Decision Time on ARC and PLC

TOPICS

Wheat

photo credit: Arkansas Farm Bureau, used with permission.

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

USDA’s March 10 World Agricultural Supply and Demand Estimates provides the latest 2019/20 marketing year average price projections for corn, soybeans and wheat before the March 16 deadline to enroll base acres in Title I commodity safety net programs (What’s in Title I of the 2018 Farm Bill for Field Crops? and ARC-County, A Bird in The Hand for Some in 2019). Farmers with base acres may enroll on a commodity-by-commodity basis in Agricultural Risk Coverage or Price Loss Coverage for the 2019/20 and 2020/21 crop years, e.g., Reviewing ARC, PLC and SCO Commodity Safety Net Programs. Farmers may not change their coverage options again before the 2021/22 crop year -- making this current decision binding for two crop years.

ARC is a revenue-based program that makes deficiency payments when actual revenue falls below 86% of the benchmark revenue – defined as the product of the Olympic moving average yield and the Olympic moving average of the marketing year average price. PLC is a price-based program that makes deficiency payments when the actual price falls below an effective reference price. The effective reference price for corn is $3.70 per bushel, for soybeans, $8.40 per bushel and for wheat, $5.50 per bushel (USDA Farm Service Agency’s 2019 Effective Reference Price Calculations).

To assist farmers making an ARC or PLC election in the coming days, today’s article uses WASDE’s most recent price projections for corn, soybeans and wheat, USDA’s 2020/21 price projections from the recent Agricultural Outlook Forum and Chicago Mercantile Exchange implied volatilities to derive log-normal price distributions. I then use a Monte Carlo simulation to estimate the probability of ARC and PLC triggering safety net benefits in any of the upcoming crop years.

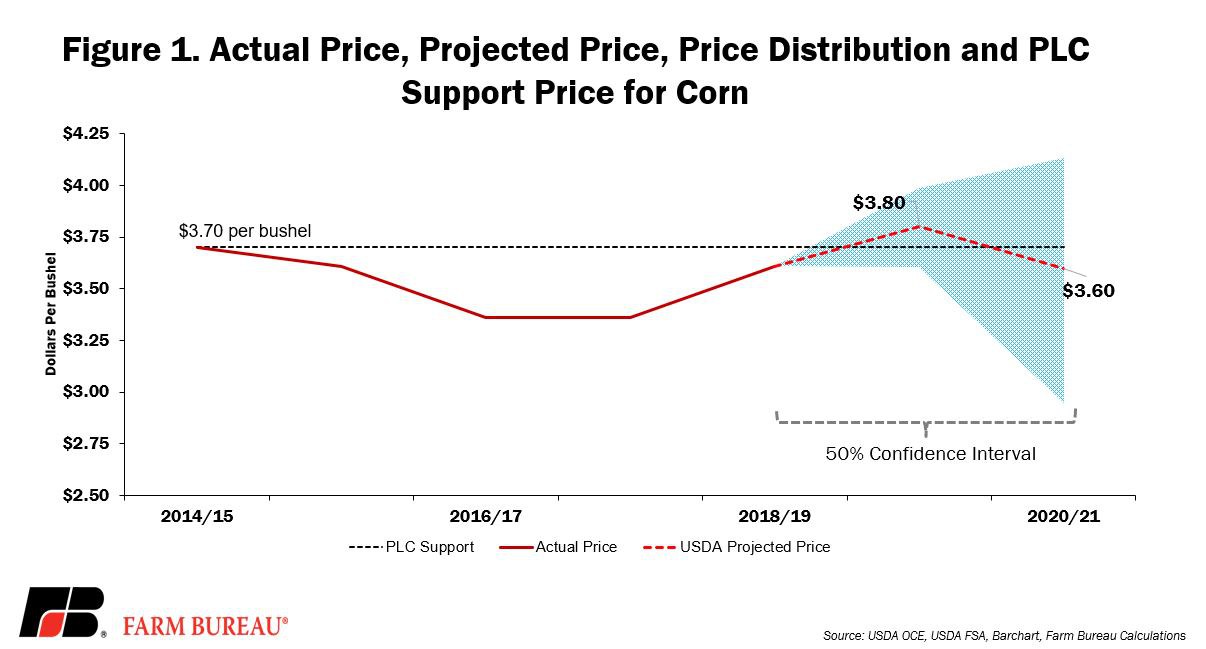

Simulated Benefits for Corn

USDA currently projects the 2019/20 marketing year average price for corn at $3.80 per bushel and the 2020/21 price at $3.60 per bushel. Implied volatilities for old- and new-crop corn were both 20% on March 9, but with the 2019/20 crop year nearly 50% complete, an implied volatility of 10% was used to tighten the log-normal price distribution. A 50% confidence interval around the mean ranged from $3.60 to $3.99 per bushel in 2019/20 and ranged from $2.95 per bushel to $4.13 per bushel in 2020/21, Figure 1.

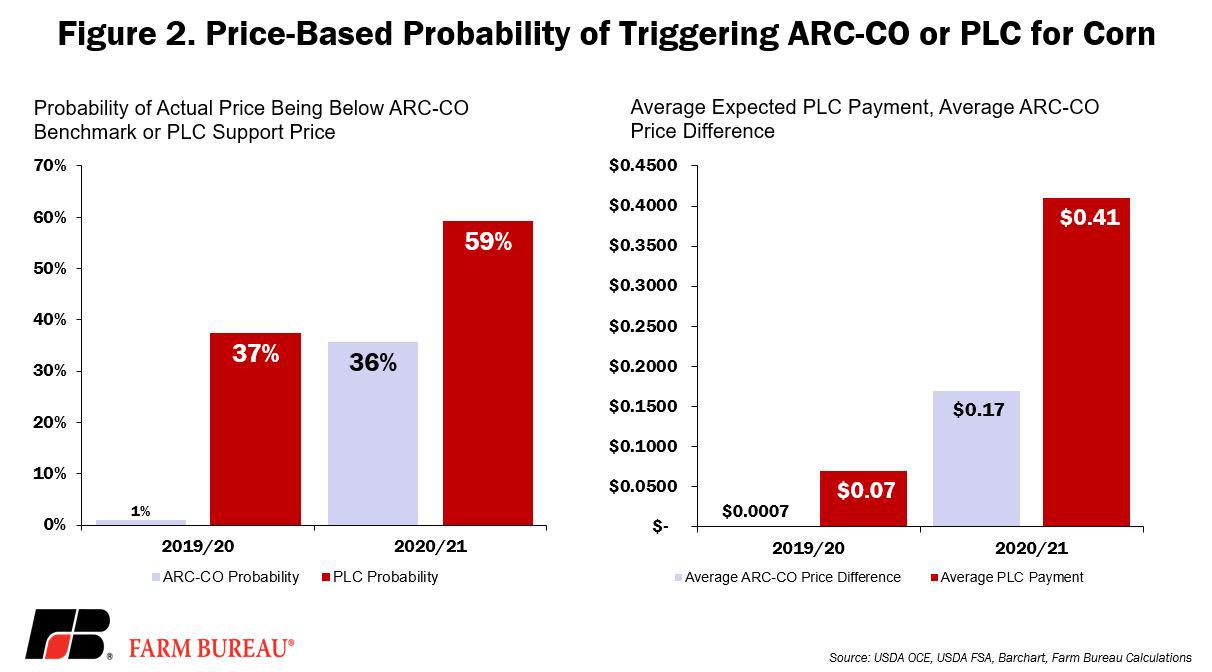

Holding yields constant, and based on price alone, results of the Monte Carlo simulation indicated a 1% probability of ARC-CO triggering for corn in 2019/20 and a 36% probability of marketing year average corn prices falling below the $3.18 ARC-CO benchmark price guarantee, i.e., $3.18=86%×$3.70. For PLC, the simulation results indicated a 37% probability and 59% probability that the marketing year average price for corn would fall below $3.70 per bushel in 2019/20 and 2020/21, respectively.

Based on these probabilities, the average difference between the simulated marketing year average price and the ARC-CO benchmark price guarantee was $0.0007 per bushel in 2019/20 and 17 cents per bushel in 2020/21. For PLC, the average expected PLC payment was 7 cents per bushel in 2019/20 and 41 cents per bushel in 2020/21, Figure 2.

Based on these simulation results, and holding yields constant, farm program benefits are likely higher for PLC than ARC-CO. Famers who experienced a yield decline in 2019 may find the benefits of ARC-CO or ARC-Individual exceed those of PLC since ARC is a revenue-based program and lower yields result in lower revenue.

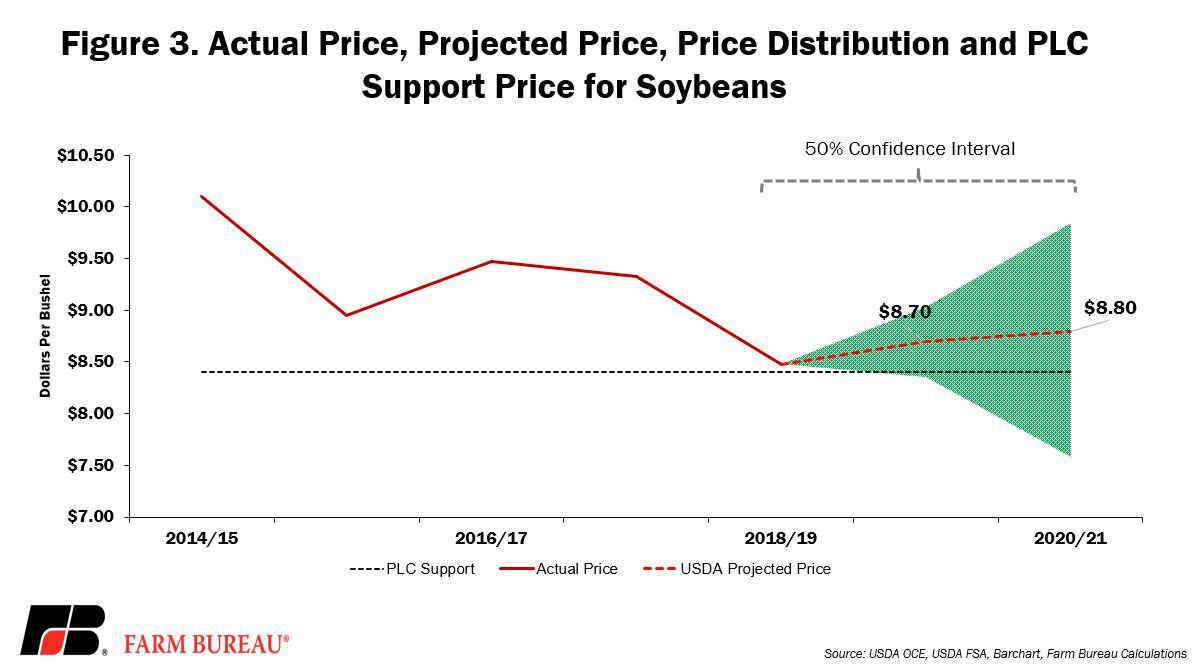

Simulated Benefits for Soybeans

USDA currently projects the marketing year average price for soybeans at $8.70 per bushel and $8.80 per bushel for the 2019/20 and 2020/21 crop years, respectively. The new crop implied volatility was 15.5%, and a volatility of 8% was used to estimate the 2019/20 price distribution. Based on the mean and standard deviation, the 50% confidence interval for soybeans ranged from $8.35 per bushel to $9.03 per bushel for the 2019/20 crop year and ranged from $7.58 per bushel to $9.84 per bushel for the 2020/21 crop year, Figure 3.

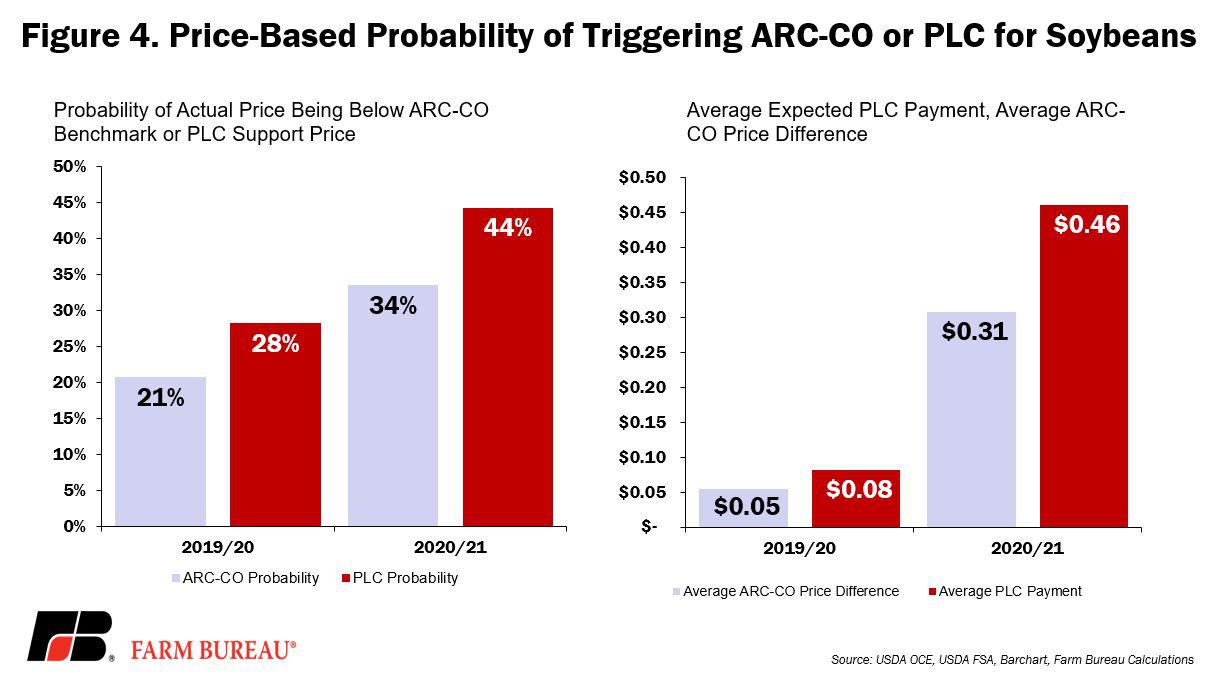

Holding yields constant and based on the Olympic moving average price of $9.63 per bushel and $9.25 per bushel, there is currently a 21% probability that the 2019/20 marketing year average price for soybeans will fall below the ARC-CO benchmark price guarantee. For 2020/21 this probability rises to 34%. For farmers who experienced a crop loss in 2019, the probability of triggering ARC-CO is likely higher given the joint effect of low prices and low yields in the revenue calculation.

For PLC, the probability of soybean prices falling below the $8.40 support price is 28% during the current crop year and 44% during the 2020/21 crop year. The higher probability during 2020/21 is due to the larger implied volatility and a larger range of potential prices.

The average difference between the marketing year average price and the ARC-CO benchmark price guarantee is 5 cents per bushel in 2019/20 and rises to 31 cents per bushel in 2020/21. For PLC, the average expected payment rate in 2019/20 is 8 cents per bushel and rises to 46 cents per bushel in 2020/21, Figure 4.

With USDA projected prices above the PLC support price and below the ARC-CO Olympic moving average prices, these simulation results suggest ARC-CO may provide more support on soybean base acres than PLC for the current and next crop year.

Simulated Benefits for Wheat

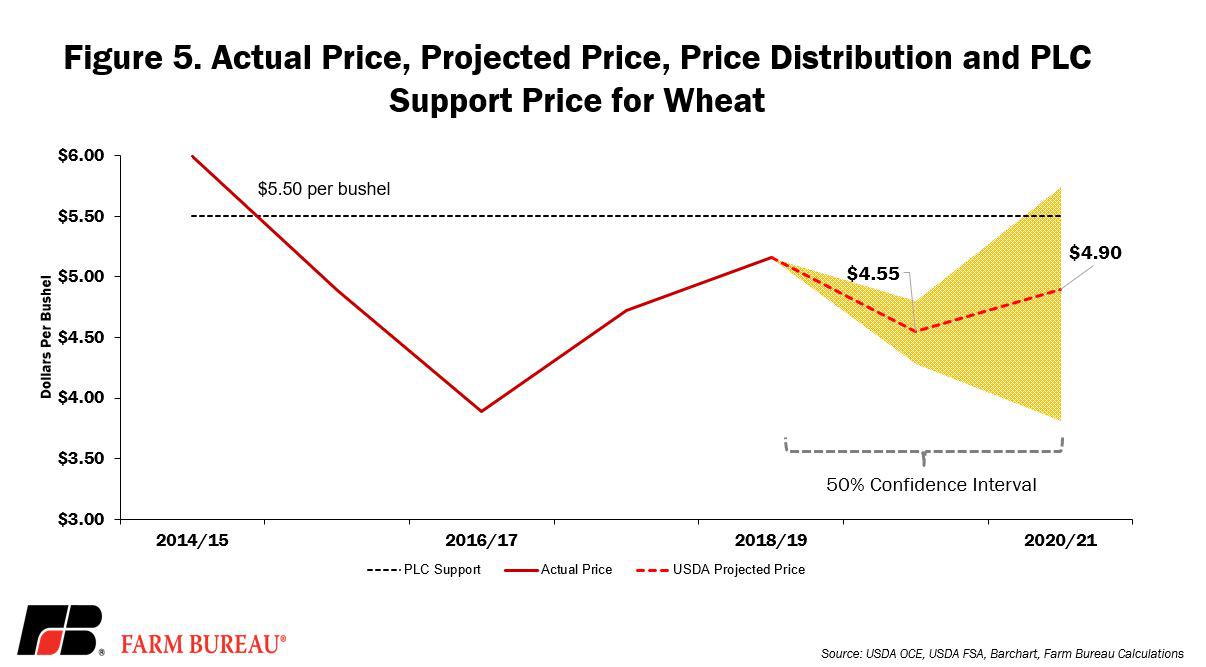

For wheat, USDA’s projected price of $4.55 per bushel in 2019/20 and $4.90 per bushel in 2020/21 are both below the PLC support price and the ARC-CO Olympic moving average price of $5.66 per bushel and $5.50 per bushel, respectively, Figure 5.

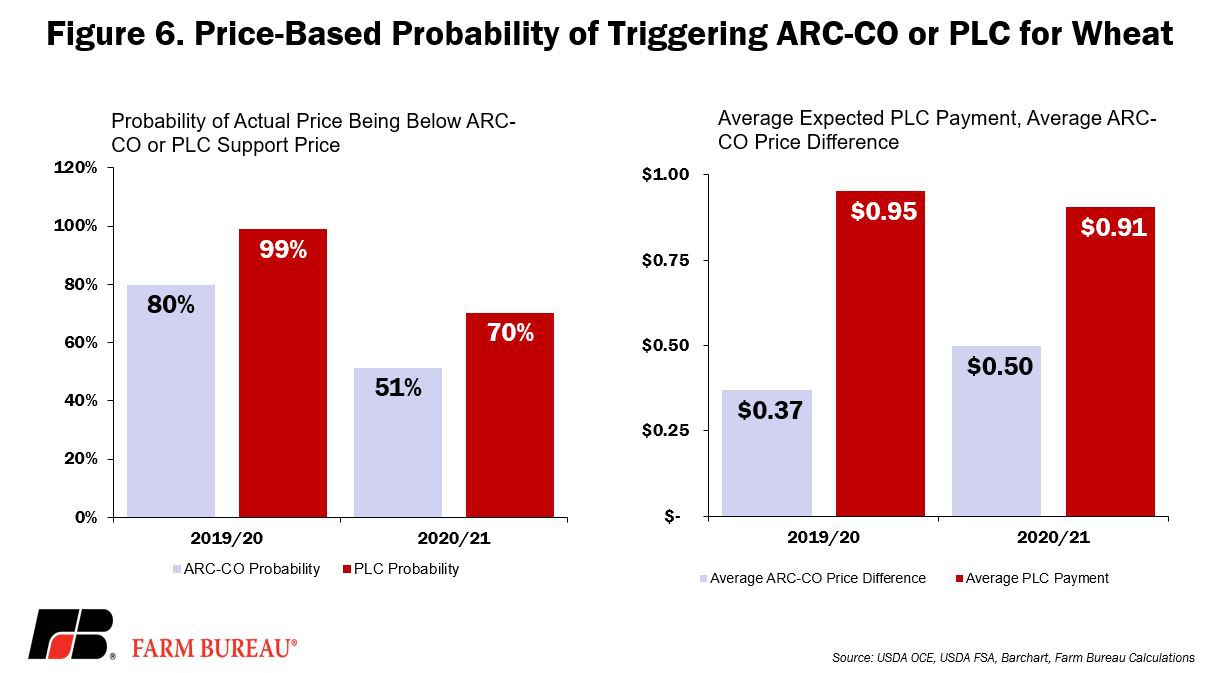

As a result, simulation results indicate a high probability that both ARC-CO and PLC will trigger on wheat base acres in the current and next crop year. The probability is notably higher for PLC at 99% in 2019/20 and 70% in 2020/21. The high probability of PLC triggering program benefits results in an average expected PLC payment of 95 cents per bushel in 2019/20 and 91 cents per bushel in 2020/21. With such a high probability of program payments, and a higher expected payment rate per bushel (and holding yields constant), PLC will likely provide more support to farmers in both 2019/20 and 2020/21.

Summary

To assist farmers in making an ARC or PLC election for the 2019/20 and 2020/21 crop years, USDA projected prices, implied volatilities and a Monte Carlo simulation were combined to estimate expected price distributions, the probability of ARC or PLC triggering based on price declines, and potential PLC benefits.

Based on these simulation results, and holding crop yields constant, PLC is likely to provide more support for corn and wheat while ARC-CO is likely to provide more support for soybeans. Crop yields do matter, however. Growers who experienced a crop loss in 2019 or had above average county yields during the Olympic averaging period may want to evaluate the potential benefits of ARC-CO or ARC-Individual (using USDA’s decision tools) as these revenue-based safety nets are designed to provide financial support in the event of a revenue decline due to low prices or low yields.

Top Issues

VIEW ALL