U.S. Soybean Exports to Fall This Year

TOPICS

Trade

photo credit: AFBF Photo, Morgan Walker

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

U.S. to Export Less as Brazil Fills The Gap

For the first time since the 2011/12 crop year, U.S. soybean exports are projected to decline from prior-year levels. USDA’s March 2018 World Agricultural Supply and Demand Estimates projects soybean exports in 2017/18 at 2.065 billion bushels, down 109 million bushels, or 5 percent, from prior marketing-year levels. One bushel of soybeans yields 47.5 pounds of soybean meal and 10.7 pounds of soybean oil. After converting U.S. soybean meal and soybean oil exports to their soybean equivalents, total U.S. soybean-equivalent exports are projected at 2.764 billion bushels, down 136 million bushels from the prior marketing year’s record-high export volume of 2.9 billion bushels.

Lower soybean exports come despite a smaller-than-anticipated Argentinian crop, but also coincides with NAFTA renegotiations and concern over potential retaliations based on U.S.-imposed steel, aluminum, washing machine and solar panel import tariffs. China and Mexico are our top markets for soybean exports. Through January of the 2017/18 marketing year, USDA Foreign Agricultural Service data reveals exports of soybeans to China at 867 million bushels, down 19 percent, while exports to Mexico were 63 million bushels, up 8 percent from prior-year levels. A recent Market Intel reviewed the concerns over steel and aluminum tariffs: Potential Aluminum and Steel Tariffs Bring Angst to Farm Country.

To some extent major soybean importers can diversify. Other major soybean-producing countries include Argentina and Brazil, which combined have an exportable surplus, i.e. ending stock level, of 1.9 billion bushels for the 2017/18 marketing year. Combined, Brazil and Argentina will represent nearly 50 percent of global soybean production this marketing year. Thus, the primary competitors in the soybean export business are our counterparts in South America.

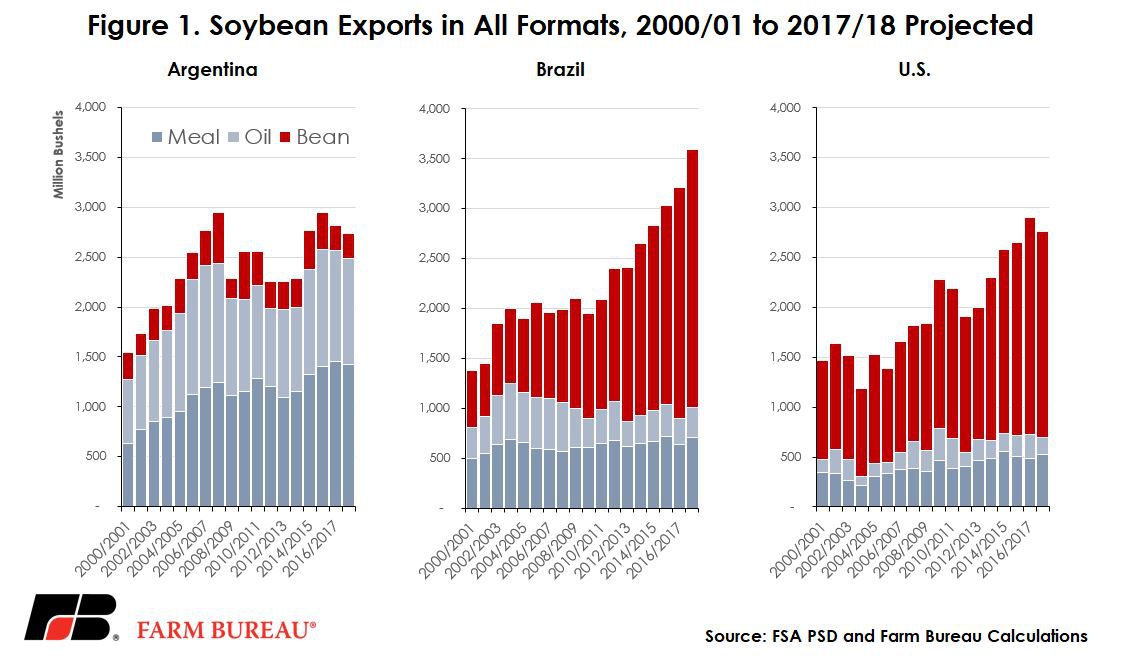

Exports of soybeans and soybean byproducts from Argentina face an export tax of nearly 30 percent, but taxes are lower for exports of soybean meal and soybean oil. As a result, Argentina primarily exports soybean meal and soybean oil. During the 2017/18 marketing year Argentinian soybean meal exports are projected to decline by 2 percent to 30.8 million metric tons. Soybean oil exports are projected to decline 5 percent to 5.12 million metric tons. Combined, soybean, soybean oil and soybean meal export-equivalents are projected at 2.733 billion bushels, down 88 million bushels from the prior marketing year. The decline in exports is expected given the smaller-than-anticipated Argentinian crop. Argentina soybean production is forecast at 47 million tons, down 19 percent from last year due to lower projected yields and dry conditions.

For the 2017/18 marketing year, Brazil’s soybean exports, including soybean meal and soybean oil, are projected at 3.597 billion bushels, up 383 million bushels or 12 percent from the prior year’s record. In fact, for all three soybean export categories, Brazil is expecting double-digit growth. Soybean oil exports are projected to be up 17 percent, soybean meal exports are up 11 percent and soybean exports are up 12 percent. Across all export categories, Brazil will export 800-plus million bushels more than the U.S. or Argentina. Figure 1 highlights soybean-equivalent export volumes for Argentina, Brazil and the U.S.

Implications

With exports slowing, increases in other consumption categories are needed to support prices. USDA is currently projecting for soybean crushing in the U.S. to rise to 1.96 billion bushels, up 59 million bushels from the 2016/17 marketing year. However, higher domestic crushing is expected to only partially offset the decline in export volumes, and as a result, total soybean use in the U.S. is projected to fall by 1.2 percent, to 4.163 billion bushels.

The net effect of lower total consumption is higher ending stocks. Ending stocks are now projected at 555 million bushels, up 25 million bushels from last month’s projection due to slower than anticipated exports. Stocks-to-use levels are projected at 13.3 percent. If realized, this would be the highest soybean ending stocks level and stocks-to-use ratio in 12 years.

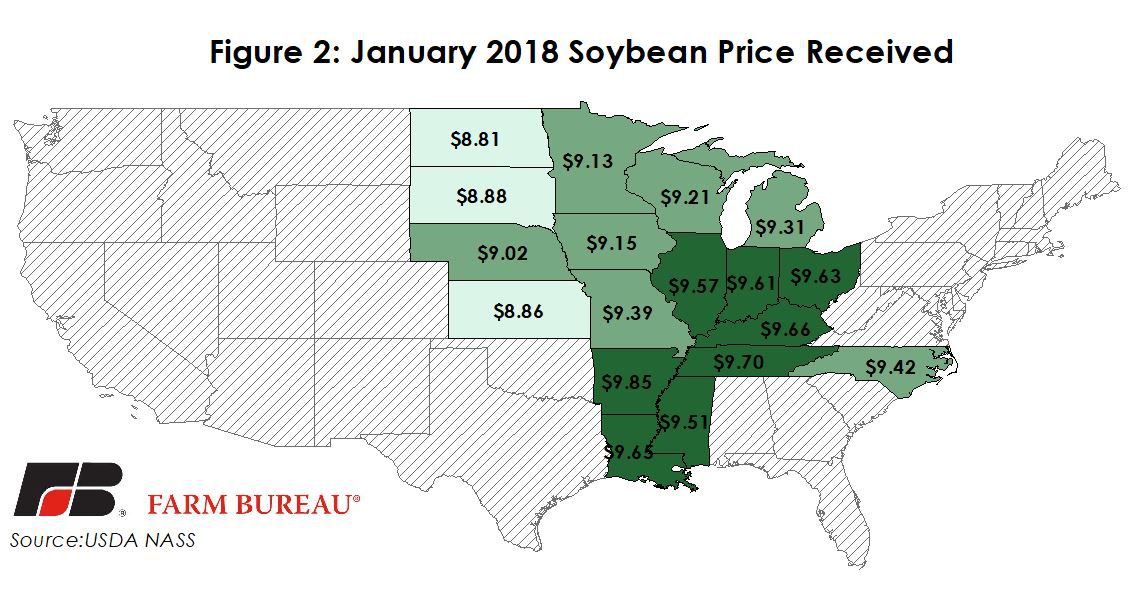

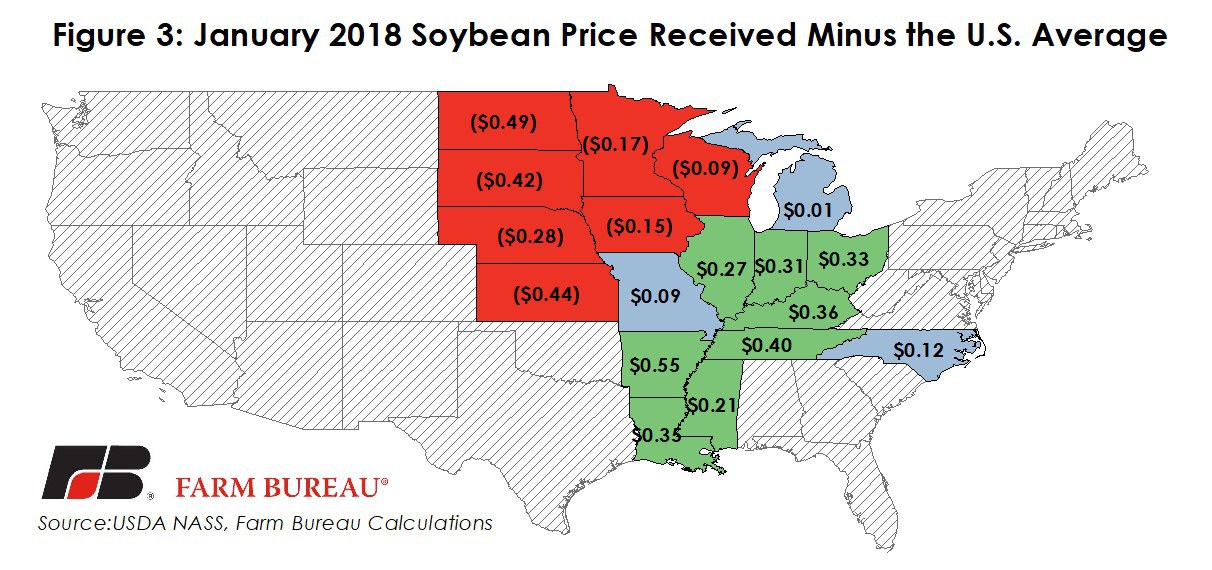

Following weaker demand and increasing inventories, the U.S. marketing year average soybean price is projected at $9.30 per bushel, down 17 cents from last year. Currently, monthly average cash soybean prices received range from $8.81 per bushel in North Dakota to $9.85 in Arkansas. The U.S. average January price received was $9.30 per bushel. Figures 2 and 3 highlight state-level U.S. soybean prices received for January 2018.

The potential for reduced export demand in soybeans could lead to U.S. growers planting fewer acres in 2018. Despite the uncertainty in demand for the current and upcoming marketing year, the new-crop soybean-to-corn price ratio remains at lofty levels. This would imply the current market is certainly not bearish on soybeans, or at least was preserving soybean acres during the USDA prospective planting survey period, i.e. the first two weeks of March. All eyes now turn to the March 29 USDA Prospective Planting survey results and soybean acreage intentions.

Top Issues

VIEW ALL