USDA Makes More Commodities Eligible for CFAP Assistance

TOPICS

USDAShelby Myers

Former AFBF Economist

USDA has made more commodities eligible for the Coronavirus Food Assistance Program and has extended the deadline for all producers to apply for CFAP to September 11, 2020. Following the collection of comments and supporting data, USDA has added more specialty crops, livestock, aquaculture, nursery crops and flowers to the CFAP eligibility list.

The original details of CFAP were released on May 19 and provided direct payments to farmers and ranchers to partially offset COVID-19-related losses for livestock, dairy, non-specialty crops and specialty crops, e.g., Reviewing Coronavirus Food Assistance Program Details. Following the notice of funding availability comment period, USDA expanded CFAP eligibility to certain specialty crops. While a large number of commodities were CFAP-eligible, many more were initially ineligible due to a lack of publicly available price data showing a 5%-or-greater price decline, as the newly created program required. USDA continues to add commodities as more information is provided to the department.

Expanded Specialty Crop CFAP Eligibility

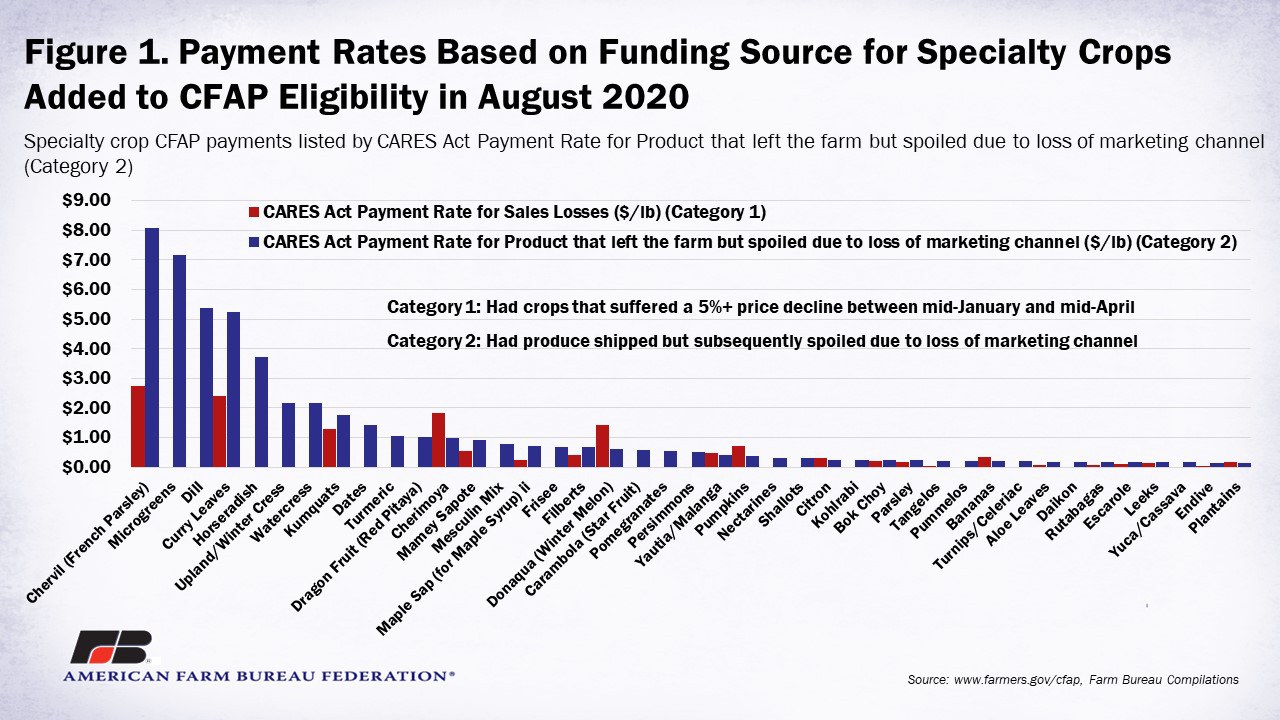

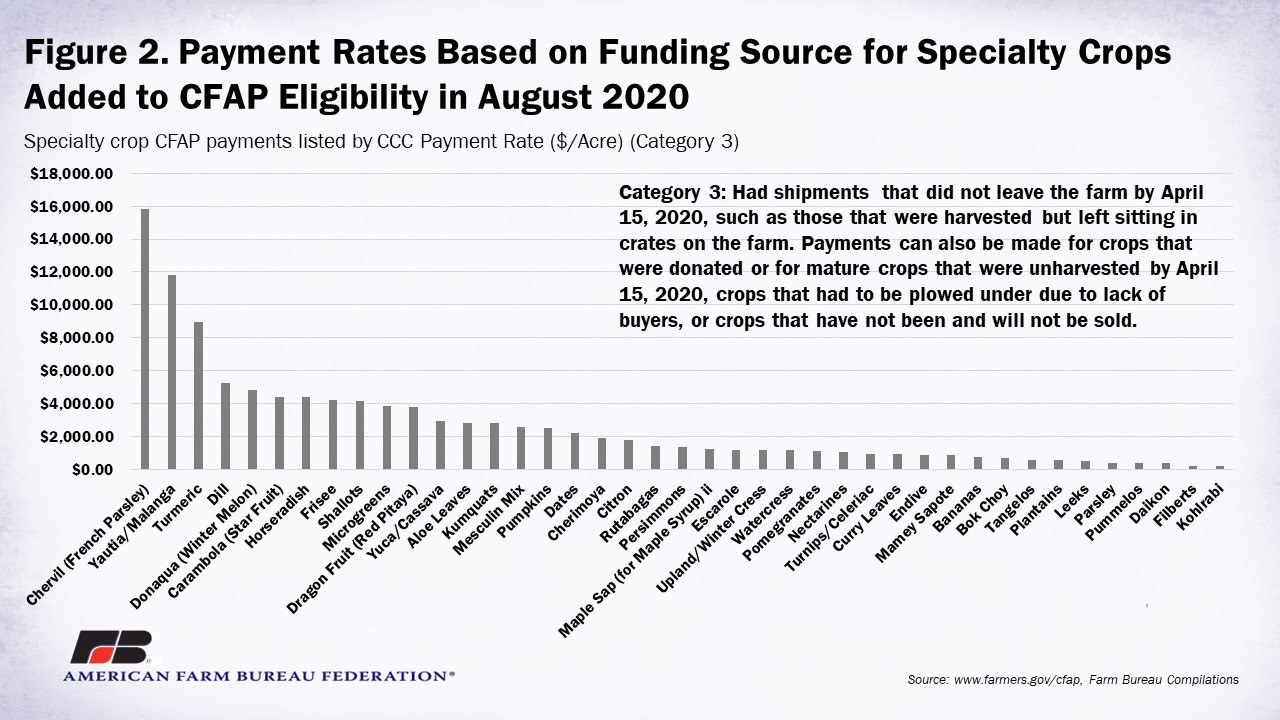

Specialty crop producers are eligible for CFAP payments if they qualify for one of the following three categories: 1) They had crops that suffered a 5%-or-greater price decline as a result of the COVID-19 pandemic on sales that occurred between mid-January and mid-April; 2) They had produce shipped but subsequently spoiled due to loss of marketing channel, or 3) They had shipments that did not leave the farm or mature crops that remained unharvested. See Expanded CFAP Eligibility Provides More Assistance for Specialty Crops to get information about the July expanded eligibility of specialty crops for CFAP and associated payment rates by loss category.

The most recent expansion of specialty crop eligibility includes aloe leaves, bananas, batatas, bok choy, carambola (star fruit), cherimoya, chervil (French parsley), citron, curry leaves, daikon, dates, dill, donqua (winter melon), dragon fruit (red pitaya), endive, escarole, filberts, frisee, horseradish, kohlrabi, kumquats, leeks, mamey sapote, maple sap (for maple syrup), mesculin mix, microgreens, nectarines, parsley, persimmons, plantains, pomegranates, pummelos, pumpkins, rutabagas, shallots, tangelos, turnips/celeriac, turmeric, upland/winter cress, watercress, yautia/malanga, and yuca/cassava.

Depending on the crop and loss-type category under which a producer is filing, payment rates range from 4 cents per pound for endive to $8.09 per pound for French parsley in Category 1 or Category 2. If they file under Category 3, producers can expect a payment rate between $189.06 per acre for kohlrabi to $15,800 per acre for French parsley. For more information, consult the CFAP Payments for Specialty Crops page provided by USDA to determine each eligible specialty crop and qualified loss type payment rate. Figure 1 shows the payment rates for the newly eligible specialty crops in CFAP for Category 1 and Category 2 losses. Figure 2 shows the payment rate per acre for newly eligible specialty crops in CFAP for Category 3 losses.

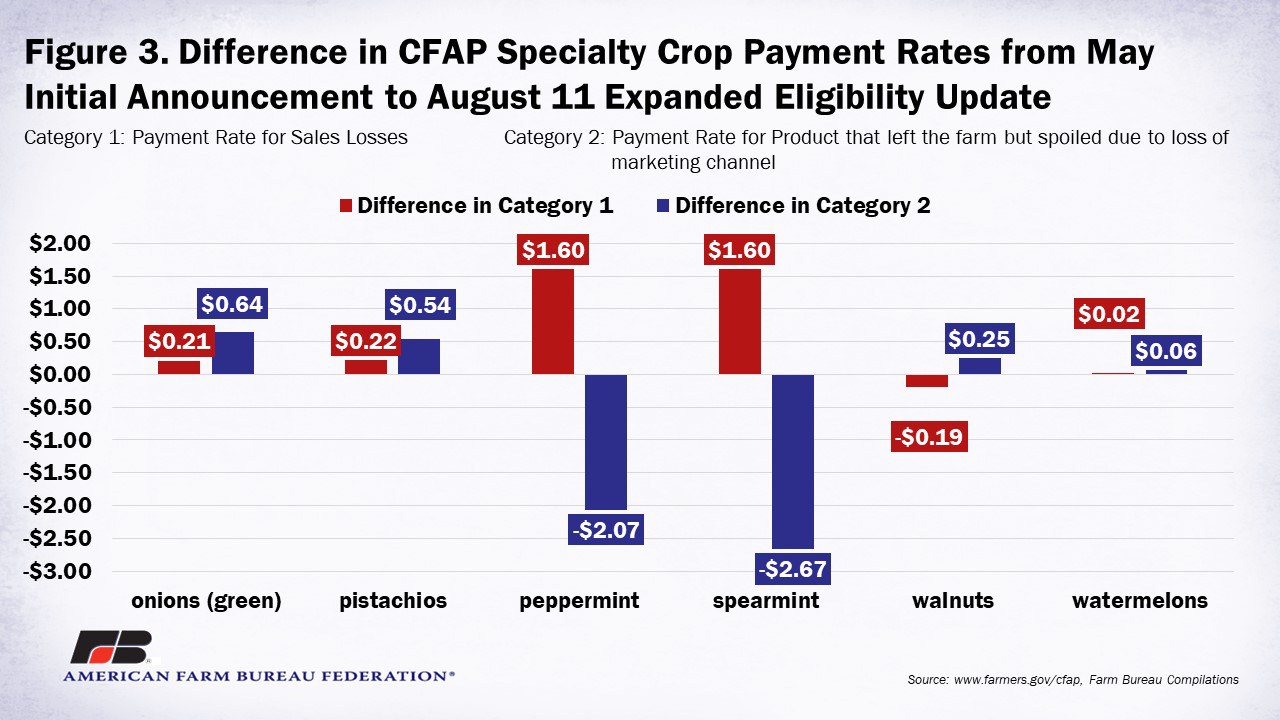

With the addition of eligible specialty crops, USDA also made changes to already eligible crops based on information collected during the comment period. USDA amended payment rates for onions (green), pistachios, walnuts, and watermelons, and expanded the mint category to assign specific payment rates to peppermint and spearmint. Figure 3 shows the change in payment rates for Category 1 and Category 2 losses of the amended specialty crops eligible for CFAP.

Expanded Livestock CFAP Eligibility

The expanded list of eligible livestock commodities includes the addition of liquid eggs, frozen eggs and all sheep.

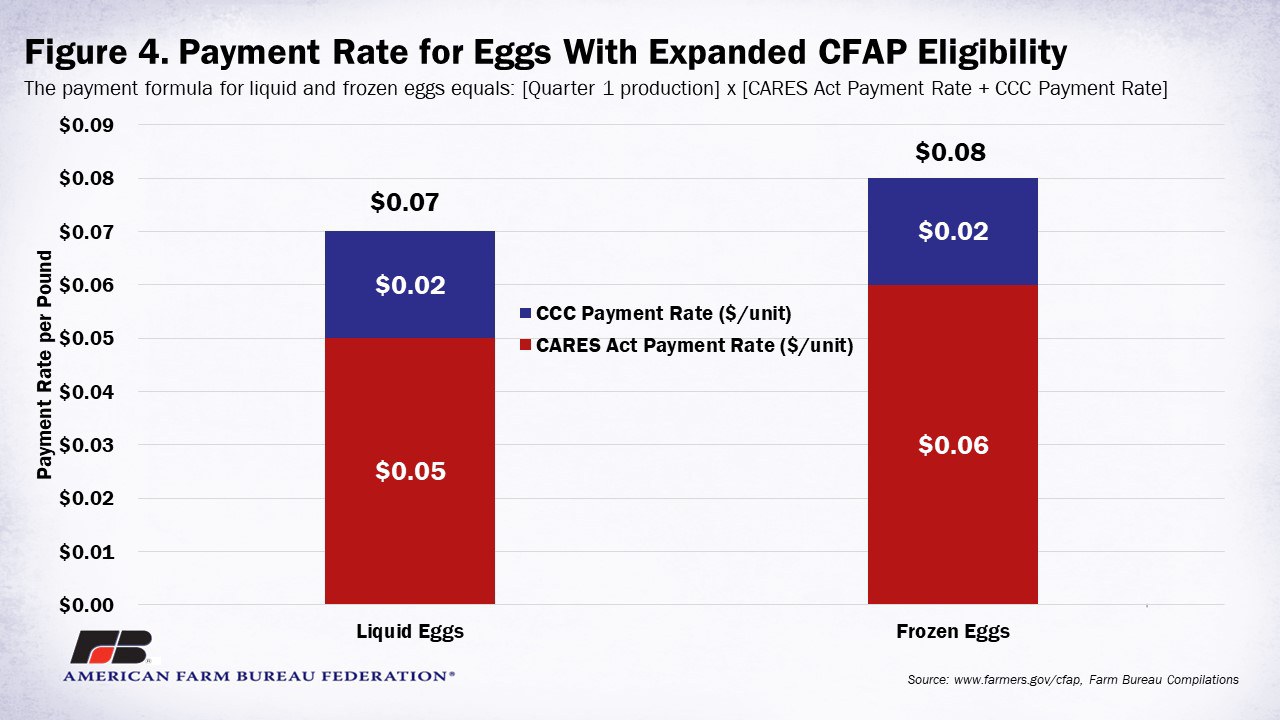

Producers of liquid and frozen eggs will receive a single payment for production that occurred during the first quarter of 2020 multiplied by the sum of the CARES Act payment rate and the Commodity Credit Corporation payment rate. Egg products were not on the original list of eligibility and shell eggs and dried eggs did not meet the required 5%-or-greater price decline nationally and are not eligible for CFAP.

The payment formula for liquid and frozen eggs equals: [Quarter 1 production] x [CARES Act Payment Rate + CCC Payment Rate]

Figure 4 displays the CFAP payment rates for liquid and frozen eggs.

Previously, only lambs and sheep less than 2 years old were eligible for CFAP. USDA has expanded eligibility to include all sheep, regardless of age.

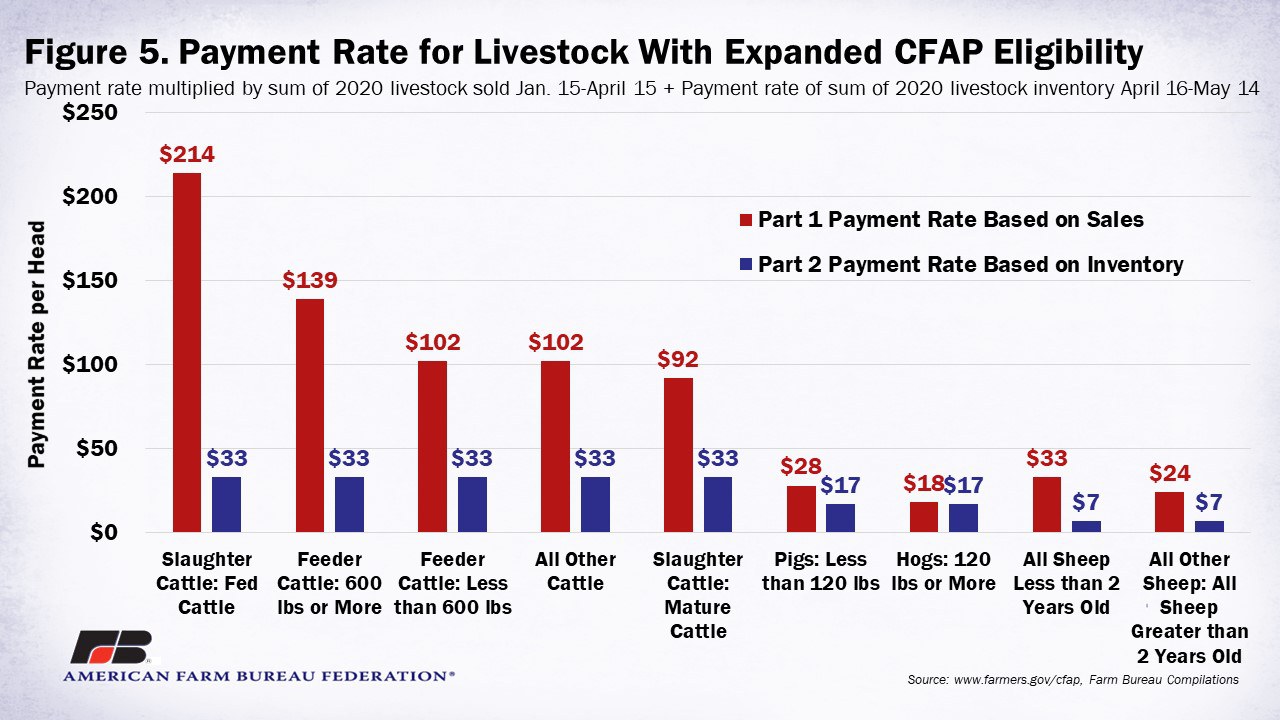

Sheep producers eligible for a CFAP will receive a single payment calculated using the sum of the producer’s number of sheep sold between January 15 and April 15, 2020, multiplied by the payment rates per head, and the highest inventory number of sheep between April 16 and May 14, 2020, multiplied by the payment rate per head.

The livestock payment formula equals: [Number of Livestock Sold Jan. 15 to Apr. 15]×[CARES Act Part 1 Payment Rate] + [Inventory Apr. 16 and May 14]×[CCC Part 2 Payment Rate]

Figure 5 shows the CFAP payment rate for all livestock with the expanded eligibility of all sheep.

Expanded Aquaculture CFAP Eligibility

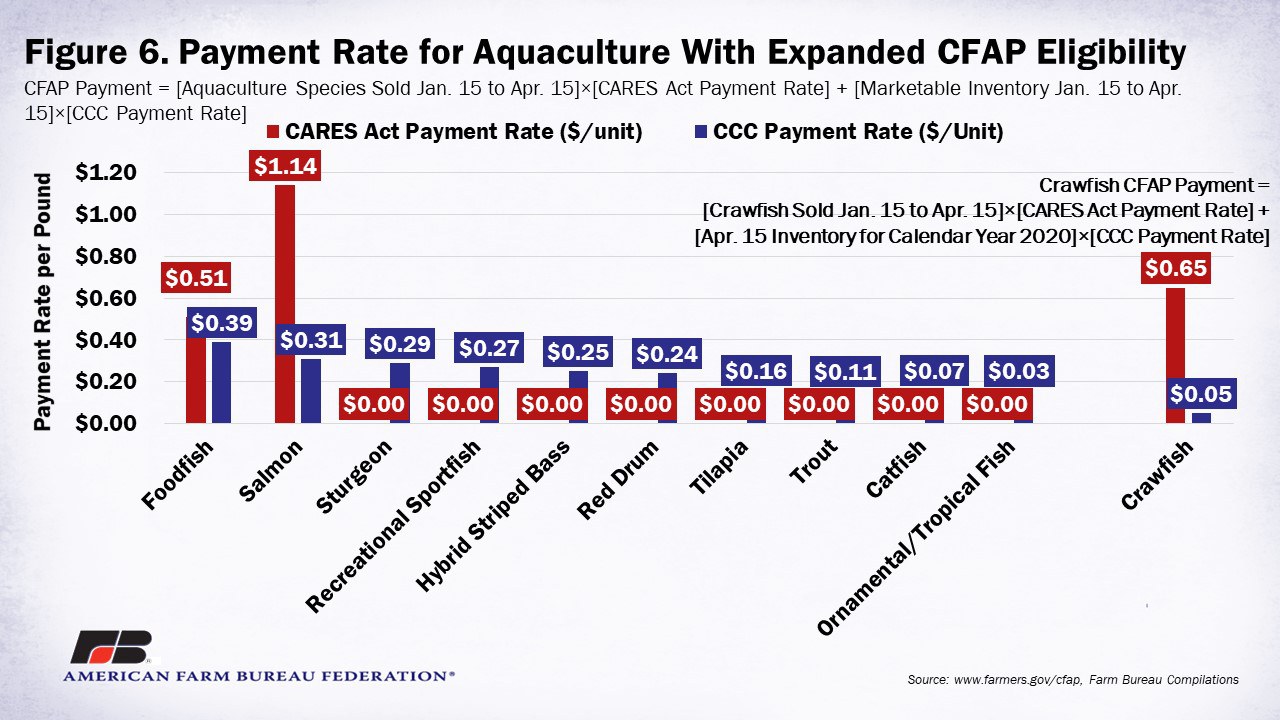

Producers of certain aquaculture are now eligible for CFAP direct financial assistance including catfish, crawfish, largemouth bass and carp sold live as foodfish, hybrid striped bass, red drum, salmon, sturgeon, tilapia, trout, ornamental/tropical fish, and recreational sportfish. USDA has separated payments for fish from payments for crustaceans.

Producers of eligible aquaculture species, not including crawfish, will receive a single payment calculated using the sum of the species sold from January 15 through April 15, 2020, multiplied by the CARES Act payment rate, and the inventory of the aquaculture species that was not sold but was market size and available to be marketed between January 15 and April 15, 2020, multiplied by the CCC payment rate.

The payment formula equals: [Aquaculture Species Sold Jan. 15 to Apr. 15]×[CARES Act Payment Rate] + [Marketable Inventory Jan. 15 to Apr. 15]×[CCC Payment Rate]

Producers of eligible crawfish will receive a single payment calculated using the sum of the crawfish sales from January 15 through April 15, 2020, multiplied by the CARES Act payment rate, and the inventory of crawfish that was not sold as of April 15, 2020, due to lack of market and will not be sold in the calendar year 2020, multiplied by the CCC payment rate.

The payment formula equals: [Crawfish Sold Jan. 15 to Apr. 15]×[CARES Act Payment Rate] + [Apr. 15 Inventory for Calendar Year 2020]×[CCC Payment Rate]

For molluscan shellfish and marine algae producers needing direct financial assistance, the Secretary of Commerce is providing assistance with funding provided by Sec. 12005 of the CARES Act, e.g., The Ins and Outs of Direct Assistance for Fisheries. To avoid duplicate payments for the same losses, USDA has determined that CFAP will not cover related fishery commodities such as oysters, clams, mussels, scallops and marine algae.

Figure 6 displays the CFAP payment rates for eligible aquaculture and crawfish.

Expanded Nursery Crops and Flowers CFAP Eligibility

Producers of nursery crops and cut flowers have been extended eligibility for CFAP. Nursery crops are considered decorative or non-decorative plants grown in a container or controlled environment for commercial sale. Cut flowers includes cut flowers and cut greenery from annual and perennial flowering plants grown in a container or controlled environment for commercial sale.

Producers of eligible nursery crops and flowers will receive a single payment based on a percentage of the producer’s wholesale value of inventory. Payments will be the sum of the calculated CARES Act payment and the CCC payment.

The CARES Act payment is determined by multiplying the wholesale value of a producer’s inventory that was shipped but subsequently spoiled or is unpaid due to loss of marketing channels between January 15 and April 15, 2020, by 15.55%.

The CCC payment is determined by multiplying the April 15, 2020, wholesale value of a producer’s inventory that did not leave the farm between January 15 and April 15, 2020, due to a complete loss of marketing channel by 13.45%.

The payment formula equals: 15.55% x [Wholesale value of Shipped/Unpaid Inventory Jan. 15 to Apr. 15] + 13.45% x [Apr. 15 Wholesale value of On-Farm Inventory Jan. 15 to Apr. 15]

Nursery crop and cut flower inventory that may be sold after April 15, 2020, is not eligible for CFAP.

Summary

USDA has expanded eligibility of CFAP direct assistance to 41 more specialty crops, in addition to the 42 added in July, and has added sheep, frozen and liquid eggs, aquaculture, nursery crops and cut flowers, while amending eligibility for six other specialty crops. This expansion will help more producers access direct assistance to ease the financial and economic burdens resulting from COVID-19. There are still commodities that have yet to be eligible for any kind of financial assistance related to COVID-19 impacts.

Additionally, producers who have already been approved for CFAP payments initially received 80% of the total payment. Starting August 11, 2020, FSA will automatically issue the remaining 20% of the total calculated payment to producers and, going forward, will pay the full 100% of the total payment, not to exceed the payment limit, to producers when their applications are approved.

USDA will begin accepting applications for the expanded CFAP commodities on August 17 and producers can apply until September 11.