Fertilizer Outlook: Global Risks, Higher Costs, Tighter Margins

TOPICS

fertilizer

Faith Parum, Ph.D.

Economist

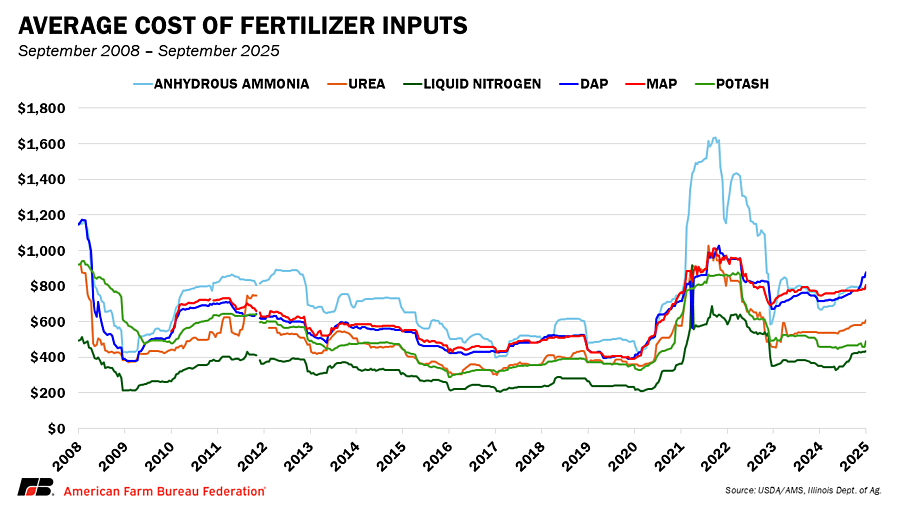

Fertilizer costs are having a bigger and bigger impact on farm budgets. In the lead-up to the 2022 crop year, fertilizer prices surged to record highs, driven by tight global supplies, energy shocks and trade disruptions. That period became a turning point in how farmers and policymakers thought about farm input risks. Fertilizer prices eased somewhat in 2023 and 2024 as energy markets stabilized and supply chains recovered, but price volatility is at the forefront once again.

While prices today remain below the extreme peaks of 2022, prices for several key fertilizers are climbing higher. Phosphate fertilizers are leading the increase, while nitrogen products are showing month-to-month swings, and potash is rising due to trade policy risks. At the same time, the share of fertilizer within total farm production costs has not returned to earlier highs because other expenses are also climbing. Livestock expenses, electricity, cash labor, interest, rent and property taxes are among the categories showing notable increases in 2025, adding to the overall pressure on farm budgets. Farmers are facing a familiar challenge: building budgets and making planting decisions with unpredictable fertilizer markets. This Market Intel updates current price levels, revisits the drivers of fertilizer markets and explores what they mean for 2026 farm planning.

Current Fertilizer Prices

Phosphates have had the sharpest price increase this year. Gulf diammonium phosphate (DAP) prices rose from about $583 per ton in January 2025 to nearly $800 in August. That is a 36% increase in less than eight months, creating new strain for already struggling crop budgets. Monoammonium phosphate (MAP) has followed a similar trend, reflecting the same pressures in production costs and export availability.

Nitrogen markets have been mixed but still volatile. Urea prices rose sharply into the summer before easing modestly. Tampa ammonia settlements reached about $487 per metric ton in August and market indications suggest higher prices in September. Urea Ammonium Nitrate (UAN) solutions have shown regional variation, with tighter supplies in areas farther from production hubs and import terminals, while regions closer to key river or rail transport routes have had more consistent availability. These swings highlight how quickly nitrogen prices can change in response to global trade and natural gas markets.

Potash prices are also rising compared to last year. Global spot values hover around $350 to $360 per metric ton, which is about 21% higher than in 2024.U.S. wholesale prices have been further supported by concerns over tariff actions on Canadian imports. Currently, potash imports from Canada are subject to a 10% tariff.

While none of these prices are as severe as the extreme highs recorded in 2022, the upward direction in 2025 is a reminder that fertilizer markets remain in flux and sensitive to global developments.

What’s Driving Fertilizer Prices

Trade and Policy Actions

Global trade policy is directly shaping fertilizer markets. On July 1, the European Union began applying tariffs on Russian fertilizer imports. This move redirected Russian supplies toward other markets such as Brazil, India and potentially the United States. The shift tightened availability in other markets and supported global prices.

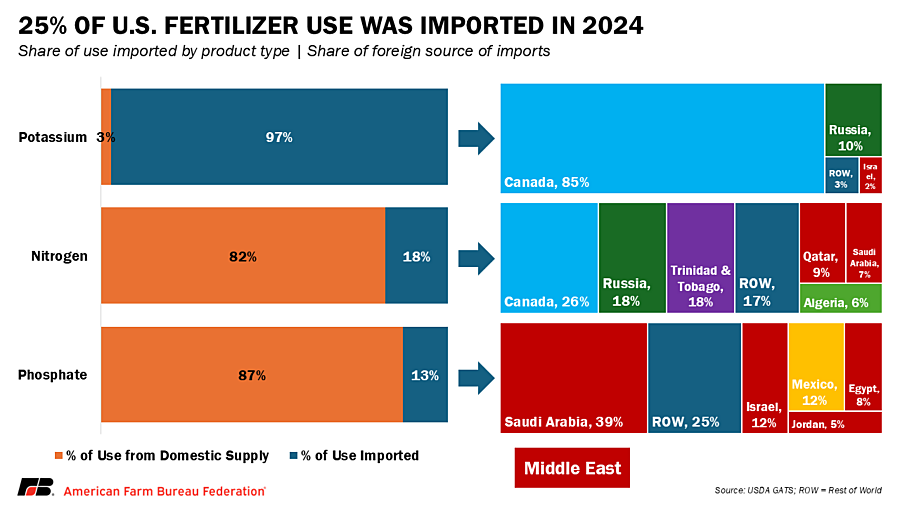

In North America, U.S. tariffs on Canadian goods have drawn attention because of the potential impact on potash. Canada supplies the vast majority of U.S. potash imports. Even without direct restrictions, the perception of risk has lifted U.S. wholesale values, creating uncertainty for farm buyers.

China has also played a central role. Early in 2025, the Chinese government restricted phosphate and urea exports to protect domestic supplies. Those policies sharply reduced global availability and contributed to higher prices. In July, China allowed more fertilizer exports after previously keeping shipments very restricted. While that briefly increased global supplies, China often changes its export rules with little notice, creating uncertainty for buyers and sellers worldwide. Each policy shift ripples quickly through international prices and eventually into farm budgets.

Structural Supply Risks

Importantly, fertilizer markets are shaped not only by short-term shocks but also by long-term structural risks. The industry is highly concentrated: a small number of countries dominate nitrogen, phosphate and potash production, leaving supply chains exposed to geopolitical or logistical disruptions. Investments in new ammonia capacity are concentrated in countries with low-cost gas and in decarbonization hubs like the U.S., Qatar and Nigeria. Europe, in contrast, has seen permanent fertilizer plant closures due to high energy costs.

Potash supply is concentrated in just a few regions, with Canada, Russia and Belarus accounting for more than two-thirds of world exports. Phosphate production is dominated by Morocco, China and Saudi Arabia. For nitrogen, natural gas supply (which is a key component in nitrogen fertilizer) remains the critical bottleneck. These structural dynamics mean that geopolitical events, from sanctions on Russia to unrest in the Middle East, carry outsized impacts on farm input costs worldwide.

Geopolitical Pressures: Russia, Ukraine and the Middle East

The Russia–Ukraine conflict remains a defining backdrop for fertilizer trade. Russia is a top exporter of nitrogen, phosphate and potash, while Belarus, aligned with Russia, is another major potash supplier. Sanctions and shipping restrictions from other countries continue to complicate trade. Although Russia has rerouted fertilizer to markets like Brazil and India, ammonia exports remain more than 80% below pre-war levels. Ukraine’s domestic production has been severely disrupted, further tightening global availability. Ukraine typically produces nitrogen-based fertilizers, particularly ammonium nitrate, urea-ammonium nitrate (UAN), and urea.

In the Middle East, rising tensions between Israel and Iran have raised risks of regional disruption. The area is critical for global natural gas and ammonia production, as well as containing shipping routes like the Suez Canal that connect fertilizer producers in North Africa and the Gulf with European and American buyers. Morocco and Saudi Arabia are also expanding phosphate capacity, making the region even more important for global supply security. Any instability that interrupts these flows can amplify the price pressures farmers already face.

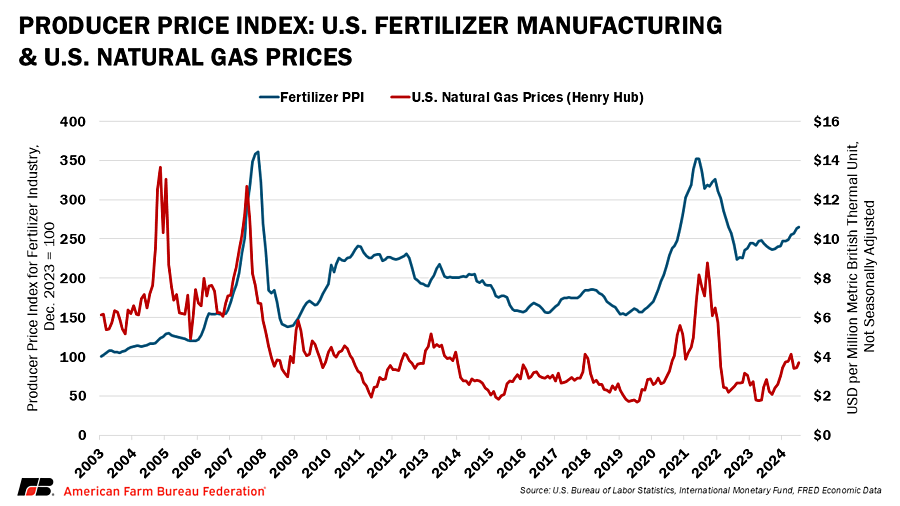

Energy Markets

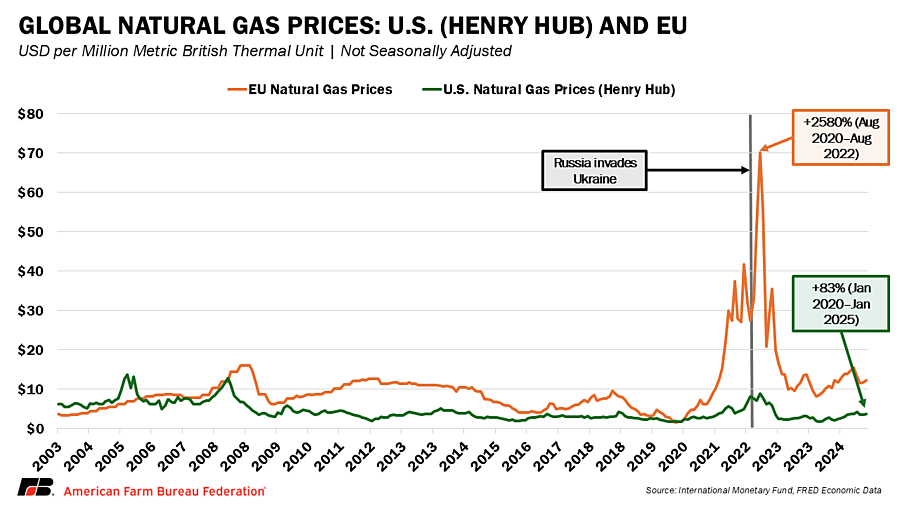

Energy remains a critical factor in fertilizer prices because natural gas is the main feedstock for nitrogen fertilizer. In the United States, natural gas prices are projected to rise into late 2025 and 2026 as liquefied natural gas export capacity grows. That means the baseline cost of producing ammonia, urea and UAN is higher than it was in early 2024, when gas was relatively cheap.

In Europe, natural gas prices are far below the crisis levels of 2022 but still remain volatile. Weather, storage levels and liquified natural gas (LNG) shipments all influence prices. A cold winter or disruptions in LNG supply could quickly push European gas prices higher, forcing producers to raise ammonia and urea prices that flow into the global market.

Taken together, geopolitical conflict, trade restrictions, and rising energy costs explain why fertilizer markets remain high and volatile despite the absence of the extreme energy shock of 2022.

Impact on Farmers

The return of higher fertilizer prices has direct consequences for farm finances. As of late 2025, fertilizer costs are trending above last year’s levels and are expected to remain elevated into 2026. This increase comes at a time when crop receipts are shrinking, especially in major row crops, leaving farmers with thinner, even negative, margins.

Volatility is also expected to be a defining feature of the months ahead. Seasonal swings in natural gas markets during the winter, coupled with shifting Chinese export policies, are likely to create added price uncertainty in the fourth quarter of 2025 and the first quarter of 2026. Markets can change direction quickly, making it difficult for producers to anticipate input costs with certainty.

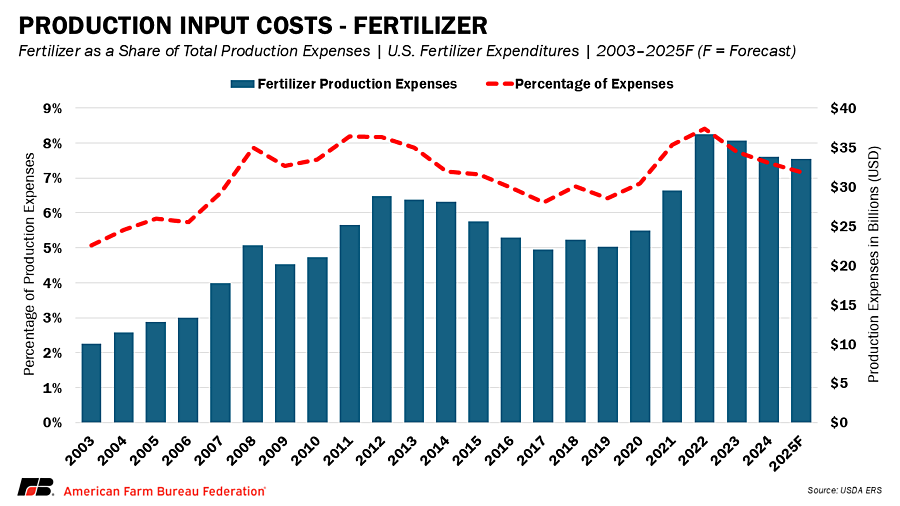

These higher fertilizer costs ripple beyond individual purchasing decisions and tie directly into broader farm income trends. USDA projections show overall production expenses rising in 2025, with fertilizer and lime counting for 7% of production expenses. At the same time, crop revenues are falling, a dynamic that compounds financial pressure on farmers. The result is an extreme squeeze on margins that is more pronounced for row crops, where nutrient requirements and production costs per acre are higher.

The combined effect of higher expenses and lower revenues is contributing to warnings of stress in the farm economy. Even though conditions differ across regions and commodities, the overarching pattern is clear: farmers are entering another year in which volatile markets and tight, or negative, margins reduce their ability to accommodate rising costs.

Conclusion

Fertilizer markets in 2025 look different than they did in 2022 but carry the same message for farmers: input costs remain highly volatile. Instead of being driven mainly by energy shortages and shipping bottlenecks, today’s increases are rooted in trade uncertainty, natural gas trends and regional conflicts. Concentration of supply in a handful of countries means that geopolitical risk has become a permanent feature of fertilizer markets. Fertilizer markets illustrate how global geopolitics directly influence U.S. farmers’ bottom lines. The war in Ukraine continues to limit reliable exports, while tensions in the Middle East inject risk into global phosphate and natural gas supplies. For the farm economy, the year ahead points to another period of tight, or negative, margins shaped as much by input costs as by falling crop prices. The combination of higher expenses and weaker crop revenues is expected to weigh on overall net farm income, particularly for row crop producers. Fertilizer remains one of the largest and most volatile expenses for crop production, meaning even modest swings in price can alter the outlook for profitability.