Farm Income Rebounds, Livestock Gains as Crops Fall

TOPICS

Farm Income

photo credit: North Carolina Farm Bureau, Used with Permission

Bernt Nelson

Economist

Faith Parum, Ph.D.

Economist

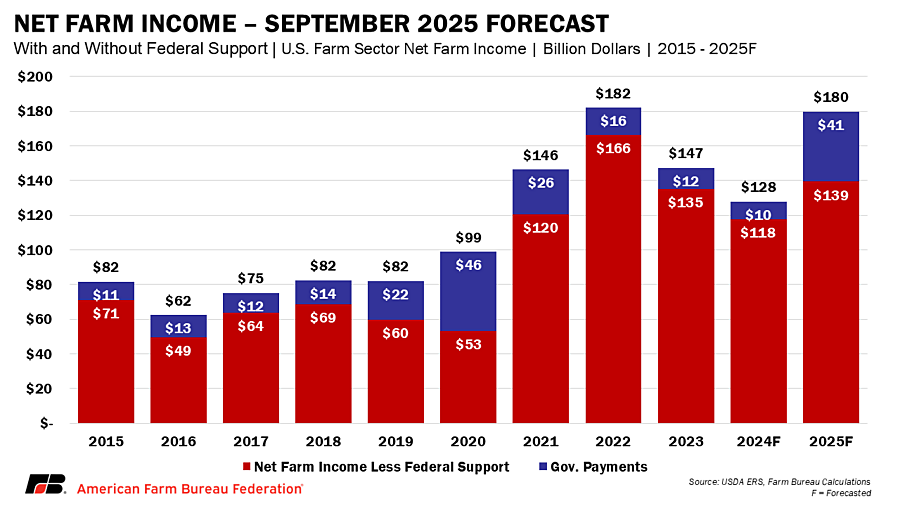

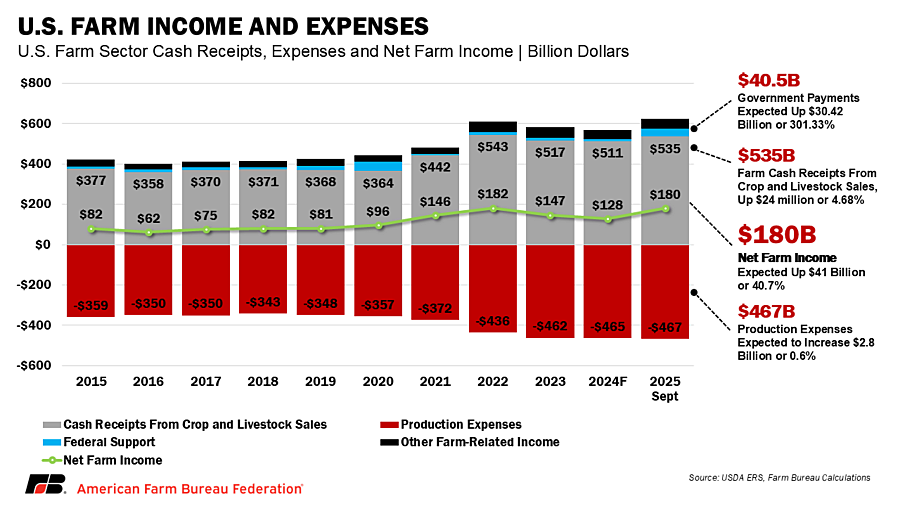

USDA’s September 2025 net farm income forecast, released Sept. 3, projects net farm income will rise sharply from 2024. While stronger performance in some sectors is a factor in the increase, much of it is tied to continued support from government disaster assistance.

The report points to some improvements in the farm economy, particularly for livestock producers who are expected to see notable gains in receipts and profitability, but elevated costs for labor, taxes and inputs, combined with weaker crop receipts, remain significant challenges for many farmers.

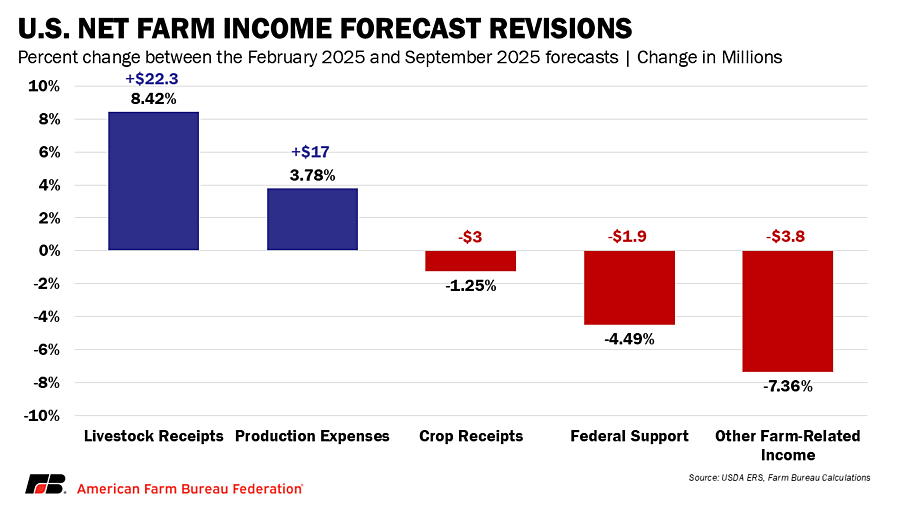

Overall, USDA’s September 2025 net farm income forecast projects a mixed outlook for farmers. Net farm income, a key measure of profitability, is forecast at $179.8 billion in 2025. This is an increase of $52 billion, or 40.7%, from $127.8 billion in 2024, but about $300 million lower than USDA’s February forecast of $180.1 billion. After adjusting for inflation, net farm income is expected to rise $48.8 billion, or 37.2%, from 2024 to 2025. Net cash farm income is forecast to increase $36.5 billion, or 25.3%, over the same period.

In addition to revising February 2025 estimates, USDA also updated prior-year figures. The 2024 net farm income estimate was lowered from $139.1 billion to $127.8 billion, an 8.1% drop. The reduction was driven by declines in crop receipts, crop inventories and animal receipts, along with higher production expenses. These were partially offset by slight increases in government payments and animal inventories. In total, the 2024 estimate fell by $11.3 billion.

Cash Receipts

Crops

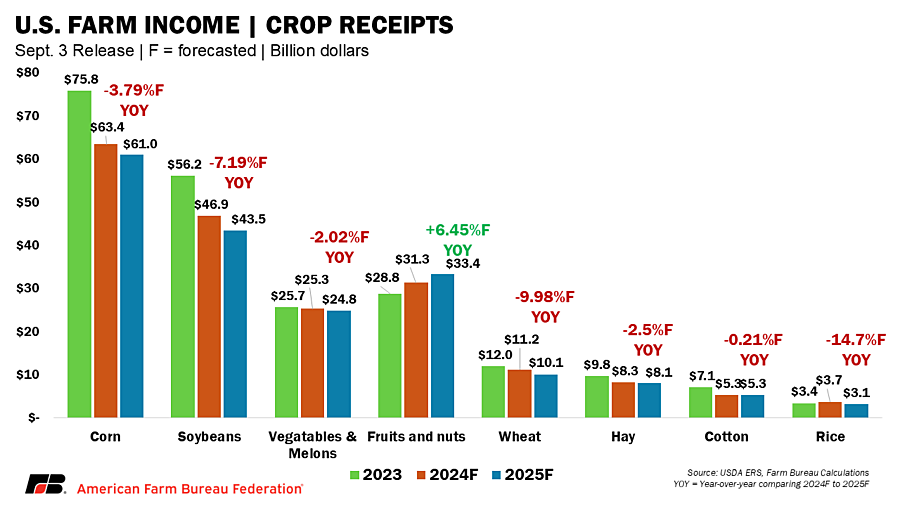

Cash receipts from crop sales are forecasted to decrease by $6.1 billion, or 2.5%, from $242.7 billion in 2024 to $236.6 billion in 2025. USDA lowered its crop cash receipts projection by $17 billion from the $253.6 billion forecast in February 2025. If this forecast is realized, this would be the lowest cash receipts for crop sales since 2007.

Corn

Corn receipts are expected to fall $2.3 billion, or 3.7%, from $63.4 billion in 2024 to $61 billion in 2025. The projected decline in receipts demonstrates how lower prices are outweighing the record corn crop forecast in USDA’s August World Agricultural Supply and Demand Estimates (WASDE) report.

Soybeans

Cash soybean receipts are forecast to drop by $3.4 billion, or 7.2%, from $46.8 billion in 2024 to $43.5 billion in 2025. The projected decrease reflects lower production as acres shifted to corn and weaker prices driven by ample global supplies.

Wheat

Cash receipts for wheat are forecast to fall $1.1 billion, or 9.8%, from $11.2 billion in 2024 to $10.1 billion in 2025. The decline reflects both lower prices and reduced sales volumes.

Hay and Other Crops

Cash receipts for hay were forecast to fall $207 million, or 2.4%, from $8.29 billion in 2024 to $8.09 billion in 2025, mostly due to increased supplies. Cash receipts from cotton were left unchanged from 2024 at $5.3 billion. While receipts for vegetables and melons fell by $500 million, or 2.1%, from $25.3 billion in 2024 to $24.8 billion in 2025. Fruits and nuts were the only major U.S. crop category that saw a rise in cash receipts. USDA forecast cash receipts for fruits and tree nuts to grow by $2 billion, or 6.5%, from $31.3 billion in 2024 to $33.4 billion in 2025.

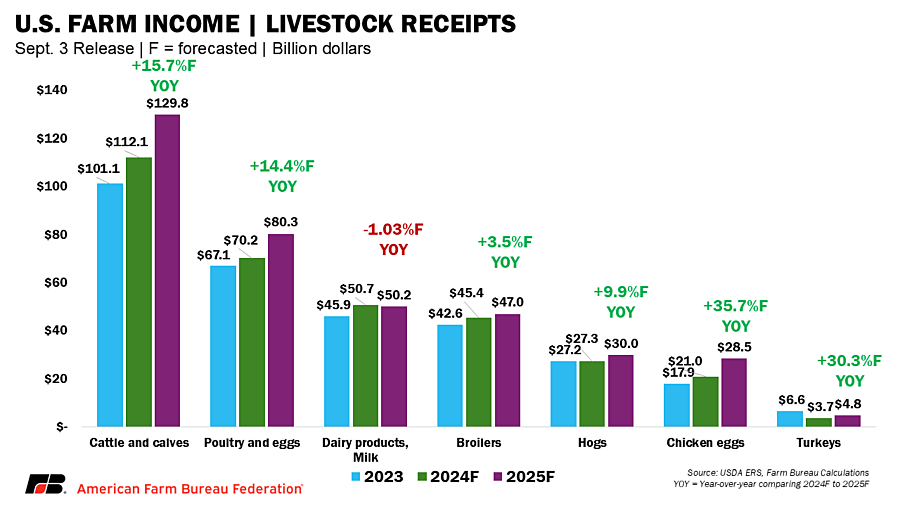

Animals and Animal Products

Total animal/animal product cash receipts are forecast to increase by $30 billion, or 11.2%, from $268.6 billion in 2024 to $298.6 billion in 2025. Receipts for all major animal/animal products are expected to grow mostly from higher prices. If realized, this would be a record high for cash receipts from animals and animal products.

Cattle and Calves

Cash receipts for cattle and calves had the largest increase, reflecting record cattle prices from tight supplies and strong demand. Cash receipts for cattle and calves are forecast to rise by $17.6 billion, or 16%, from $112.1 billion in 2024 to $129.7 billion in 2025. If this forecast is realized, it would be a record high for cash receipts for cattle and calves.

Hogs

After several years of challenges, including some of the worst losses in history in 2023, hog farmers are expected to experience some recovery in profitability. Cash receipts from hogs are forecast to grow by $2.6 billion, or 9.5%, from $27.3 billion in 2024 to $29.9 billion in 2025.

Poultry

Cash receipts for broilers (raised for meat), are expected to rise by $1.6 billion, or 2.5%, from $45.4 billion in 2024 to $47 billion in 2025. Cash receipts for eggs are also projected to increase in 2025 by $7.5 billion, or 35.4%, from $21 billion to $28.5 billion.

Dairy

Milk is the only major animal product with cash receipts forecast to fall with USDA estimating a $500 million, or 1%, drop, from $50.7 billion in 2024 to $50.2 billion in 2025.

Expenses

Total production expenses, including those associated with operator dwellings, are forecast to increase $11.9 billion, from $455.5 billion in 2024 to $467.5 billion in 2025. While Spending on livestock/poultry purchases, mostly driven by record cash prices for cattle, are expected to increase the most relative to 2024 at $10.6 billion. When adjusted for inflation, USDA’s projection for expenses is comparable to 2024. When paired with lower cash receipts for crops, elevated production expenses paint a picture of the obstacles facing the country’s row crop farmers. These challenges help explain why government payments play such a large role in pulling up net farm income in USDA’s forecast.

Disaster Assistance

A surge in government disaster and economic assistance underpins the sharp rise in USDA’s 2025 net farm income forecast. Direct payments are expected to reach about $40.5 billion, an increase of more than 301% from $10.9 billion in 2024, largely due to supplemental aid for losses from 2023 and 2024. USDA reduced its estimate for government aid slightly in the latest update, lowering it from $42.4 billion to $40.5 billion. Much of the forecasted $41 billion rebound in net farm income is therefore the result of policy-driven support rather than strength in commodity markets, signaling that the recovery is supported by temporary relief rather than sustained improvements. Its also important to note that Congress authorized the disaster assistance to offset some of the losses farmers faced in previous years.

Farm Debt

USDA’s 2025 forecast also highlights the importance of farm debt. Total farm sector debt is forecast to increase by $28.35 billion, or 5%, from $563.48 billion in 2024 to $591.82 billion in 2025. This is an increase of nearly 20% since 2022 when the Fed began raising interest rates to combat inflation. Interest expenses to service farm debt are forecast at $33.09 billion, up $1.6 billion, or 5.1%, from $31.48 billion in 2024. The 2025 interest expense forecast is 16% higher than 2022.

Conclusions

USDA’s September 2025 net farm income forecast projects net farm income at $179.8 billion, a sharp increase from 2024 but slightly below the February projection. Livestock producers are expected to drive much of the improvement, with cash receipts forecast to reach a record $298.6 billion. In contrast, crop receipts are projected to fall to $236.6 billion, the lowest since 2007. Taken together, the forecast points to an uneven and uncertain farm economy in 2025. Stronger livestock markets provide critical support, but continued reliance on government aid reacting to prior years underscores the fragility of farm finances that are being degraded by rising farm debt and interest expenses to service that debt. Without sustained, market-driven growth, the rebound in net farm income will be difficult to maintain, leaving many producers vulnerable to future price shifts, expense pressures and policy changes.