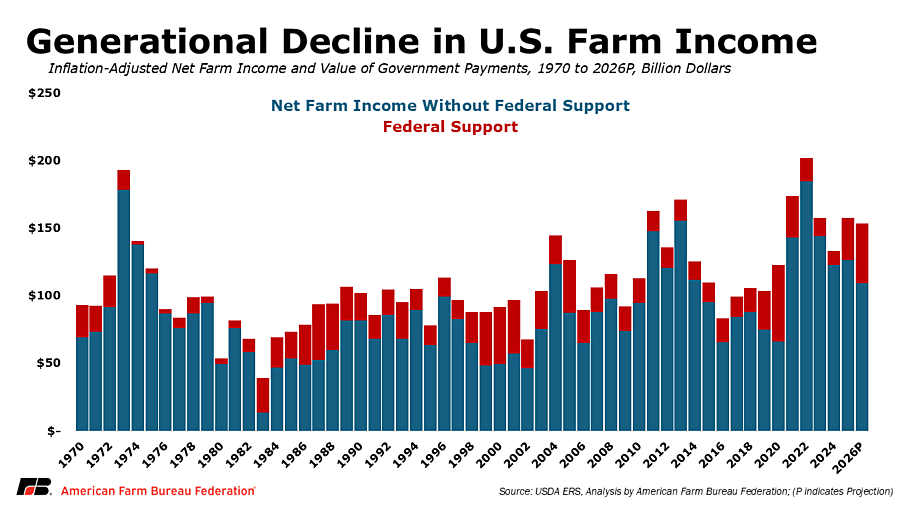

- USDA projects net farm income will slip lower in 2026 and remain roughly $48 billion (24%) below the record highs reached in 2022, underscoring a generational downturn in the farm economy.

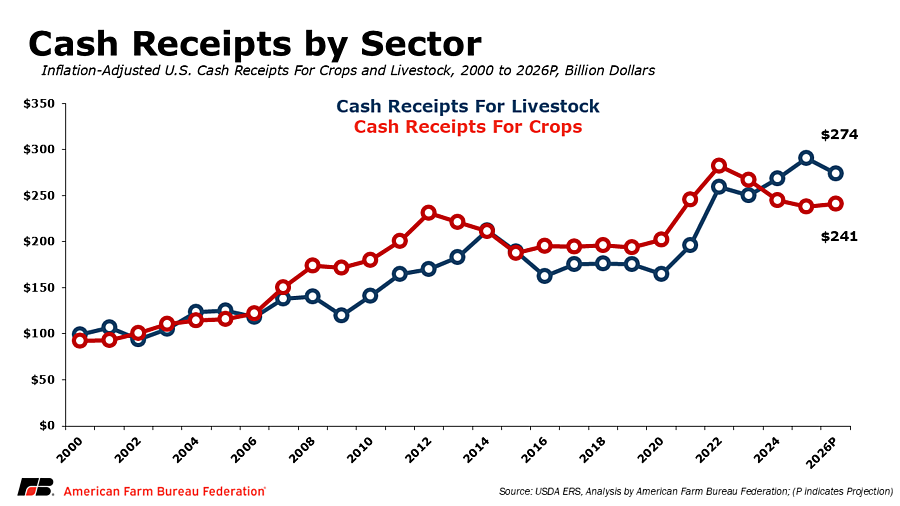

- Strength in the beef market masks broader financial weakness across most commodity sectors.

- USDA’s latest update dramatically rewrites the 2025 story, cutting net farm income by roughly $25 billion from last fall and revealing a much weaker rebound.

- Production expenses continue to climb to record highs while low commodity prices strain farm finances, and rising debt levels leave farmers unable to absorb ongoing losses.

Revisions to 2025

USDA’s latest farm income forecast delivers the first estimates for 2026 while also significantly revising its outlook for 2025. Because USDA did not release its customary December farm income update, this February report marks the first update since September, and the changes are substantial. USDA now estimates that 2025 net farm income totaled about $154.6 billion, down roughly $25 billion from the $179.8 billion forecast in September. Net cash farm income for 2025 was similarly revised down to about $153.9 billion, nearly $27 billion below the $180.7 billion previously projected.

At the same time, USDA revised 2025 production expenses higher, to $473.1 billion, while adjusting direct government payments lower, to about $30.5 billion, roughly $10 billion below earlier expectations. Together, these revisions suggest the farm economy is experiencing a generational downturn rather than a temporary slowdown. Outside of the cattle sector, most commodity markets are weakening. The updated forecast further cements that the expectations of a strong income rebound for 2025 did not come to fruition and this reinforces that farm profitability last year was more fragile than previously believed.

First Look at 2026

Against that backdrop, USDA’s first look at 2026 points to continued pressure in the farm economy. Net farm income is forecast at $153.4 billion in 2026, down $1.2 billion from 2025 in nominal terms, while net cash farm income is projected to rise modestly to $158.5 billion. Despite remaining above long-run averages, the 2026 outlook continues to reflect declining market-based receipts and an ongoing reliance on government support.

Government Payments Continue to Drive Farm Income in 2025 and 2026

Government payments remain a key factor in USDA’s farm income outlook, particularly after the agency revised its 2025 estimates. USDA now estimates direct government payments totaled $30.5 billion in 2025, down from the $40.5 billion forecast in September. This roughly $10 billion downward revision reflects, in part, that not all disaster assistance expected for 2025 was paid out during the year.

Some payments tied to 2023 and 2024 natural disaster losses, particularly under the Supplemental Disaster Relief Program (SDRP), have not yet been distributed and are now shifting into 2026. As of Jan. 31, only $5.98 billion of the $16.1 billion available under SDRP had been paid. In addition, payments from the $11 billion Farmer Bridge Assistance Program, authorized to offset economic losses incurred in 2025, are expected to be disbursed by the end of February 2026.

As a result, USDA forecasts direct government payments will rise to $44.3 billion in 2026, an increase of $13.8 billion from the revised 2025 level. Supplemental and ad hoc disaster assistance payments are forecast at $23.9 billion in 2026, driven largely by remaining SDRP payments and Farmer Bridge Assistance Program outlays. Farm bill payments that are triggered when commodity prices fall are forecast at $15.2 billion, up $13.1 billion from 2025, reflecting modifications to Agriculture Risk Coverage and Price Loss Coverage authorized under the One Big Beautiful Bill Act. Dairy Margin Coverage payments are forecast at $122.9 million, up from 2025, while conservation payments are expected to total $5.3 billion, an increase of $219 million from the prior year.

This timing shift helps explain why net cash farm income is forecast to rise in 2026 even as cash receipts from commodity sales decline, reinforcing that recent income stability continues to be supported by government assistance rather than stronger market conditions.

Even at these elevated levels, government payments do not fully offset the scale of losses farmers have absorbed in recent years. With production costs still high and market prices under pressure, many operations remain below breakeven, even after accounting for disaster and economic assistance, leaving significant financial gaps.

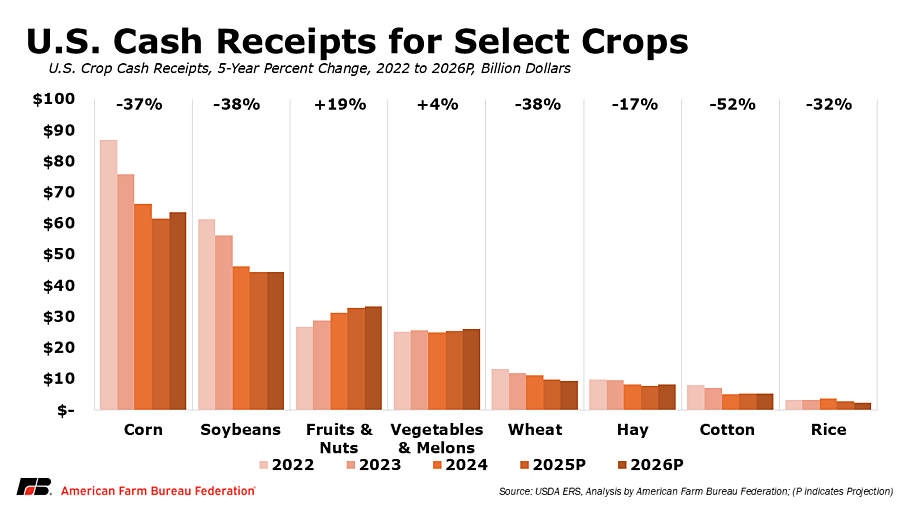

Crop Receipts Remain Under Pressure Despite Modest 2026 Gains

USDA forecasts crop cash receipts will total $240.8 billion in 2026, an increase of $2.8 billion (1.2% from the revised 2025 estimate). After adjusting for inflation, however, crop receipts are projected to decline by about 0.7%, reflecting continued pressure across most crop markets.

USDA’s February update also revised its estimate of 2025 crop receipts slightly higher compared to last fall. In September, USDA projected 2025 crop receipts at $236.6 billion. The updated estimate now places 2025 crop receipts at $238.1 billion, an upward revision of roughly $1.5 billion. While the revision reflects somewhat stronger realized receipts, it does not change the broader picture of weak crop market conditions in 2025, particularly given elevated production costs and declining prices for several major row crops.

Looking ahead, corn is one of the few major crops showing growth in 2026, with receipts expected to increase $2 billion (3.3%), driven largely by higher quantities sold rather than price strength. Soybean receipts are forecast to remain near 2025 levels, while wheat receipts decline $0.2 billion (2.4%) due to lower sales volumes. Rice receipts are projected to fall $0.4 billion (12.5%) as both prices and quantities sold decline. Hay receipts are expected to rise $0.4 billion (5.5%), while cotton receipts are forecast to remain near 2025 levels.

Among specialty crops, vegetable and melon receipts are projected to increase $0.7 billion (2.7%) in 2026, supported by higher prices, while fruit and nut receipts are forecast to rise a combined $0.4 billion (1.2%). While these gains provide some support, they are not large enough to offset ongoing weakness across major field crops.

Taken together, USDA’s revised 2025 estimates and modest 2026 forecast point to a crop sector that remains financially strained. The downward revision to 2025 confirms that last year’s income was weaker than expected, and the limited nominal growth projected for 2026 does little to improve margins once inflation and elevated production costs are considered.

Livestock and Dairy Receipts Lower in 2026 After Mixed 2025 Results

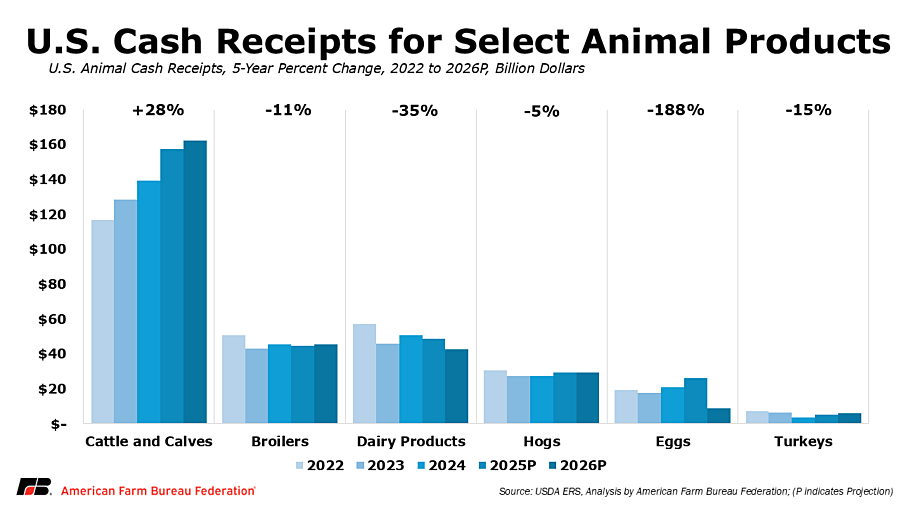

USDA forecasts total animal and animal product cash receipts will decline to $273.9 billion in 2026, down $17 billion (5.8%) from the revised 2025 estimate. After adjusting for inflation, animal product receipts are projected to fall 7.6%, marking one of the larger year-over-year declines in the farm income forecast.

USDA’s February update also revised its estimate of 2025 livestock receipts downward. In September, USDA projected 2025 animal and animal product receipts at $298.6 billion. The updated estimate now places 2025 receipts at roughly $290.9 billion, a downward revision of about $7.7 billion, reflecting weaker-than-expected pricing late in the year across several livestock and poultry sectors.

Looking ahead to 2026, lower prices for several major animal products drive the decline. Milk receipts are forecast to fall $6.2 billion (12.8%) as prices retreat from recent strength. Egg receipts are projected to drop sharply, falling $17.3 billion (66%) as prices normalize following extraordinary avian influenza-linked market conditions in prior years. Hog receipts are expected to decline slightly, down $0.2 billion (0.7%).

In contrast, cattle and calf receipts are forecast to continue increasing in 2026, rising $5.2 billion (4.1%) as tight supplies support higher prices. Broiler receipts are projected to increase modestly, up $0.6 billion (1.4%), reflecting steady demand and production.

The livestock outlook follows a mixed year in 2025. USDA estimates animal and animal product receipts totaled $275.4 billion in 2025, up modestly from 2024 but weaker than previously expected. While some sectors benefited from higher prices, the downward revision to 2025 confirms that market strength was uneven and less durable than earlier forecasts suggested. Gains in cattle and calf receipts remain one of the few sources of market-driven income growth, masking broader weakness across crops, dairy and poultry and leaving the farm income outlook vulnerable if cattle markets soften.

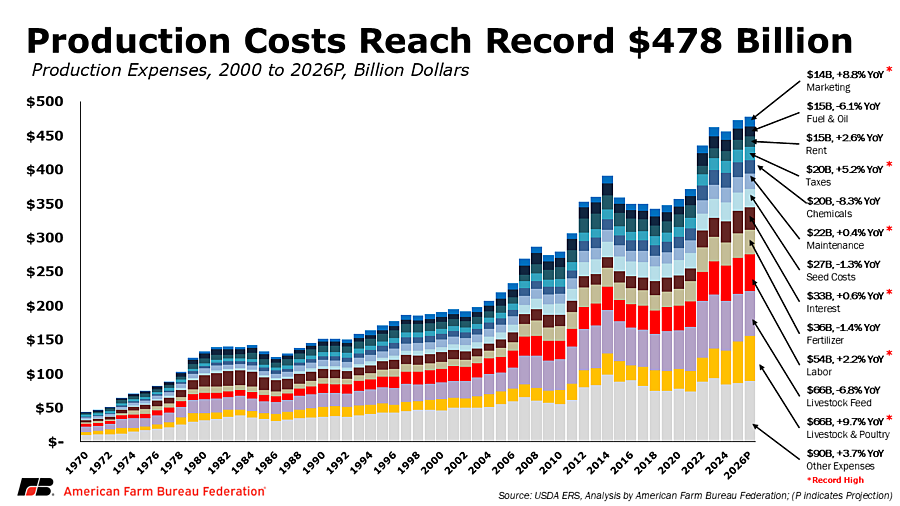

Production Expenses Remain Elevated Despite Modest Real Decline

USDA forecasts total farm production expenses, including those associated with operator dwellings, will total $477.7 billion in 2026, an increase of $4.6 billion (1%) from the revised $473.1 billion estimate for 2025. After adjusting for inflation, however, total expenses are projected to decline by 0.9%, reflecting modest easing in some input costs rather than a broad reduction in cost pressure.

USDA’s February update also revised 2025 production expenses higher. Last fall, USDA estimated 2025 expenses at $467.4 billion. The revised estimate of $473.1 billion represents an increase of nearly $6 billion, confirming that production costs remained higher in 2025 than previously expected, further constraining farm margins.

Looking ahead to 2026, livestock and poultry purchases are projected to rise sharply, increasing $5.9 billion (9.7%) to $66.3 billion, making them the largest single expense category. Feed expenses are forecast to decline $4.8 billion (6.8%) to $65.6 billion, continuing a downward trend that began in 2023 as grain prices eased. Cash labor expenses are projected to rise to $53.9 billion, up $1.2 billion (2.2%), reflecting ongoing wage pressures and labor shortages.

Other input categories show mixed movement. Pesticide expenses and fuel and oil costs are expected to decline in 2026, while property taxes, fees and electricity expenses are forecast to increase. While these shifts result in a small inflation-adjusted decline in total expenses, overall costs remain historically high.

Taken together, the revised 2025 estimates and 2026 projections suggest that expense relief remains limited. Even where costs are stabilizing or easing slightly, they remain well above pre-pandemic levels, leaving many producers with little margin for error if prices weaken further or revenues fall short of expectations.

Farm Debt Continues to Rise as Producers Use Aid to Shore Up Balance Sheets

USDA forecasts total farm sector debt will increase to $624.7 billion in 2026, up $30.8 billion (5.2%) from 2025. Both real estate and non-real estate debt are expected to rise as producers continue to rely on borrowing to manage elevated operating costs and uneven cash flow. Farm real estate debt is projected to reach $404.3 billion, while non-real estate debt is forecast to climb to $220.4 billion. As a result, USDA expects the farm sector’s debt-to-asset ratio to increase from 13.49% in 2025 to 13.75% in 2026.

Recent research and farmer surveys suggest that rising debt levels are also shaping how producers are using federal assistance. Data from Purdue University’s Ag Economy Barometer show that a majority of farmers report using government payments primarily to pay down existing debt rather than reinvest in their operations.

Together, rising debt levels and the use of government aid to stabilize balance sheets highlight the financial strain facing many farm operations. While assistance is helping farmers manage short-term obligations, it also signals limited capacity to invest, expand or absorb future shocks, particularly as liquidity is projected to tighten further in 2026.

Conclusion

USDA’s latest farm income forecast reinforces the difficult reality for U.S. agriculture. Net farm income is projected to edge lower in real terms, cash receipts from commodity sales are generally expected to decline, production costs remain historically high, and farm debt continues to rise. At the same time, the sharp downward revision to 2025 income underscores that last year’s anticipated rebound was weaker and more fragile than previously believed, shaped heavily by the timing of disaster and economic assistance rather than broad improvements in market conditions.

Looking ahead to 2026, modest gains in cash income come alongside continued cost pressure, rising debt and tightening liquidity. While commodity receipts are expected to soften for many products, elevated production costs continue to push breakeven prices higher, limiting farmers’ ability to rely on the marketplace alone.

Taken together, the outlook suggests a farm economy being stabilized by short-term support rather than strengthened by durable market recovery. Existing federal assistance remains critical in the near term, but it does not close the gap between costs and returns or resolve the underlying financial strain many farmers and ranchers face. Without stronger markets and a more predictable, effective safety net, uncertainty will continue to shape farm-level decisions heading into the next production year.