Reviewing 2025 Crop Insurance Price Discovery

TOPICS

Crop Insurance

photo credit: Arkansas Farm Bureau, Used with Permission

Faith Parum, Ph.D.

Economist

Crop insurance, along with Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC), is one of several tools farmers use to manage risk. Each season brings its share of uncertainty, from weather and pests to market swings that can change prices overnight. Crop insurance helps farmers navigate these risks, which could put them out of business. In 2025, more than 90 million acres of corn, 9 million acres of cotton and 75 million acres of soybeans were protected under federal crop insurance. This year alone, farmers paid more than $3.6 billion in crop insurance premiums, ensuring a safety net that helps keep their businesses stable when challenges arise.

Revenue Protection with the Harvest Price Option

Among the different coverage types available to farmers, Revenue Protection (RP) with the harvest price option remains the clear favorite. In 2025, these policies covered about 85 million acres of corn, 8.4 million acres of cotton and 71 million acres of soybeans.

Farmers choose RP coverage because it protects both yield and price risk. The policy guarantees a certain level of revenue, based on the higher of two prices: the projected price set before planting (the spring price) or the market price at harvest (the harvest price). If weather or other issues reduce yields, RP pays for the lost production. If prices drop between planting and harvest, RP helps cover the gap between what the crop was expected to earn and what it actually sells for. If prices rise instead, the coverage increases so farmers can replace lost bushels at current market prices.

Spring and Harvest Prices

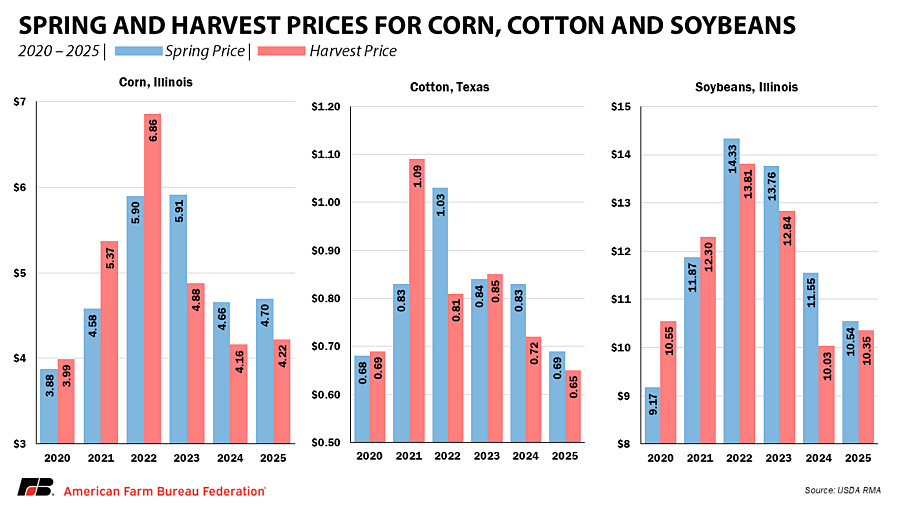

Each year, USDA’s Risk Management Agency (RMA) sets spring prices by averaging futures contract settlement prices during February’s price discovery period using December contracts for corn and cotton and November contracts for soybeans. The same process in October determines harvest prices.

For 2025, spring prices were $4.70 per bushel for corn, 69 cents per pound for cotton and $10.54 per bushel for soybeans. Harvest prices settled lower, at $4.22 for corn (down 10.2%), 65 cents for cotton (down 5.8%) and $10.35 for soybeans (down 1.8%).

For corn, the harvest price was 48 cents below the spring price, marking the third consecutive year of lower harvest prices. Cotton’s harvest price was 4 cents lower, extending a four-year trend, while soybeans declined 19 cents per bushel, a smaller decrease supported by news of increased trade opportunities.

Record production forecasts for 2025, supported by strong yields and expanded acreage, added downward pressure to prices through harvest. Because harvest prices fell below the spring levels, crop insurance guarantees for 2025 will be based on the higher spring prices of $4.70 for corn, 69 cents for cotton and $10.54 for soybeans, respectively. When prices decline, smaller yield losses can still trigger indemnities since part of the revenue drop comes from lower market prices rather than reduced production. In other words, farmers will be paid based on the higher spring prices, helping make up for lower harvest prices and keeping their revenue closer to what they planned.

A Reliable Safety Net

The Federal Crop Insurance Program remains a vital piece of the farm safety net. By sharing premium costs with the federal government, farmers can secure coverage before a disaster hits. That stability matters beyond the farm gate. Unlike most businesses, farmers can do everything right and still lose a year’s income overnight to conditions like drought, hail or flood. Indeed, crop insurance provides a critical return on investment to taxpayers and farmers. Reliable crop insurance helps growers manage debt, gives lenders confidence to extend credit and supports the steady flow of food, fiber and fuel that keeps rural economies strong. Looking ahead, the One Big Beautiful Bill Act (OBBBA) builds on this foundation by expanding crop insurance options, improving affordability and providing stronger, more flexible protection for farmers in the years to come.