In-Shell Pistachio Tariff Profile

TOPICS

PistachiosMegan Nelson

Economic Analyst

Megan Nelson

Economic Analyst

Our Market Intel series on commodity-specific tariff profiles continues with in-shell pistachios.

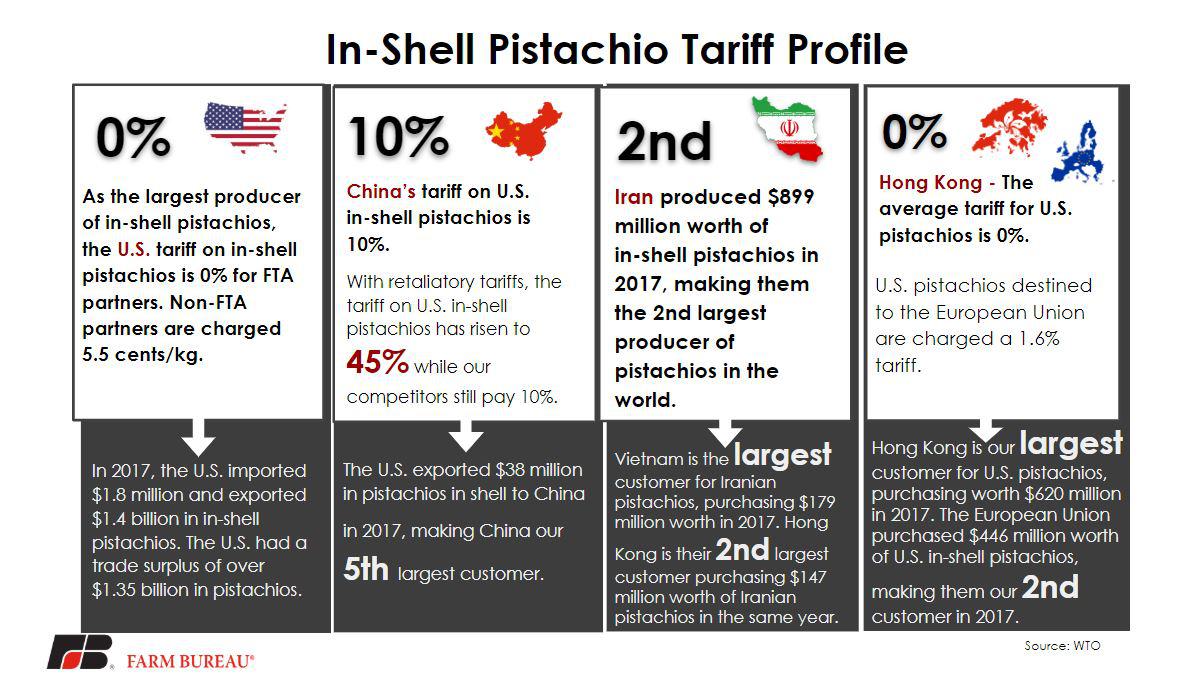

As the world’s largest exporter of pistachios, the U.S. sold $1.4 billion worth of in-shell pistachios in 2017. While importing only $1.8 million in the same year, the U.S. maintained a trade surplus of over $1.35 billion in in-shell pistachios in 2017. The U.S. charges a 0 percent tariff on in-shell pistachios for all free trade agreement partners. For non-FTA partners, the U.S. charges a tariff of 5.5 cents per kilogram.

In 2017, Iran produced $899 million worth of pistachios, making them the second-largest producer of pistachios in the world. As our largest competitor in the pistachio market, Iran exported $179 million worth of in-shell pistachios to Vietnam, their largest customer, in 2017. The second-largest customer for Iranian in-shell pistachios is Hong Kong, purchasing $147 million in 2017.

The largest customer for U.S. in-shell pistachios is Hong Kong, purchasing $620 million worth in 2017. On these imports, Hong Kong charges a 0 percent tariff for all most favored nation trading partners. Purchasing $446 million worth of U.S. in-shell pistachios in 2017, the European Union is our second-largest customer. U.S. pistachio exporters are subject to a 1.6 percent tariff on all U.S. in-shell pistachios to the EU.

China is the fifth-largest customer of U.S. in-shell pistachios, purchasing $38 million worth in 2017. As a most favored nation trading partner with China, U.S. pistachio exporters are charged a 10 percent tariff. However, with retaliatory tariffs in place, the tariff on U.S. pistachios has increased to 45 percent, while our competitors are still subject to a 10-percent tariff.

To read more in the series, check out our deep-dive into soybean, wheat, corn, pork, cotton, beef, shelled almond, sweet cherry, apple, sorghum and fresh oranges tariffs.

Top Issues

VIEW ALL