Grain Sorghum Tariff Profile

TOPICS

Grain SorghumMegan Nelson

Economic Analyst

Megan Nelson

Economic Analyst

Our Market Intel series on commodity-specific tariff profiles continues with grain sorghum.

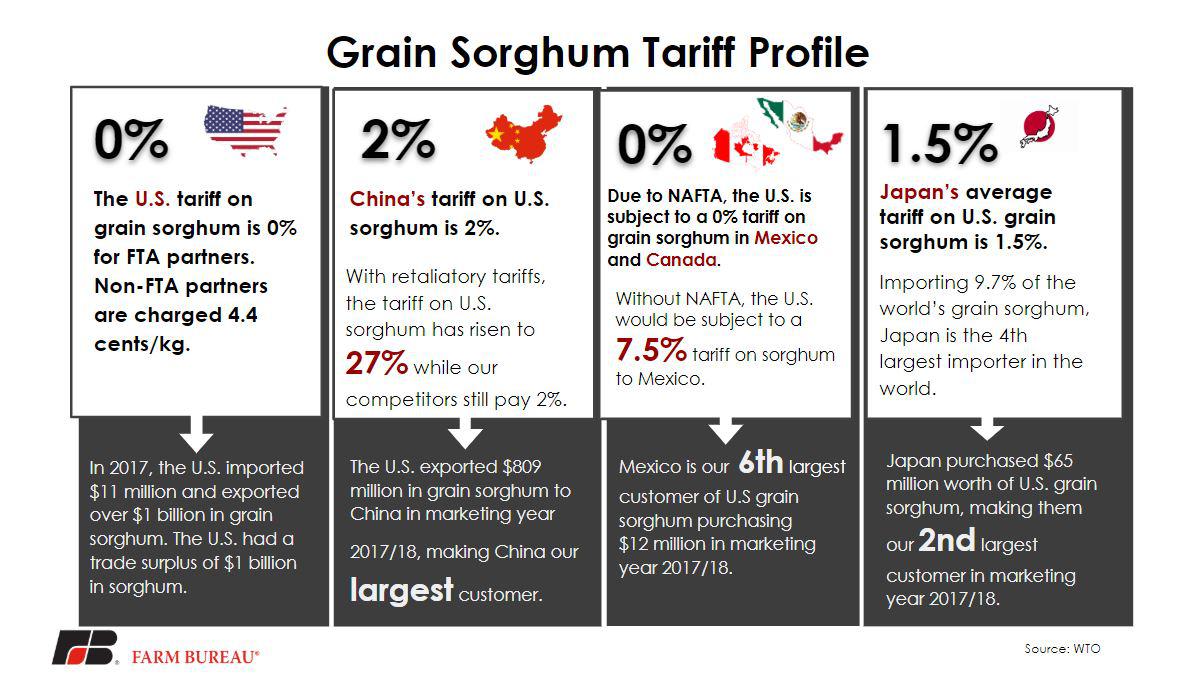

Producing 16.2 percent of the world’s grain sorghum, the U.S. is currently the largest producer of grain sorghum in the world. The U.S. exported over $1 billion worth of grain sorghum in 2017. By importing only $11 million in the same year, the U.S. maintained a trade surplus of $1 billion in grain sorghum in 2017. On its sorghum imports, the U.S. charges a 0 percent tariff for all free trade agreement partners, like Mexico and Canada. For non-FTA partners, the U.S. charges a tariff of 4.4 cents per kilogram.

In marketing year 2017/18, China purchased 81 percent of all U.S. grain sorghum exports, worth $809 million. Not only our largest grain sorghum customer, China is also the No.1 buyer of grain sorghum in the world. Chinese tariffs on U.S. grain sorghum were 2 percent in 2017.

Chinese tariffs on U.S. grain sorghum have varied wildly in 2018. From Jan. 1 through April 17, U.S. grain sorghum faced a 2 percent tariff. However, beginning April 18, China began collecting antidumping and countervailing duties of 178.6 percent on U.S. grain sorghum. The additional AD and CVD duties lasted until May 18, when the Ministry of Commerce of the People's Republic of China announced that it was dropping its AD and CVD investigation on imports of U.S. sorghum.

MOFCOM cited three reasons for ending the investigation:

1. It did not serve China’s public interest;

2. It harmed Chinese farmers and downstream industries;

3. It raised living costs for consumers.

In addition to the AD and CVD duties, U.S. sorghum has also been subject to retaliatory tariffs of 25 percent, bringing the current tariff on U.S. sorghum to 27 percent. All the while, our competitors are still subject to a 2 percent tariff. Despite these fluctuations in tariffs, U.S. exports of grain sorghum to China from January 2018 to August 2018 are only 5 percent lower by value than during the same months in 2017.

Mexico is the sixth-largest importer of U.S. grain sorghum, purchasing $12 million worth in marketing year 2017/18. Due to the North American Free Trade Agreement, U.S. sorghum exporters are subject to a 0 percent tariff on all sorghum to both Mexico and Canada. Without NAFTA, the same exporters would be subject to a 7.5 percent tariff in Mexico.

Japan is the second-largest customer for U.S. grain sorghum, importing 9.7 percent of the world’s grain sorghum production in marketing year 2017/18. Japan purchased $66 million worth of U.S. grain sorghum in 2017. The tariff Japan charges on U.S. grain sorghum is 1.5 percent.

To read more in the series, check out our deep-dive into soybean, wheat, corn, pork, cotton, beef, shelled almond, sweet cherry and apple tariffs.