Fresh Oranges Tariff Profile

TOPICS

Fresh OrangesMegan Nelson

Economic Analyst

photo credit: Alabama Farmers Federation, Used with Permission

Megan Nelson

Economic Analyst

Our Market Intel series on commodity-specific tariff profiles continues with fresh oranges.

Over a year after Hurricane Irma, and just a few weeks after Hurricane Michael, citrus growers are seeing the lowest utilized production rates in the past decade. According to USDA’s Citrus Fruits 2018 Summary, citrus utilized production is currently 6.1 million tons, representing a 20-percent decrease since the 2016/17 season. With problems ranging from storms to citrus greening, the value of production for oranges is estimated to have decreased 9 percent from last season.

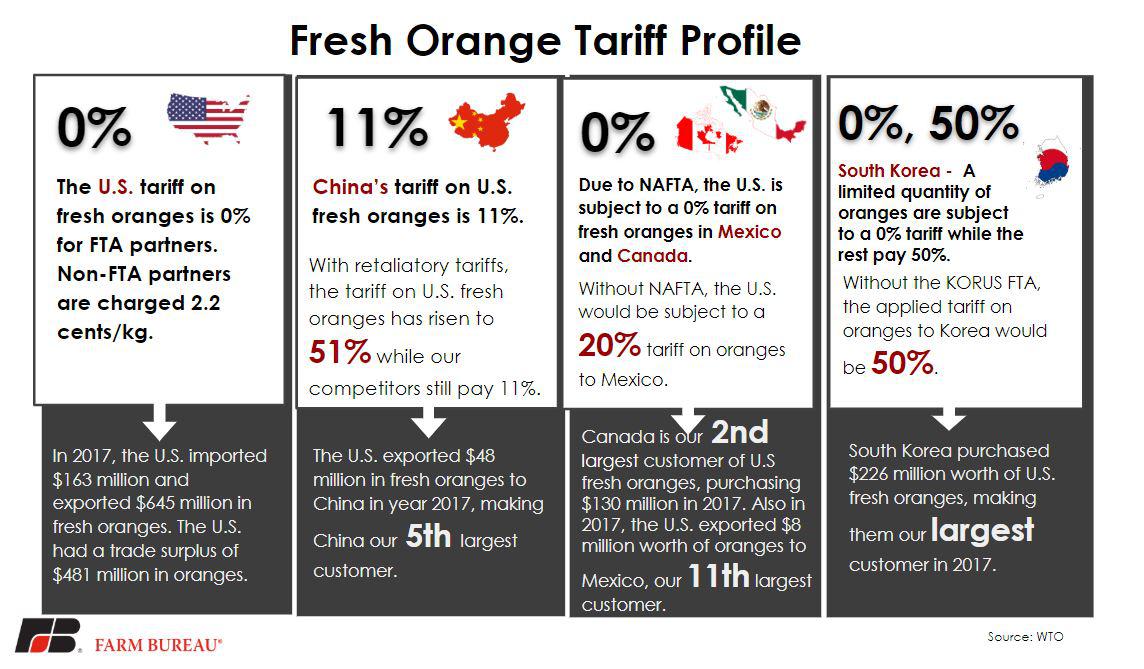

As the third-largest exporter of fresh oranges in the world, the U.S. exported $645 million worth of fresh oranges in 2017. Importing $163 million in the same year, the U.S. maintained a trade surplus of $481 million in fresh oranges in 2017. On its orange imports, the U.S. charges a 0 percent tariff for all free trade agreement partners. For non-FTA partners, the U.S. charges a tariff of 2.2 cents per kilogram.

In 2017, purchasing $48 million in U.S. fresh oranges, China represents our fifth-largest customer. The tariff on U.S. fresh oranges to China is 11 percent. However, with retaliatory tariffs in place, the tariff on U.S. oranges has increased to 51 percent. While our competitors such as South Africa, Egypt, and Australia are still subject to a 11 percent tariff.

Our northern neighbor, Canada, is the second-largest customer of U.S. fresh oranges, purchasing $130 million in 2017. Our other North American Free Trade Agreement partner, Mexico, is the 11th-largest importer of U.S. fresh oranges, purchasing $8 million worth in 2017. Due to NAFTA, U.S. orange exports are subject to a 0 percent tariff on all oranges sent to both Mexico and Canada. Without NAFTA however, the same exporters would be subject to a 20 percent tariff to Mexico.

The largest importer of U.S. fresh oranges is South Korea, purchasing $226 million worth of U.S. oranges in 2017. Importing 3 percent of the world’s fresh oranges, South Korea charges a 50 percent tariff on all imported fresh oranges. However, due to the Korea-US free trade agreement, the applied tariff on U.S. fresh oranges to Korea is 0 percent on a limited quantity of oranges. The rest are subject to a 50 percent tariff.

To read more in the series, check out our deep-dive into soybean, wheat, corn, pork, cotton, beef, shelled almond, sweet cherry, apple and sorghum tariffs.