Understanding USDA’s New Natural Disaster Relief: Part 1

Daniel Munch

Economist

Key Takeaways:

- USDA has finalized the remaining Supplemental Disaster Relief Program (SDRP) provisions for certain 2023–2024 crop losses, and applications are open through April 30, 2026. These rules apply to losses not previously covered under earlier SDRP stages.

- This article covers SDRP components that use producers’ existing crop-insurance and Noninsured Crop Disaster Assistance Program records. Stage 1 quality-loss payments and Stage 2 shallow-loss payments fall into this group.

- Quality-loss payments compare crop insurance quality adjustments with elevator price discounts. Payments are based on the percentage-point difference between the two, applied to revenue-to-count.

- Shallow-loss payments use disaster-adjusted guarantees and production values to identify uncovered losses. Formulas differ for insured and Noninsured Crop Disaster Assistance Program (NAP) crops, but both follow structured, record-based calculations.

USDA’s final rule for Stage 2 of the Supplemental Disaster Relief Program (SDRP) delivers the long-awaited second tranche of congressionally authorized natural disaster funding, with applications due by April 30, 2026. Farmers can now start to recover 2023–2024 losses that were not covered, or not fully covered, by crop insurance or the Noninsured Crop Disaster Assistance Program (NAP). This rule represents the remaining major opportunity for growers to receive natural disaster aid under the American Relief Act’s $30.78 billion disaster authority, of which USDA expects about $16.09 billion will be SDRP payments to crop, tree, bush and vine producers.

This first installment of a two-part Market Intel series focuses on the components of SDRP that rely on existing producer records: crop insurance and NAP. These portions of the program are generally more familiar to producers and involve payment formulas tied closely to established indemnity structures. Part 2 will examine categories where USDA must assign expected yields, crop values or plant values, including uninsured crops, value-loss crops, tree/bush/vine losses, on-farm storage losses and the Milk Loss Program.

Background and Context: From WHIP+ and ERP to SDRP

SDRP is the latest installment in a series of disaster assistance programs released under the American Relief Act, following the Emergency Livestock Relief Program (ELRP) for drought losses, SDRP Stage 1 for insured crop losses and ELRP assistance for flood and wildfire impacts.

WHIP+ (2018–2020) set the foundation for this style of ad hoc assistance by comparing a crop’s expected value to its actual post-disaster value, though the program required substantial documentation and varied widely across crops. ERP for 2020–2021 improved administrative efficiency by using prefilled crop-insurance data, while ERP 2022 introduced a revenue-comparison model that proved administratively burdensome and, due to progressive factoring, sharply reduced payments for many producers with larger losses.

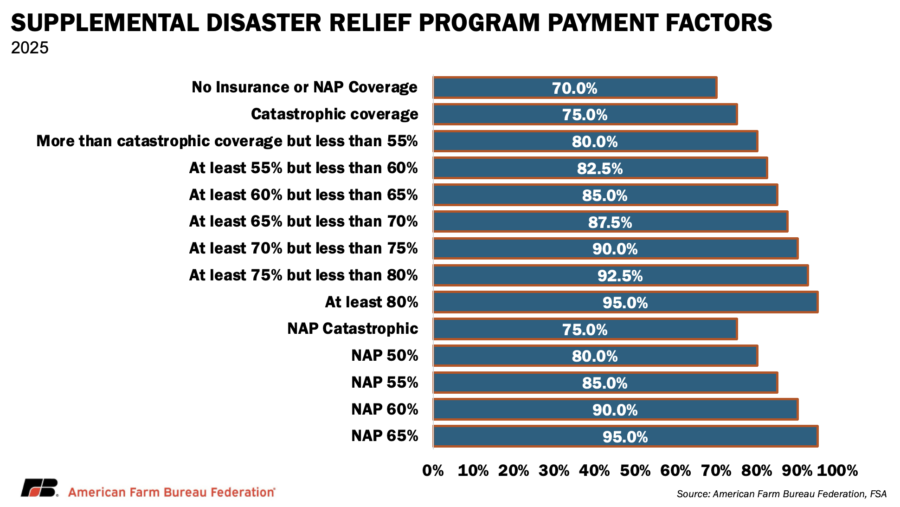

SDRP Stage 1 mirrored the ERP Phase 1 model by using existing crop insurance and NAP records to calculate a supplemental 35% payment on insured disaster losses. This newest rule adds a new quality-loss component to Stage 1, modeled loosely on the former Quality Loss Adjustment (QLA) program, which attempts to compensate producers when market-based discounts exceed what was already reflected in Risk Management Agency (RMA) quality adjustments. But the bulk of the rule establishes SDRP Stage 2, which provides assistance for losses not captured by insurance or NAP: uninsured crops, shallow losses, trees, bushes and vines, stored commodities and milk losses.

Stage 1: Quality Loss

The quality-loss component added to SDRP Stage 1 is intended to compensate producers for the portion of quality loss not already covered by crop insurance quality adjustments. Crop insurance accounts for quality by reducing “production to count,” which is the number of bushels crop insurance counts as marketable after adjusting for test weight, damage, foreign material and other grade issues. Buyers, by contrast, account for quality by reducing the price they pay at the elevator. The rule attempts to measure the remaining gap between these two systems.

To do this for crops insured under actual production history (APH) and other yield-based crop-insurance policies, USDA requires producers to compare two percentages:

- the RMA quality-loss percentage, based on how crop insurance reduces your usable bushels for quality problems; and

- the SDRP quality-loss percentage, based on how much the elevator lowers your price because the crop doesn’t meet grade (total price reduction divided by elevator price).

If the SDRP percentage is higher than the RMA percentage, USDA pays on the percentage-point difference. That difference is then applied to the insured unit’s revenue to count (the crop value calculated by crop insurance after accounting for yield losses and quality adjustments) and multiplied by 35% to determine the final payment.

This design reflects USDA’s intent to avoid duplicating benefits already delivered through crop insurance while addressing remaining market-based losses. However, because the rule applies the percentage-point difference to revenue to count, which is already lower than the crop’s full market value, the resulting payment usually represents only a portion of a farmer’s total price-level quality loss. In practice, the calculation often captures the uncovered part of the loss only partially, not in full.

For NAP-covered crops, USDA does not compare percentages. Instead, FSA applies the SDRP quality-loss percentage directly to the unit’s revenue to count and then multiplies the result by 35%.

Equation: Stage 1 Quality-Loss Payment = (SDRP quality-loss percentage − RMA quality-loss percentage) × revenue to count × 35%

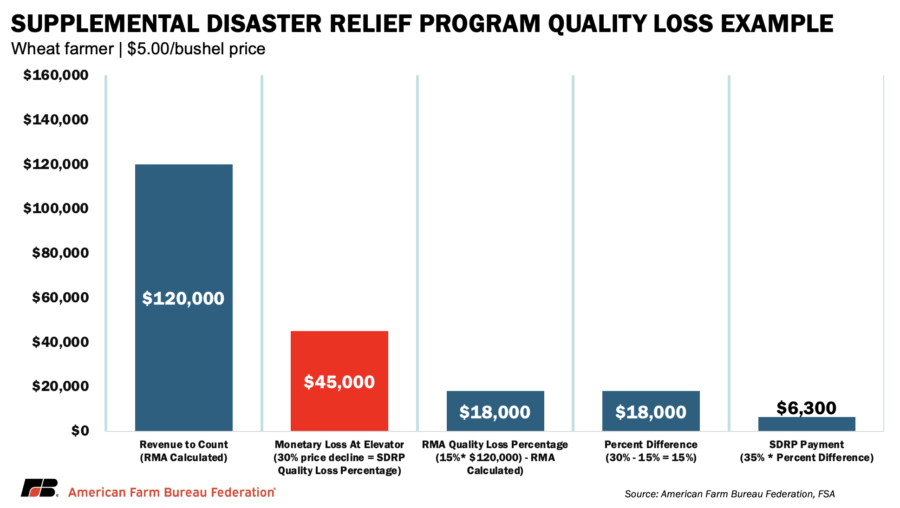

Example: A wheat farmer delivers 30,000 bushels and receives $45,000 in dockage at the elevator (a $1.50-per-bushel price cut on a $5.00 elevator price) equal to a 30% SDRP quality-loss percentage. Crop insurance separately applies quality adjustments to determine “production to count,” reducing the insured bushel count to 24,000, which corresponds to an assumed 15% RMA quality-loss percentage for illustration purposes (a figure normally assigned by RMA based on grading factors).

Under the rule, USDA pays only on the 15-percentage-point difference between the two metrics. If the farmer’s insured revenue to count is $120,000 (24,000 production-to-count bushels × $5.00 insurance price), the Stage 1 quality-loss amount is:

15% × $120,000 = $18,000

$18,000 × 35% = $6,300

While the producer experienced $45,000 in actual market-level quality losses, the structure of the Stage 1 calculation treats the difference between yield loss and price loss as if they were directly comparable. This makes the payment calculation only loosely connected to the producer’s actual quality-related revenue loss.

Forage crops are handled differently under the rule. Instead of using elevator price discounts to calculate the SDRP quality-loss percentage, USDA applies predetermined forage quality-adjustment factors, meaning forage producers will follow a separate set of quality-loss instructions rather than the elevator-based method used for other crops.

Stage 2: Assistance for Non-Indemnified Producers

Stage 2 covers producers who did not receive an indemnity or NAP payment despite suffering an eligible loss. It includes shallow-loss pathways for insured and NAP producers, as well as payments for uninsured crops, nurseries, perennial plants, stored commodities and milk disposal.

Crop, tree, bush and vine losses in Connecticut, Hawaii, Maine and Massachusetts are not eligible for SDRP because the American Relief Act directs those states to compensate producers for the same losses through separate state-administered block grants.

Stage 2, Category 1: Insured Shallow-Loss Producers

These producers held crop insurance but did not receive an indemnity because their losses did not exceed their deductible or because yield and price interactions kept revenue above the guarantee.

A critical feature of this calculation is that both the SDRP liability and the production value rely on the spring projected price used by RMA when establishing the insurance guarantee. USDA did not use the harvest price for Stage 2, even though Stage 1 payments were influenced by harvest-price movements via the underlying crop insurance indemnity structure. In years when harvest prices fell sharply below projected prices, as happened for several major crops in 2023 and 2024, using the higher spring price can make a unit appear to have more revenue on paper than the producer actually received at harvest.

As a result, the shallow-loss gap may narrow or disappear entirely, not because the producer avoided a loss, but because the calculation does not reflect the lower price at which the crop was ultimately marketed.

The Stage 2 equation for this group mirrors the Stage 1 structure:

- Calculated loss = SDRP liability – (production x (1 – quality loss percentage) x price used by RMA to calculate the liability)

- Potential insured indemnity = (SDRP liability/SDRP factor) x coverage level - (production x price used by RMA to calculate the liability x price election)

- SDRP Stage 2 payment = (Calculated loss – potential insured indemnity + premium + administrative fee) x 35%

The “potential indemnity” reflects what the indemnity would have been if the SDRP disaster-adjusted factor had applied. Because the equation subtracts this hypothetical indemnity, Stage 2 payments can be moderate or small depending on coverage level and loss size. For insured crops, producers do not calculate the SDRP liability themselves; FSA receives this value directly from RMA or the Approved Insurance Providers, using the producer’s existing insurance records.

Example:

A farmer has 100 acres of soybeans insured under an APH plan at a 65% coverage level with a price election of 100%. The producer’s approved APH yield is 60 bushels per acre (used to establish the insurance guarantee), but the producer did not suffer a yield loss large enough, after applying quality adjustments, to trigger an indemnity under the underlying crop-insurance policy. The producer’s total production for the unit was 4,050 bushels, and they also experienced a quality loss of 2% (calculated as explained above for Stage 1 quality losses). The SDRP liability provided by RMA is $72,240, which is the crop’s expected value based on the farmer’s crop insurance plan multiplied by the SDRP factor of 87.5%. The price used by RMA to calculate the liability is $13.76 per bushel. The producer paid a premium of $1,500 and an administrative fee of $100 for their insurance coverage.

APH guarantee: (60 bu × 0.65 × 100 acres) = 3,900 bushels

Production to count: 4,050 bushels × (1 − 0.02 quality loss) = 3,969 bushels

Because 3,969 bushels is above the 3,900-bushel APH guarantee, no indemnity is triggered under the underlying APH policy, making this unit potentially eligible for SDRP shallow-loss assistance.

- $72,240 – (4,050 bushels x (1 – 0.02) x $13.76) = $17,626.56

- ($72,240/0.875) x 0.65 – (4,050 bushels x $13.76 x 1.00) = -$2,064

- ($17,626.56 – ( -$2,064) + $1,500 + $100) x 0.35 = $7,451.70

*An earlier version of this example, adapted directly from USDA’s final rule, used an underlying APH scenario that would have triggered an indemnity and therefore would not have qualified for SDRP shallow-loss assistance. The example has been updated to reflect a true shallow-loss situation.

Stage 2, Category 2: NAP Shallow-Loss Producers

For NAP crops, USDA reduces the producer’s NAP guarantee by the SDRP factor (87.5%), then compares that disaster-adjusted guarantee to the operation’s certified production value. Any remaining gap is adjusted by subtracting what the NAP payment would have been (if any), adding the NAP service fee and premium, and multiplying by 35%.

The equation can be understood in three steps:

- Disaster-adjusted guarantee = NAP guarantee × 87.5%

- Uncovered loss = (Disaster-adjusted guarantee − production value) − potential NAP payment

- SDRP Stage 2 NAP payment = (Uncovered loss + NAP service fee and premium) × 35%

Example: A vegetable grower has 30 acres of fresh green beans covered under NAP at a 65% coverage level with a 100% price election. FSA has approved a yield of 200 cwt per acre and an average market price of $18 per cwt, giving a NAP guarantee of $108,000. In the disaster year, the farm harvests 4,800 cwt, resulting in a production value of $86,400. The SDRP factor for NAP shallow-loss producers is 87.5%. The grower has no quality loss, no salvage value, a 100% share, and paid $300 in NAP service fees and premiums.

- Disaster-adjusted guarantee = $108,000 x 87.5% = $94,500

- Uncovered loss = ($94,500-$86,400) - $0 = $8,100

- SDRP Stage 2 NAP payment = ($8,100 + $300) x 35% = $2,940

SDRP Stage 2 provides a $2,940 payment — support the grower did not receive through NAP because the loss fell in the “shallow-loss” range.

Program-Wide Requirements and Limitations

Across all components, SDRP applies standard USDA compliance rules. Farmers must have all required eligibility, adjusted gross income (AGI), conservation, entity and customer-record forms on file with FSA; certify acres, production and disaster impacts; and avoid duplicate benefits for the same loss. The rule also requires documentation of the disaster event and that losses occur within an eligible disaster window or county declaration. Producers who receive SDRP payments must also obtain crop insurance or NAP coverage of at least 60% for the next two available years for the same crop and county or repay the assistance with interest. Payment limits mirror ERP and apply cumulatively across Stage 1 and Stage 2, and payments may be prorated if funding is insufficient.

Conclusion

SDRP’s Stage 1 enhancements and Stage 2 shallow-loss provisions extend support to farmers whose losses fell just short of triggering traditional indemnities. Because these components rely on existing crop insurance and NAP records, they are more straightforward than other parts of SDRP, though the formulas still have limits. Stage 1 quality-loss payments may capture only part of the price penalties producers faced, and shallow-loss payments for both insured and NAP growers often shrink once USDA nets out “potential” indemnities that were never actually paid — before both amounts are reduced to 35% to fit the programs funding limits.

Even so, these pathways provide meaningful assistance for producers who otherwise would receive none, especially where shallow losses accumulated across multiple crops or units.

Farmers must submit SDRP applications for all 2023–2024 losses by April 30, 2026, with separate applications required for each crop year. Farmers can apply by submitting the appropriate SDRP forms to any local FSA county office, even if their operation spans multiple counties. Behind that single application, FSA will apply county-specific expected yields, prices and disaster designations for each county where the crop was grown, based on the producer’s acreage reports and insurance records. FSA will announce sign-up start dates for each application group, and producers may find these dates and additional instructions at their county office or on USDA’s SDRP program webpage.

Top Issues

VIEW ALL